Choosing between a debt collection lawyer and a collection agency can often be confusing.

In simple terms, the decision comes down to how much pressure you want to apply to your debtors.

To illustrate, think of it this way: a collection lawyer wields the biggest hammer when it comes to enforcing payment.

| Collection Type | Hammer Size |

| Written demands of a Collection agency: | 🔨 |

| Recovery Calls made by a Collection Agency: | 🔨 |

| Court Summons of a Lawyer: |

🔨 |

Using the biggest hammer may be necessary in some cases, but it’s always better to start with the smallest and gradually increase pressure.

This approach helps preserve your reputation and gives the debtor a fair chance to settle the debt. Jumping to the biggest hammer too quickly can anger the debtor, potentially leading to unintended consequences.

Moreover, involving an attorney can increase the risk of facing a counter-lawsuit.

| A collection lawyer can be overly aggressive for most debt recovery situations. If preserving the relationship with the debtor isn’t important to you, this approach might still be suitable.

In contrast, a collection agency typically uses a more amicable and structured approach. It starts with polite collection letters, followed by collection calls if necessary. If the debt remains unresolved, the case can escalate to legal action—matching the intensity of a lawyer when needed. However, working with a collection agency offers a better chance of maintaining a positive relationship with your customer or consumer throughout the process. |

Let’s briefly understand how both these entities work:

Collection Agencies:

Most Collection Agencies offer these services: Collection Letters, Collection Calls and Legal Collections.

Collection Letters: An agency will send five collection letters on “their own letterhead” asking the debtors to pay. The verbiage on each letter becomes more and more intensive with every passing letter. These letters firmly explain to the debtors the consequences of ignoring their payment requests diplomatically.

This set of 5 letters costs between $10-$20 per account. Payment for Collection Letters is made upfront, regardless the debtor pays or not. If the debtor pays the outstanding debt, you get all that money, and the collection agency does not charge anything extra.

Collection Calls: A debt collector calls the debtor personally and asks him to pay, maybe in installments. The debt collector may even settle the debt for a slightly lower amount with your (creditor) permission. The Agency charges a contingency fee for the Collection Calls service, which means they will only get paid if some amount is collected. If they do not recover anything, nothing is charged. Typically agencies keep 25% to 50% as their commission.

Legal Collections: A lawsuit is filed against the debtor, and the contingency fee is disclosed in advance. Collection Agencies rarely have their in-house lawyers. They transfer your case to one of the local Collection Attorney firms with whom they have a tie-up.

Collection Lawyers:

Unlike the “one size fits all” approach that the Collection Agencies follow, Collection Lawyers take a very different approach. Once they study your case, they will give you a preliminary estimate. Their fees will vary based on how difficult it is to collect the debt. Collection lawyers are usually more expensive than Collection Agencies.

- A debt that is harder and more complex to collect will require a higher upfront fee and a lower contingency fee.

- Depending on the amount of outstanding debt, they will charge a lower commission on large debts (around 10% on a $50,000 debt), and a higher commission on smaller debts (around 50% for debts around $1000). There will be additional costs like Court Costs, Attorney Suit fees, Per Hour Fees, etc., which vary in each case.

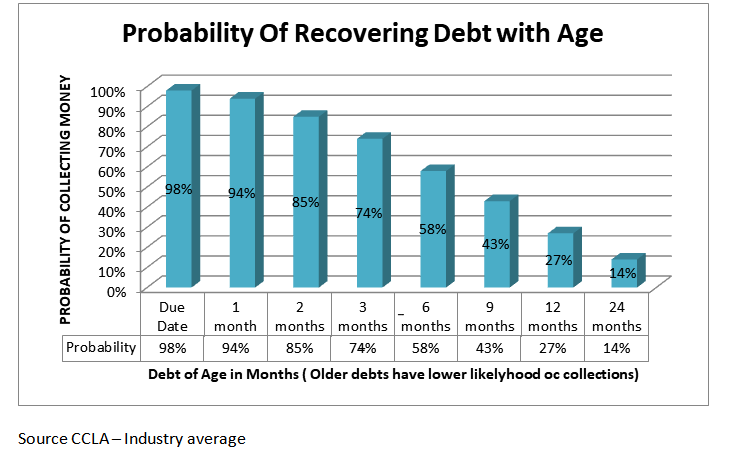

- For the older debts (over 1-year-old) , they charge a higher fee as they are harder to collect.

