Are you a large or even a mid-sized company, college, hospital, or government entity? In that case, you should always ask all collection agencies seeking your business to fill out Request-For-Proposal (RFP) document provided by you.

Benefits of asking to fill out your RFP

- It helps select a collection agency that takes your client’s data seriously and commits to keeping it secure.

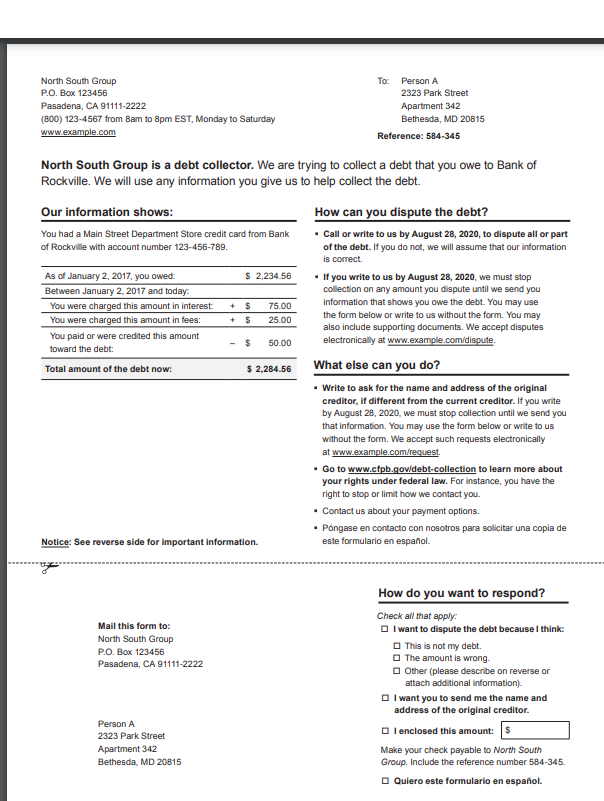

- Follows all federal and local laws when working on your accounts.

- It gives you a clear picture of whether they utilize other entities with whom your data will be shared during the collection process.

- It protects you from any legal issues that may arise in the future.

- Other benefits include competitive pricing, quality assessment, defining your needs and objectives, legal compliance, and risk assessment.

Here are essential points to include in your RFP questionnaire.

- Is their collection agency nationally licensed or not? (If not, which all states are you licensed in?)

- What services do they offer? Check all those which apply (Collection Letters, Collection Calls, and Legal).

- What are the fees for each of the above services and payment methods?

- Ask if they have the resources to handle the volume of data you would be submitting.

- How long have they been in business?

- Do they have a secure portal for submitting accounts?

- List all security certifications they have (Like SSAE / SOC / HIPAA etc.?)

- Are they GLBA compliant? (Important),

- Provide a workflow/chart of their collection process and if there are any other entities with whom your data will be shared.

- Can the accounts be uploaded in a batch using an Excel spreadsheet?

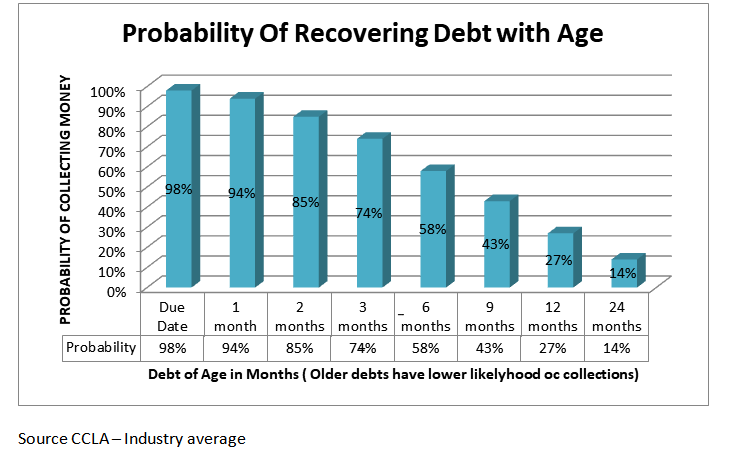

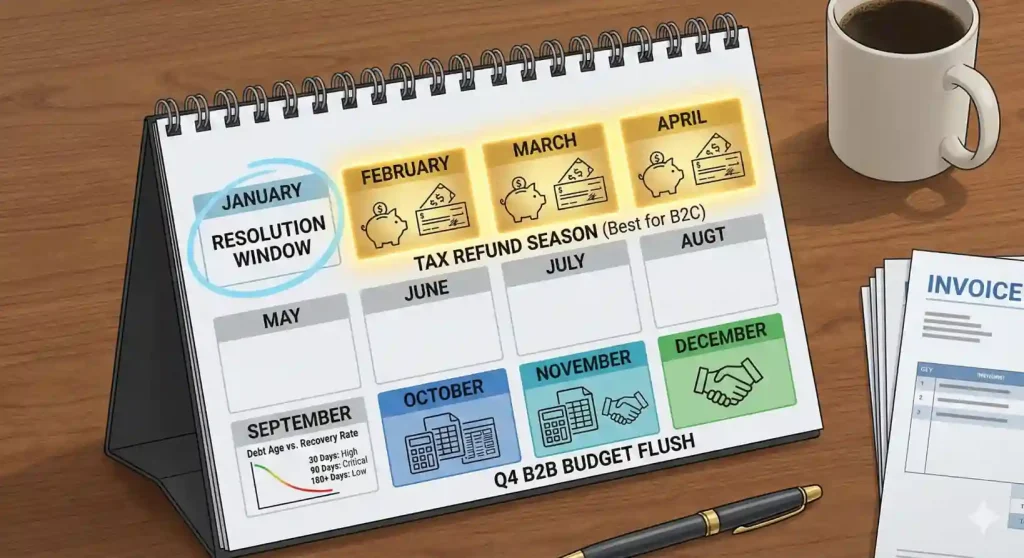

- Can they provide references (or names) of clients similar to our company? What is your average collection rate for our industry?

- Are their debt collectors regularly trained for debt collection laws like FDCPA/TCPA/HIPAA/State Legislation?

- What if the remittance frequency (for the amount collected by the collection agency)?

- Do they provide monthly collection status reports for all accounts?

- Which subcontractors/vendors are involved in performing your services? Do they also handle the debtor data securely as well?

- Are your company operations located overseas, or are you a 100% USA-based company?

- In case of a debtor dispute or litigation, what is your procedure? Do you have liability insurance against such disputes? Attach the proof.

- In case of service issues, who will be our point of contact from the senior management?

- In case of disagreement, can we withdraw all our accounts from you? Are there any exceptions?

- Do you offer both B2B and B2C collections?