Small businesses must partner with a collection agency to recover unpaid invoices swiftly—without draining internal resources or risking valuable customer relationships.

Our service is cost-effective, results-driven, and built on professionalism, helping you maintain goodwill while boosting your cash flow.

Unpaid invoices can significantly strain a business’s finances. Collecting money from accounts receivable can be very tricky, especially when you have shared a long-term business relationship with these clients.

Without a proper debt collection strategy, these accounts tend to become non-recoverable over time. Hiring a debt collection agency becomes mandatory when your in-house recovery efforts are exhausted. Always select a collection agency whose approach is achieving higher recovery rates while preserving your business reputation and customer relationship.

Here are the top 7 things small businesses want from a collection agency:

- High Success Rates and Excellent Online Reviews

- Low Cost and Transparent Fee Structure

- Professional and Ethical Practices

- Strong Client Support Team and Reporting

- Customized Solutions for Specific Needs

- Focus on Preserving Customer Relationships

- Ability to do Skip Tracing and Credit Bureau Reporting

Need a Collection Agency for your Business?Contact us• Nationwide Coverage • US Citizens-Only Team • High Recovery Rates • Free Bankruptcy screening • Free Credit Bureau reporting • Free skip tracing • 5-star rated • 24×7 Secure Portal • Industry Specific Collectors • Cost-Effective |

Past-due accounts can result in several financial issues, including:

- Negative cash flow for your small business.

- A severe cash crunch may restrict the ability of a small business to continue with its normal operations.

- Delay in providing salary to your employees.

- Even hamper your ability to make payments to your own suppliers.

- Frankly, everyone hates following up with customers regarding payments; again and again, it results in a growing frustration in your staff and wastage of their time and your money.

Does your Small Business have an Internal Accounts Receivable Strategy?

Unless you create a well-defined policy for your staff, you will keep losing money to unpaid bills. What different steps should you take when a bill is 15 days overdue, then 30 days, then 60 days, etc. There must be a well-documented policy in this regard. Here are a few things to consider:

1. Has this happened for the first time?

Send a follow-up invoice via certified mail and retain a copy for your records. Then make a phone call the day after the client receives your reminder invoice. Say something like this .. “John, maybe you did not get our invoice last time. Therefore, we have re-sent it.“, then carefully listen to what the client has to say. The client will likely give you the reason for non-payment, even without you asking for an explanation.

There is a possibility that their delay is simply due to an oversight, glitch or a temporary business circumstance. For example, an officer who issues the check could be on leave, a temporary non-serious cash flow crunch, or maybe the client never received your invoice or lost it. They might tell you that the payment will be issued today or tomorrow if it was just an oversight.

But, if the client appears to be deferring the payment or giving false excuses, take it as a warning sign. Keep this account under watch.

Your staff should also be informed in advance to be extremely careful, professional, and diplomatic with such clients. Since there is a doubt regarding their ability to make timely payments, have a well-planned strategy to prevent their debt from increasing further.

2. Has the client started to delay payments repeatedly?

There is likely a more significant problem brewing at your client side. Maybe the client’s own business is not doing too well. You should find out. Politely ask, “John, we have been doing business with you for “X” number of years, and getting payments on time was never a concern earlier. Would you mind sharing with us what has changed recently?“.

Tell them that your own business is also facing problems due to this delay in payment. You could say, “John, since your payments are late, it has created some cash flow problems for us as well. Our small business runs on a very thin margin. I request you to clear our bills at the earliest“.

Showing your problem will convey that it’s not just your eagerness to get paid but your own compelling need behind it.

3. Do you have a better alternative?

Since getting compensated for your products or services has become an ongoing problem, start looking out for other clients/business partner/supplier who does not have a cash flow problem. Doing business with your current client has become too risky; it’s the right time to cut the cord and minimize your losses.

4. Do you know the real reason behind these non-payments?

Talk to all contacts you usually deal with at this client’s office. Maybe another client contact will disclose the reason for non-payment, although you can never be sure if the reason given by your client is right or not. Keep notes of what the client says during each call and if the story changes in the next call. Be mentally prepared for all kinds of excuses.

Meanwhile, start preparing to outsource the debt-collection process to a 3rd party Collection Agency.

5. Show faith in your client. It helps.

Create a good relationship so they will want to pay you first because other parties like you may also be waiting for payment.

