Watching only pennies trickle back from thousands in overdue invoices? Low recovery rates aren’t a mystery—they’re a warning sign that something in your collection pipeline is broken and needs a quick fix.

Industry Quick-Take

-

Typical success rate: U.S. agencies recover 20 – 30 % of the dollars placed with them—$20–$30 on every $100.

-

Time kills accounts: Place a balance within 90 days and recovery can double; wait a full year and odds drop below 10 %.

If your current partner lags behind even these modest benchmarks, run through the checklist below before you replace them—or confirm that you definitely should.

| # | What to Ask the Agency | Why It Matters |

|---|---|---|

| 1 | Do you publish live metrics on an online collections portal? | A last-minute scramble for data means they were never tracking performance. |

| 2 | Are you running all scrubs—Change of Address, bankruptcy, litigious-debtor? | Skipping them saves pennies but can lift recovery 5–8 %. |

| 3 | Did you sell me the right tier—collection letters vs. live collection calls? | Letters shine in the first 120 days; older files need live calls and skip tracing. |

| 4 | Can I see sample letters? | Color printing and line-item charges make debtors 17 % more likely to pay. |

| 5 | Show me two call logs from high-balance files. | You should see 5–7 contact attempts in the first month. |

| 6 | What payment channels do you offer—ACH, credit-card, Western Union? | More options = 10 % higher completion. |

| 7 | Is a “Settle-in-Full” policy in place? | Accepting 80–90 % today beats 0 % next year. |

| 8 | Do you handle credit-bureau reporting in line with U.S. debt-collection laws? | Collectors can’t threaten to report, but must tell the truth when asked. |

Could You Be Behind the Low Numbers?

-

Late placements. After twelve months, the probability of recovery sinks below 15 %.

-

Missing documents. Contracts, invoices or service receipts are the collector’s legal ammunition—deliver them within 48 hours of request.

-

Portfolio mix. A cluster of bankruptcies or skip-traced accounts drags any metric down; compare your file to industry averages before placing blame.

Real-World Example

ABC Pediatric Clinic sent $50,000 in 120-day-old co-pays to one of NexaCollect’s vetted partners and recovered $24,500 (49 %) within six months—more than double the 22 % rate they saw with their previous agency.

Ready for Better Results?

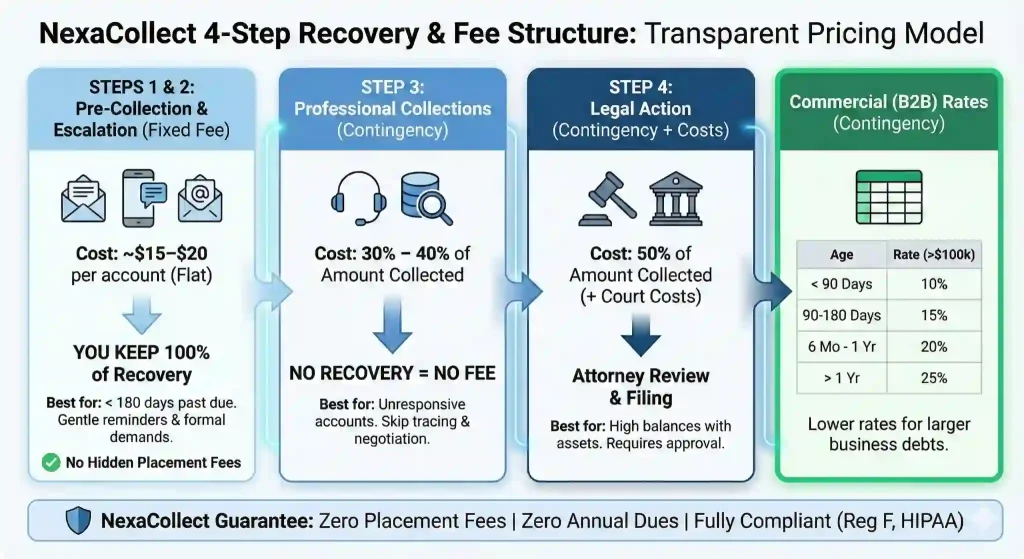

NexaCollect has already vetted agencies that post 40–55 % recovery on fresh medical and small-business debt—nearly twice the industry mean. Want an introduction? Contact us for a free, no-obligation referral.