Mortgages are the biggest loans in the United States, running into hundreds of thousands of dollars against each property. Many mortgage borrowers go above and beyond what they can afford to become proud home-owner of that expensive dream house. If a recession strikes, such borrowers are the first ones to default on their obligations.

Before their financial situation deteriorates further, hiring professional debt collectors to cut potential losses a lender may incur is highly advisable. Not every collection agency understands how the foreclosure/mortgage loan process works.

Serving Lenders NationwideNeed an Experienced Agency for Mortgage Collection? Contact Us |

Most Banks and Credit Unions have their in-house collection teams to remind borrowers once they miss a payment. They usually report a late or missed payment to the borrower’s credit report every 30 days. But those missed payments are not going away; they make the mortgage repayment even steeper and more challenging for the borrower. Only a couple of missed payments can potentially push many borrowers beyond that point where they become mortgage defaulters.

To get a higher mortgage recovery, follow these three thumb rules.

1. Transferring an account to a collections agency earlier rather than waiting.

2. Scanning and storing all paperwork in electronic format and forwarding it to the collections agency promptly when requested.

3. Rather than selling the debt cheaply to a debt buyer, outsource it to a collection agency for better collection returns and profits.

| Collection Letters Service |

|

| Collection Calls Service |

|

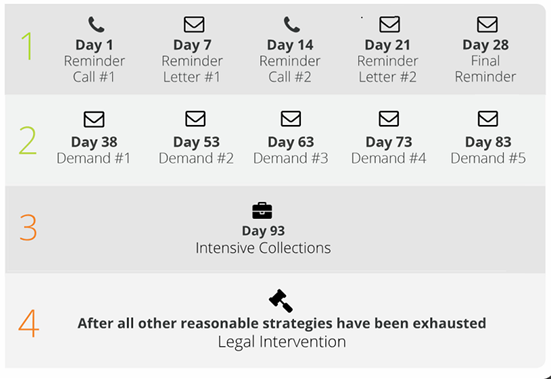

Steps involved in recovering unpaid mortgage

Recovering unpaid mortgages involves a series of legal and administrative steps. It’s important to note that the process may vary depending on the jurisdiction or country in which the property is located. Here is a general outline of the steps that may be involved in the process of recovering an unpaid mortgage:

- Review the Mortgage Agreement: The first step is to thoroughly review the mortgage agreement to understand the terms and conditions, and what steps can be taken in the event of non-payment.

- Contact the Borrower: Before taking any legal action, it is standard practice to contact the borrower to inquire about the missed payments. It is possible that there is a legitimate reason for the non-payment.

- Send a Formal Notice: If the borrower does not respond or is unable to make the payments, a formal notice may be sent. This notice should detail the amount due, including any late fees and the deadline by which the payment must be made.

- Consider Alternative Solutions: Depending on the borrower’s circumstances, you might consider alternative solutions such as loan modification, forbearance, or a repayment plan.

- Initiate Legal Action: If the borrower is still not able to make the payments, the lender can initiate legal proceedings. This usually involves filing a lawsuit in court to recover the money owed.

- Foreclosure Proceedings: In many cases, recovering an unpaid mortgage may involve the lender repossessing the property through a process known as foreclosure. The foreclosure process can be judicial or non-judicial depending on the laws in the jurisdiction.

- Property Auction or Sale: Once the property is repossessed, it may be sold through an auction or traditional sale to recover the unpaid mortgage amount.

- Deficiency Judgment: In some cases, if the sale of the property does not cover the total amount owed on the mortgage, the lender may seek a deficiency judgment against the borrower for the remaining balance.

- Collecting the Deficiency: If a deficiency judgment is granted, the lender may take further actions to collect the remaining balance. This can include garnishing wages, levying bank accounts, or placing liens on other properties owned by the borrower.

- Report to Credit Bureaus: The lender may also report the foreclosure and any deficiency judgments to credit bureaus, which can have a significant impact on the borrower’s credit score.

- Closing the Case: Once the lender has recovered the funds or the property has been sold, the legal case will be closed.

It’s important to note that laws and regulations governing mortgage recovery and foreclosure vary widely by jurisdiction. It is advisable to consult with a legal professional who specializes in real estate and mortgage law to understand the specific processes and requirements in your area. Additionally, lenders should also be cognizant of any legal obligations they have to act in good faith and to comply with laws that protect the rights of borrowers.

If you are looking for a Collections agency with extensive experience in recovering and negotiating mortgage debt: Contact us