We recover your unpaid patient balances quickly and professionally—while protecting your reputation and keeping patient relationships intact. With over 50% of our clients coming from the medical and dental fields, we are true specialists in the healthcare industry.

Healthcare providers are facing more and more cases where patients don’t pay their medical bills. Medical office staff are frustrated with being forced into part-time debt collectors, as it distracts them from their primary responsibilities.

Our medical collection services will seamlessly integrate with your existing billing process, providing online status reports and eventually depositing the amount recovered directly in your bank account ( using ACH Direct Deposit).

Need a Medical Collection Agency? Contact UsServing Thousands of Medical Professionals NationwideEasy to use • Fully Compliant with HIPAA, Federal and State Laws • USA Citizens-Only Team • 24×7 Secure Portal • High Recovery Rates • Expert Medical Collectors • Free Credit Bureau reporting • Low fee |

Why take your unpaid medical bills so seriously?

If a medical practice works on a 20% profit margin, say 3% of its patients do not pay, then effectively 15% of the net profit is gone. Collecting money from existing patients is much more important than getting new patients.

How does a medical collection agency work?

A good collection agency should be willing to tailor their approach to meet your specific needs and help you achieve your debt collection goals. They should offer you the following four options:

Fixed Fee Collections ( Amicable tactics)

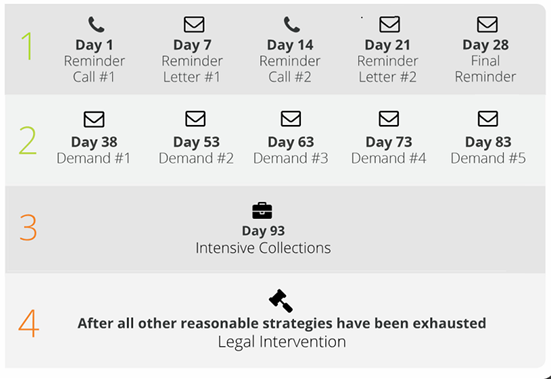

Step 1 : Send five reminders on your behalf, a process known as first-party collections. At this stage, the account has not yet entered the collections phase. You should assign a patient to this step when their invoice is overdue by 30 to 60 days. If your team is understaffed and you want them to focus on their primary duties, choose the Step-1 service to manage accounts. This approach will save time and energy, reducing the weekly frustration your staff faces when reminding patients to make payments.

Step 2 : Send five formal medical collection notices at regular intervals on their letterhead, a process known as third-party collections, which includes strong legal language. This step represents a significant shift, signaling to the patient that their account is now being handled by a professional medical collection agency. This transition greatly increases the likelihood of payment. Using this assertive yet measured approach usually preserves the integrity of your relationship with patients. Most practices move accounts to this step when they are 60 to 120 days overdue, a strategy that has consistently proven effective.

Cost:

- Step 1 or Step 2 costs about $15 an account ( 5 contacts).

- Step 1 and Step 2 combined service is about $20 per account ( 10 reminders/demands)

- If you buy more accounts, the cost per account goes down further. Unused accounts NEVER expire.

Contingency Fee Collections ( Firm tactics)

Step 3 : (📞) In this service, a professional medical debt collector will call your patient and also conduct skip tracing to find the debtor’s most recent contact information, such as phone numbers and addresses. Collectors are not paid a fixed salary; instead, they earn a percentage of the money they recover, which motivates them to work harder on your behalf. Typically, collection agencies retain 40% of the amount collected and remit the remaining 60% to you.

Step 4: (⚖ ) Uncollected accounts can be further assigned for legal collections (after your written approval). These accounts must be of a minimum dollar value to justify the attorney cost and filing fee.

New laws impacting medical debt collections

|

How soon can I forward a patient’s account for collection?

You can send a patient for debt collection at any time, per your office’s financial policy. Most medical practices transfer accounts after 60 days. It is advisable to send the patient for collection after determining final insurance coverage. This avoids confusion since the patient’s insurance coverage can differ from what was initially estimated.