“Dental Malpractice Insurance” also called “Professional Liability Insurance” is essential for all dental practices to protect them against the liabilities if a patient files a lawsuit.

According to data from NPDB, about 10,000 medical malpractice claims are paid out every year, totaling 3.5 billion dollars. It means that the average payout was nearly $350,000 per case. Unfortunately, more and more dentists are being sued these days. Even if the malpractice claim against a dentist is dismissed in court, a dentist still has to bear legal expenses if he does not have malpractice insurance. Dental Malpractice Insurance covers the cost of lawyers, trial fees, and court fees. Laws regarding medical and dental malpractice lawsuits vary by jurisdiction.

Most common reasons patients sue dentists for malpractice:

1. Tooth extractions can cause Nerve damage, Perforation of the sinus membrane, Undiagnosed infections, Wrong tooth was removed etc.

2. Anesthesia and Root Canal complications.

3. Lack of Informed Consent from the patient.

4. Failure to diagnose Gum disease, oral tumors and cancers.

5. Orthodontists who fail to monitor patients with braces accurately or incorrectly apply braces.

6. Infections of tooth decay from an ill-fitted crown.

7. Unexpected or adverse drug reactions.

8. Failure to refer the patient to a specialist.

9. Injury due to slipping or falling while at the dental office.

10. Complications from Dental Implants, Bridges and Crowns.

11. Death.

Without Dental Malpractice Insurance coverage, you may be unable to defend yourself and harm your hard-earned reputation.

Types of Dental Malpractice Insurance

1. State Patient Compensation Fund (PCF)

Many states like Pennsylvania, Wisconsin, Kansas, Indiana, Louisiana, New Mexico, Nebraska, South Carolina and New York have a provision that limits the liability of the physician/dentist in case a malpractice lawsuit is filed. Dentists usually pay an annual amount to participate in the PCF. This is not a replacement for Malpractice Insurance but only protects when the claimant demands huge sums of money, often beyond the coverage of Malpractice Insurance. Each state has different rules in the way PCF is implemented.

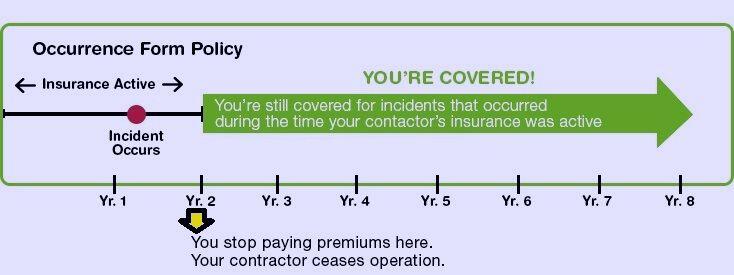

2. Occurrence Malpractice Insurance Policy:

Under this policy, you are covered while the policy was in effect. It does not matter if the coverage is in effect when the claim is made. The benefit of occurrence coverage is that even if you cancel your policy at some future date, you will still have coverage for events that occurred while the policy was in effect.

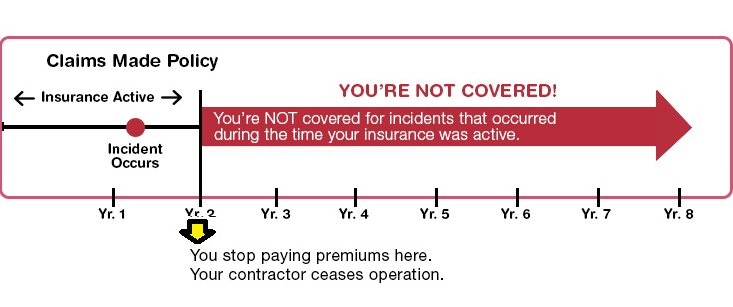

3. Claims Made Malpractice Insurance Policy:

The policy covers claims made against you only while the policy is in effect. The downside of this type of policy is that coverage must be continued indefinitely to assure coverage for claims filed in the future for actions that occurred in the past. Essentially, once the policy has lapsed, you no longer have coverage. If you no longer need coverage, you can purchase an “Extended Reporting Endorsement or Tail Coverage” to protect you from the past.

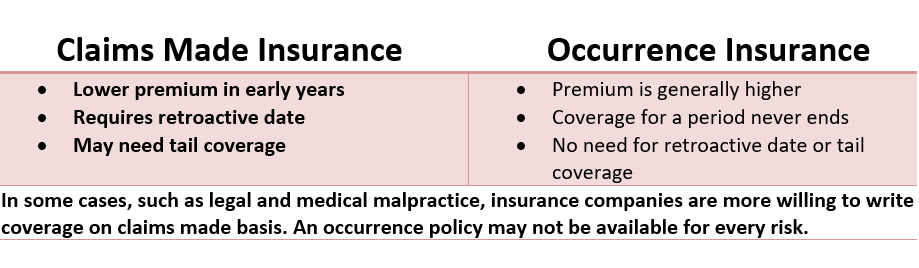

Comparison

Popular places to buy insurance:

1. American Dental Association (www.insurance.ada.org)

2. Mitchell & Mitchell Insurance (www.mitchellandmitchell.com/dental/)

3. www.medpro.com/practicing-dentists (www.medpro.com/practicing-dentists)

4. DentistCare by ProAssurance (www.proassurancedentistcare.com)

5. Fortress

6. CNA and Aon Affinity also offers dental firms nationwide malpractice insurance coverage to meet the needs of dental practices.

Links to buy dental malpractice insurance:

- https://www.medpro.com/practicing-dentists

- https://www.profsolutions.com/industries/dentists/insurance/malpractice/

- https://www.cna.com/web/guest/cna/industries/affinity/dentists

- https://www.tdicinsurance.com/Find-Coverage/Professional-Liability

Cost

Recent dental school graduates can expect to pay anywhere from $300 to $1,000 a year for a malpractice policy, depending on the coverage type and the amount of coverage purchased. After practicing for five years, these policies will usually cost $2,000 to $3,000 a year. Rates are higher in large metropolitan areas. Some insurance companies offer a 5% discount on the yearly premium if a doctor participates in an annual risk-management seminar. Sometimes you can add wrongful employee dismissal or sexual harassment claims to your malpractice policy for an additional fee.

Litigious Scrub of Collection Agencies

Patients file many lawsuits after failing to pay for the treatment, but when the dental practice staff tries to recover money from the patient, they wait for a debt collection law violation to sue the dental practice back for huge payouts. Many of these patients have a history of suing medical practices. It is advisable to transfer accounts to a collection agency after it has been due for over 60-90 days. Collection agencies are well trained on debt collection laws, and many agencies do a litigious scrub on these. If a patient is found to have a history of suing doctors, they advise the dental practice accordingly.

Sources:

www.npdb.hrsa.gov

www.eqgroup.com/occurrence_claimsmade_explained/

www.wwml.ca/insurance.html

United States is constantly experiencing rising health care costs and shortages of providers. An overly /lk3restrictive occupational licensing in the form of SOP (scope-of-practice) laws may also increase health care prices in the future.