Financial institutions of all sizes frequently struggle with accounts receivable, often losing significant resources chasing the 2%–3% of accounts that refuse to pay. When internal follow-ups fail, a professional financial collection agency is essential to recovering unpaid bills without draining your internal team’s productivity.

Nexa provides a reputation-safe approach, equipped with all 50-state collections license, offering free credit reporting, free litigation, free bankruptcy scrubs, and zero onboarding fees. Secure – SOC 2 Type II & GLBA compliant. Over 2,000 online reviews rate us 4.85 out of 5.

Need a Collection Agency? Contact us

The Cost of Inaction

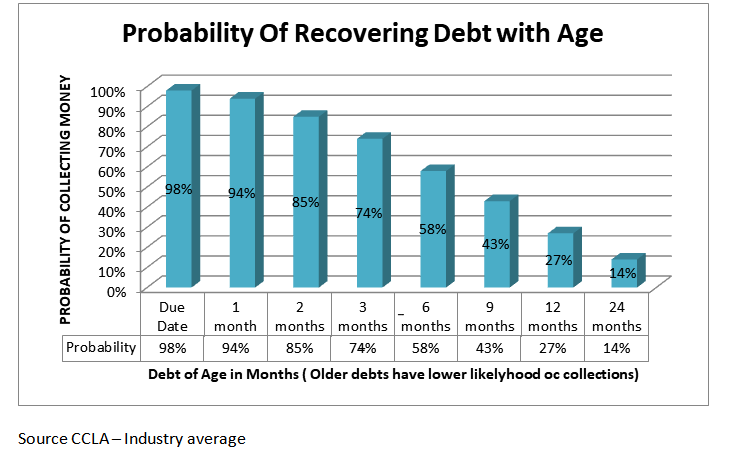

Writing off delinquent loans, mortgages, or overdraft fees directly impacts your profit margin and can lead to severe cash flow issues. Data shows that accounts not resolved within the first 90 days rarely get settled. In fact, the likelihood of recovery drops by approximately 10% for every month that passes.

Banks, credit unions, and fintech firms require a partner that understands the delicate balance between firm recovery and brand protection.

Summary of Financial Collection Services

| Service Tier | Best For | Strategy & Cost |

| Phase 1: Specialized Letters | Accounts < 120 days past due. | Low Cost: Approx. $15 per account. Debtors pay you directly; no percentages taken. |

| Phase 2: Professional Calls | Accounts > 120 days past due. | Contingency-Based: No Recovery, No Fee. Includes intensive skip-tracing and direct negotiation. |

| Phase 3: Legal Escalation | High-balance, unresponsive accounts. | Recommended by attorneys if all other professional attempts are exhausted. |

Why Financial Institutions Choose Nexa

1. Strict Regulatory Compliance

We operate with a “compliance-first” mindset. Our team is rigorously trained in FDCPA, FCRA, and CFPB regulations to ensure your institution is never exposed to unnecessary legal risk.

2. Enterprise-Grade Security

We handle sensitive financial data with the highest level of protection. Nexa is SOC 2 Type II and HIPAA compliant, utilizing advanced encryption and secure portals to maintain data integrity.

3. Reputation-Safe Recovery

We understand that your customers are your greatest asset. Our “diplomatic yet firm” approach ensures debts are recovered while keeping your brand’s reputation intact. We provide a 50-state licensed solution that scales with your business.

4. Advanced Technology

From bankruptcy scrubs to automated credit reporting, we use high-tech tools to identify the most “collectible” accounts, ensuring your recovery efforts are targeted and efficient.

Frequently Asked Questions

When should we move an account from internal collections to Nexa?

Most financial institutions see the best ROI when transferring accounts between 60 and 90 days past due. Waiting longer significantly decreases the probability of full recovery.

Are there any setup or onboarding fees?

No. Nexa offers zero onboarding fees, allowing you to start recovering funds immediately without upfront capital investment.

How do we track the progress of our accounts?

Clients receive access to a secure, real-time portal to monitor recovery status, view reports, and manage documentation.

Need a cost-effective partner for your financial receivables? Contact Us Today