If your delinquency strategy relies on cutting locks and hosting auctions, you are playing a losing game.

For decades, self-storage owners have been taught a simple workflow: Tenant doesn’t pay -> Lock the unit -> Auction the contents. But let’s look at the real math. When you auction a unit, you are usually selling used mattresses, old clothes, and broken furniture. You might get $40 for the contents, but the tenant owes you $800.

You just accepted 5 cents on the dollar and called it a “resolution.”

That isn’t a recovery; that’s a donation.

Smart operators know that auctions clear space, but collections clear debt. At NexaCollect, we help you pivot from relying on low-yield auctions to securing full cash payments. We use the leverage of credit reporting and professional demands to get your money before the lock has to be cut.

Why the Auction Process is a Revenue Killer

Relying solely on your state’s lien laws to recover revenue is financially dangerous for three reasons:

-

The “Junk” Factor: Industry stats show that over 80% of auctioned units sell for less than the outstanding debt. You are spending money on newspaper ads and certified mail to sell items that nobody wants.

-

The Leverage Gap: Many tenants actually want you to auction their unit. They left trash behind and are using you as a free dumpster service. They don’t care about the stuff—but they do care about their credit score.

-

The Opportunity Cost: Every day you wait for the legally mandated auction timeline (often 60-90 days), that debt gets older and harder to collect.

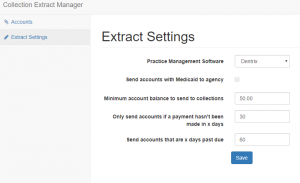

The Better Way: Don’t wait for the auction. Deploy a third-party collection agency early (Day 45-60). When a tenant realizes that non-payment will block them from renting an apartment or buying a car in the future, they find the money to pay you—often before the auction even happens.

Recover Dollars, Not Pennies: A Strategy That Works

We offer a recovery system that runs parallel to your lien process, maximizing your chance of getting paid in full.

1. The “Pre-Auction” Pressure (The Sweet Spot)

-

Timing: Days 30–60 (Before you cut the lock).

-

The Move: Use our Step 1 & 2 Flat-Fee Service ($15/account).

-

The Logic: We send official demands warning the tenant that this is now a “Collection Account.” This is far scarier than a lien notice.

-

The Result: The tenant rushes to pay the full balance to avoid credit damage. You get 100% of the cash and don’t have to waste time hosting an auction.

2. The “Deficiency” Cleanup (If You Must Auction)

-

Timing: Post-Auction.

-

The Move: Use our Step 3 Contingency Service (40% fee).

-

The Logic: If you do have to sell the unit to clear the space, don’t write off the remaining balance. We pursue the tenant for the difference.

-

The Result: You clear the unit for a new renter and we chase the old tenant for the cash they still owe.

Serving Some of the largest Self-Storage Companies!Need a collection agency? Contact us |

Real Scenarios: Auction vs. Collection

See the difference in how these scenarios play out for your bottom line:

Scenario A: The “Traditional” Auction Route

-

Debt: $1,200 (3 months rent + late fees).

-

Action: You wait 90 days. You follow lien laws. You auction the unit.

-

Sale Price: The unit sells for $110.

-

Net Result: You recover $110. You lose $1,090.

Scenario B: The NexaCollect Route (Columbus, OH Client)

-

Debt: $1,200.

-

Action: On Day 45, the facility manager submitted the account to our Step 2 service.

-

The Leverage: We sent a formal demand letter noting the intent to report the debt to credit bureaus. The tenant was applying for a mortgage and couldn’t risk a collection record.

-

Net Result: The tenant paid the full $1,200 immediately. The facility paid us a $15 flat fee. Net recovery: $1,185.

FAQ: Rethinking Storage Collections

Q: Can I send a tenant to collections before I auction their unit?

A: Yes! In fact, you should. Your lease agreement is a financial contract. Once they are in default (usually Day 5-30 depending on your lease), you have the right to demand payment through a third party. You do not have to wait for the lien process to finish.

Q: Won’t the auction satisfy the debt?

A: Rarely. Unless they are storing gold bars, the auction proceeds almost never cover the rent, late fees, and legal costs. Relying on the auction to make you whole is a gamble with terrible odds.

Q: If they pay the collection agency, what happens to the unit?

A: If they pay in full, the default is cured! You unlock the unit, and they are an active tenant again (or they can move out properly). You saved the customer relationship and avoided the hassle of a sale.

Q: Do you report to tenant screening databases?

A: We report to the major credit bureaus (Equifax, Experian, TransUnion). This feeds into the tenant screening reports that other landlords use. A tenant who stiffed you will find it very hard to rent an apartment next month.

Recent Results: Real Numbers from the Industry

The RV & Boat Storage Case (Texas)

-

The Situation: A specialized facility had 3 high-value parking spots abandoned. The vehicles were towed/auctioned, but the remaining balance for back rent was $18,500.

-

The Challenge: The owners had moved out of state and thought they were untouchable.

-

The Result: Our skip-tracing team located all three debtors. We negotiated settlements totaling $14,200 within 60 days. The facility owner recovered nearly 77% of “lost” revenue without lifting a finger.

The Multi-Unit “Hoarder” Cleanup (Ohio)

-

The Situation: A facility manager dealt with a tenant who rented 4 large units, filled them with trash, and stopped paying. The cleanup cost alone was $3,500 on top of $6,000 in back rent.

-

The Challenge: The auctions netted a combined total of only $200.

-

The Result: We pursued the tenant for the full deficiency plus lease-specified cleaning fees. Fa

Stop Trading Valuable Rent for Cheap Junk

Your units are real estate, not flea market booths. Enforce your lease and get paid what you are owed.

Click here to Contact Us and upgrade your recovery strategy.