People often engage a Collection Agency first, and they will approach a Collection Lawyer if the debt is still uncollected. Some Lawyers also offer Written Demands services like the Collection Agencies before filing a legal suit for collecting money.

Back to the priceless question, how to select?

1. Is the amount of debt more than $10,000 or Less than $10,000?

Hiring a Collection Attorney for outstanding amounts less than $1000 makes very little sense. For smaller debts, go for a Collection Agency and select their Collection Letters and Collection Calls service. If the amount is still outstanding, ask the Agency to give you an estimate for doing Legal Collections. You can further compare it with Collection Attorneys in your area.

For amounts between $1,000-$10,000, you can go either way. A lot depends on the circumstances of the case and your personal choice. I prefer to go with a Collection Agency for all debts under $10,000.

For an AR of more than $10,000, it is better to go to a Collection Lawyer, provided you are comfortable pursuing a lawsuit against the debtor.

2. Do you want to take legal action against your client?

As mentioned earlier, Collection Agencies offer services that are one size fit all kind of approach. Therefore their costs are lower than Attorneys who take each case individually.

Most debtors take Collection Letters MODERATELY-SERIOUSLY, Collection calls VERY-SERIOUSLY and Legal notices from an attorney MOST-SERIOUSLY. Often a communication sent from an attorney may be all that’s necessary to collect the debt without even proceeding with legal action.

For hard-to-collect accounts with higher balances, you should consider taking legal action directly. But, if you do not want to take the matter to the courts, then it is better to stick with a Collection Agency. Many creditors avoid Collection Attorneys because of the negative image that is associated with using legal action.

3. Do you think your debt is very hard to collect?

For hard-to-collect debt, go with an Attorney. If you are not sure, then stick with a Collection Agency.

4. No Recovery, No Charge

Attorney and Collection Agency both offer a “No Recovery, No Charge” service. If they are unsuccessful in collections, you lose nothing. If you do not want to spend money, this is the way to go. Give preference to a Collection Agency. However, a collection lawyer may ask you to pay for the filing fee, that can be refunded if you get a favorable judgement.

5. Does the Agency/Lawyer have an industry-specific specialty:

Some Collection Agencies and Collection Lawyers specialize in a particular industry. Ex Healthcare, Car Dealers, Tenants, or Student loans. These Collection Agencies and Lawyers should be given serious consideration.

6. Forcing the debtor to pay:

If a debtor has $100K sitting in his bank account, and yet he is not paying up a debt of 10K. Only a court order can force him to clear your bill. This is where a Collection Attorney has a clear advantage over a Collection Agency. Attorneys may further get court orders to garnish the debtor’s wages. A collection agency cannot force a debtor to pay (With Collection Letters and Calls) unless they too go for the Legal option. Filing a lawsuit is the most powerful step to recovering money from debtors.

Most lawyers are affiliated with the Commercial Law League of America (CLLA), the International Association of Commercial Collectors (IACC), or at narca.org.

7. Still want to maintain a good relationship with your patient/debtor?

Diplomatic letters offered by collection agencies are a great way not to break your debtor’s relationship. A lawyer’s letter/call/notice is almost always taken negatively but very seriously.

8. Who collects faster?

The model of a Collection Agency is designed to act fast and in bulk. A collection lawyer will likely act slower than a Collection Agency.

Conclusion:

Since Collection Agencies have a one size fits all approach, they are cheaper. This is also why Agencies can work on such a large number of cases at a time.

Collection Attorneys have a nearly 100% customized approach for your case; hence they are more expensive. Debtors take legal actions much more seriously. Always check their BBB ratings if available (or on bbb.org).