Selecting the right collection agency can significantly boost your recovery rates, safeguard your reputation, and simplify your accounts receivable process. Here’s what you need to look for in a great collection agency:

1. Proven Track Record

Choose a collection agency with a solid track record. Check their reviews, success rates, and experience in your specific industry (medical, dental, commercial, education, etc.). Agencies with higher Google ratings (4.5 stars or above) and hundreds of positive reviews typically deliver better results.

2. Clear and Simple Pricing

Collection agencies usually offer two pricing models:

- Fixed Fee (around $15 per account): Ideal for recent debts.

- Contingency Fee (20%-40% of recovered amount): Best for older or tougher debts.

Always choose agencies transparent about their pricing, with no hidden fees.

3. Compliance with Laws and Regulations

The agency must strictly adhere to collection laws such as:

This protects your business from lawsuits and preserves customer trust.

4. Skip Tracing Capabilities

A good agency will offer skip tracing—finding updated contact information, addresses, and employment details for debtors. While an individual search could cost you $50-$175, agencies often include it at no extra charge.

5. National Coverage and Resources

A collection agency with nationwide coverage can efficiently track down debtors who move between states. This maximizes your chances of debt recovery.

6. Excellent Customer Service

You want an agency that’s easy to work with. Test their responsiveness: Do they answer your questions clearly and quickly? Reliable customer support makes the collections process stress-free.

7. Preservation of Your Reputation

Your chosen agency represents your brand. Look for agencies committed to respectful communication. Over 80% of positive online reviews for top agencies often come from debtors themselves, impressed by the respectful and professional handling of their cases.

8. Efficient Reporting

Make sure the agency provides regular updates and clear reporting. This transparency helps you track your collection success and adjust your strategy if needed.

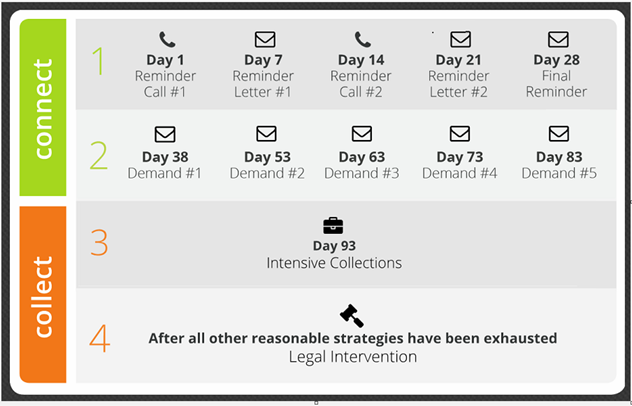

9. Legal Options if Necessary

Most debts (90%+) are resolved without going to court. However, your agency should have the option to escalate matters legally if needed, using a network of attorneys to efficiently handle tougher accounts.

10. Is Your Data Secure?

Sharing your customer data with a third party agency can be risky if they do not have appropriate security measures in place. Ask for all the certifications and in case they have cyber security insurance.

Final Tip

Don’t just pick the cheapest option. Select an agency that offers the right combination of price, reputation, recovery success, compliance, and customer care. Choosing wisely can significantly improve your cash flow and reduce financial stress.

Ready to move forward? Contact NexaCollect to discuss your specific needs and see how we can help you collect your outstanding debts professionally and efficiently.