Total student loan debt in the USA is more than $1.78 trillion. College grads with loans owe about 37,000 on average. Unlike elementary school debts, which are easier to collect, student loans for engineering, management, and medical courses carry a much larger balance and are much harder to collect.

Diplomacy is essential in the debt recovery process for colleges. Unlike other debts, the probability of recovering student loans improves as people make more money and settle in their careers.

Unlike other loans, student loan obligations do not go away even if the borrower files for bankruptcy. A private student loan is considered in default after three straight months of non-payment. This delinquent debt is usually forwarded to a professional Debt Collection Agency. An experienced collection agency can reduce the dropout rate and even encourage students to re-enroll by explaining how the federal Pell Grant program will likely cover their unpaid fees if they re-enroll.

Collecting money for colleges nationwideNeed a Student Loan Collection Agency? Contact Us |

A professional debt collector can usually deliver high recovery rates on these accounts.

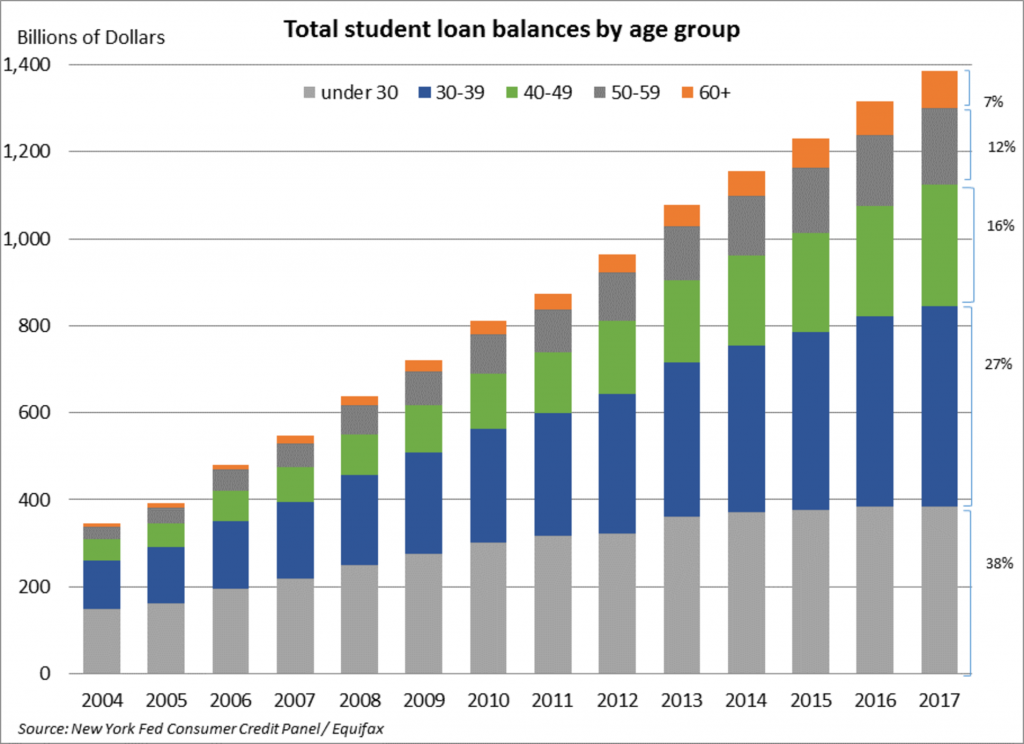

Student loans are rising, and so are the defaults. It is undoubtedly an unfortunate scenario for students, but even the lenders are taking a big financial hit and, in some cases, are forced to write off these loans completely. Banks and Credit Unions primarily issue private student loans. After the 2008 recession, many lenders cut back on their student loan programs.

A Collection Agency will seek repayment from the borrower and the cosigner (or the guarantor) if required. Education loan collection requires sending collection demands, making several collection calls, and sometimes escalating for legal action. A collection agency must follow many debt collection laws like those specified in the “Fair Debt Collection Practices Act (FDCPA)”. Upon the lender’s request, a college collection agency may report this debt to the Credit Bureaus, damaging the borrower’s ability to take further loans like mortgages, credit cards etc.

Check this: Cost of hiring a college debt collection agency

The collection agency fees can be added to the principal amount. All these clauses are defined in the promissory note signed during the initial student loan processing. Some state laws set a lower limit. The borrower is still responsible for any unpaid interest, late fees, and principal, which keeps getting more significant as time passes by.

Higher education is expensive in the United States. It is crucial to involve a Collection Agency ASAP because the amount becomes too big to repay as the interest increases. In such a scenario, the borrower often gives up entirely on repaying the loan, ready to face whatever consequences that may follow.

Even if the lender/collection agency gets a court judgment against the borrower or cosigner for wage garnishment for private student loans, this garnishment can be only up to 25% of disposable pay in most states. With the court order, a lender/collection agency can sometimes seize assets and bank accounts and place liens against property owned by the borrower or cosigner. Laws vary a lot from state to state. Getting a “highly favorable” judgment is understandably hard because the lender, the big guy, is often seen as the bad guy and the borrower is seen as the victim of circumstances.

Furthermore, there is a different approach when collecting medical debt versus non-medical debt. Therefore you cannot just hire any collection agency; you must engage a debt collection agency with extensive experience recovering money from these higher-value student loans.

Collection agencies are experts in collecting debt, including private student loans. They do a far superior job, provided the account is transferred early enough. Another huge disadvantage of waiting for private student loans is that the “Statute of limitations” applies here and could shield the borrower eventually. The statute of limitations does not apply to Federal loans. Courses like Under Grad, Graduation and Post Graduate courses are far more challenging to collect by engaging in-house staff and eventually require the intervention of a professional collection agency.

Startling Statistics

|

Reference:

https://finance.yahoo.com/news/m-29-old-235k-student-151734965.html