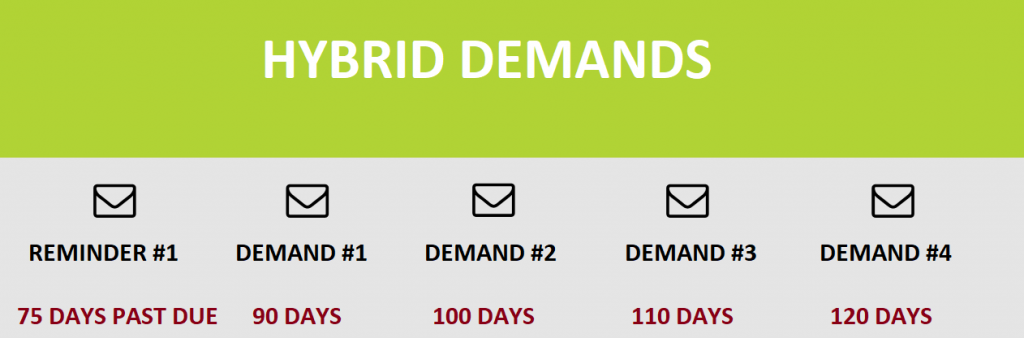

Sending fixed-fee “written demands” through a debt collection agency is the cheapest and most effective way to recover money from debtors when your unpaid bill is no more than 180 days past due. They cost merely $15 an account, and debtors pay directly to you.

Providing Flat-Fee Services NationwideNeed a Debt Collection Agency? Contact Us |

Written demands of a collection agency have the perfect blend of intensity and diplomatic verbiage. For accounts older than 180 days, the contingency-fee-based Collection Calls service is better suited.

What makes the Written Demands so effective:

1. They firmly communicate to debtors that their account has been forwarded to a professional 3rd party for debt recovery. The situation has become a lot more serious. This is an eye-opener for the debtor, and he will be more likely to pay off the debt if he can.

Many customers have multiple creditors and stop picking up their phones altogether. The only way to contact them is by sending Collection Demands.

2. Collection agencies can report accounts to Credit Bureaus, creating multiple financial problems for the debtor. This alone is a big pressurizing factor for them to make a payment.

3. Debtors rightfully understand that this is just the beginning of the collections process. They will be contacted repeatedly through written demands and eventually by a debt collector. Even a legal suit may be filed eventually.

| What makes the image of collection agencies so horrific? A collection agency will take every step that the law permits them to recover the debt. A standard creditor is not even aware of all the steps that can be made to recover the debt. In fact, they do not even have the resources or a process in place to perform a systematic collection activity. Sometimes newbie debt collectors who are not entirely unaware of FDCPA laws make the mistake of engaging in unethical and threatening ways of debt collection. Unethical and aggressive collection tactics are entirely unlawful. But this has created a nasty perception ( a monstrous image) of Collection Agencies among most people. However, this horrific perception of agencies sometimes complements the collection efforts of even those agencies which perform collection in an ethical, diplomatic and empathetic way. Creditors should always hire an experienced collection agency with competitive rates. Agencies offering cheap fees usually employ inexperienced collectors who may potentially land themselves and their clients in trouble. |

4. Debtors often relocate to a new address and try to become untraceable, thinking this will protect them from all the debt recovery contacts. Since collection agencies perform “Change of address” scrub from various sources, they can generally send the collection letter to the debtor’s new address. Debtors are quite surprised when they receive demands on their new address and gradually start accepting that there is no point in running away from their payment obligations.

5. Collection demands are extremely cost-effective. Can you imagine sending five collection demands for less than $15. Wait, but it is not just the printing, mailing, and infrastructure costs. Collection Agencies perform various scrubs on every account to get more information about the debtor (like Change of address, Bankruptcy check, Litigious debtor check etc.). Their collection demands are handcrafted and approved by expert attorneys. Each letter has different verbiage for maximum impact. These written demands contain a host of legal verbiage, good enough to make any average person very concerned, thereby elevating the intention to settle the debt.

6. They can send collection demands in both English and Spanish. Regardless of the language, both versions have a high impact.

7. These diplomatically worded Collection Demands are the best way to collect money without damaging customer relationships.

8. Say, even if merely 25% of debtors clear their bills during the Collection Demands service, you would have received returns that are probably over ten times than you had invested in buying collection letter accounts. If accounts are submitted without delay (say around 90 days), recovery rates can easily exceed over 50% with collection demands service.

If you are looking for a flat-fee collection agency: Contact Us