“John, we have been doing business together for a while. We have great trust in your organization“.

Call it “moral faith” or “moral pressure“, but it works.

6. Control your anger

Speak less and to the point. Be a good listener. Regardless of the circumstances, never sound harsh or try to threaten your client, or lose your temper. If you annoy them, it may delay your payments further. A threatening language can even result in a counter-legal action against you Do you know there are debt collection laws in every state, and some of them also apply to original creditors like you? Generally, the in-house collections are not very successful after the account has been over 30-60 days past-due date.

Talk diplomatically and amicably. Keep your conversation short and to the point.

Do not interact too firmly or appear indifferent to their problems. This may irritate the client, and they may intentionally delay your payment even further. Similarly, do not try to be very soft and personal with the client, only to be taken for granted.

7. Give them the option to pay in installments

Has it been over 4-6 weeks from the payment due date, and the sending reminder invoices or making calls have not worked? Now try giving your client an option to pay in installments. If that fails, then stop taking any more stress yourself. The matter is beyond your own control.

That’s it .. now what? ⛔

Don’t waste more time

Hire a Small Business Collection Agency

8. Most likely, you cannot resolve the situation in an amicable manner

Your client has repeatedly failed to make a payment multiple times despite reassurances. He is already avoiding taking your phone calls. Does he need more time to clear the debt? Has he suddenly started to dispute the quality of your services? The time is up.

Let an expert collection agency deal with this situation. The involvement of a Small Business Collection Agency is truly a game-changer.

9. Don’t waste more time: ( “Really-Really” Important)

If you remain on the sidelines regarding whether to transfer an account to a collection agency or not, the situation will only worsen over time. Without a doubt, approach a small business collection agency if your payment has been due for over 60-90 days.

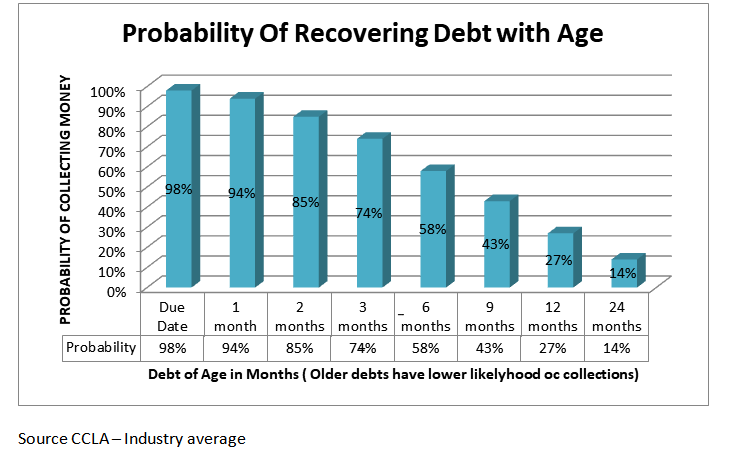

Statistics prove that the longer you wait, the harder it becomes to recover your money.

The involvement of a professional debt collection agency automatically puts astronomical pressure on the client. Collection agencies have many tricks and legally valid ways to collect money that you may not even know.

Commercial collection agencies will not charge you anything until your money is collected. Depending on the amount owed and the circumstances, a small business collection agency will charge between 30% to 40% of the amount they recover. Fully understand the fee structure before hiring a collection agency.

10. Maintain proper proof of the services or products delivered, including all communications made with your client

Keep all invoices, proof of goods or services delivered, and copies of reminder invoices sent by you. Also, keep a copy of communications done via email and the date/time of phone calls made by you and what they have been telling you. Provide this information to your Collection Agency while submitting this account.

11. Take LEGAL ACTION if necessary.

Depending on many factors (age, the amount owed, and risk), your small business collection agency will advise you if filing a lawsuit is advisable.

There is no guarantee that your business relationship with the client will remain intact. Still, a step-by-step approach will increase the chances of resolving things amicably.

| The cost of hiring a collection agency and information about their services is mentioned here. This includes Collection Letters, Collection Calls, Skip Tracing, Various Scrubs, Legal, Advanced Skip Tracing, Diplomatic Contacts, Credit Checking, Credit Bureau Reporting, and much more. Contact us for your small business debt collection agency needs. Do you need a Local or a Nationally licensed collection agency? Does your small business require Spanish Debt Collections or not? |

Recommended article: Improve Cash Flow for your Business