Choosing the right collection agency can lift recovery on aged A/R, protect your online reputation, and keep you compliant. Use this field-tested checklist to compare agencies across price, compliance, data security, and results.

Quick Comparison Table

| Criterion | Why it matters | What “good” looks like | Ask this |

|---|---|---|---|

| Industry fit | Workflows vary by vertical | Playbooks for medical, dental, commercial, education, utilities | “Show vertical benchmarks and 2 references like us.” |

| Pricing model | Misaligned fees cut net recovery | Clear fixed-fee vs contingency; sample invoices; see Pricing & Fees | “Provide fee tiers and an example invoice.” |

| Compliance | Avoid fines and brand damage | Written FDCPA policies; HIPAA/GLBA where applicable (see Medical / Dental) | “Share policies and training logs.” |

| Data security | Protect PHI/PII and vendor risk | Documented controls; MFA; encryption; cyber insurance | “Provide attestations and cyber policy limits.” |

| Skip-tracing | Drives right-party contacts | Multi-source data; documented hit rates; included fees | “What are your hit rates by segment?” |

| Reputation protection | Tone affects complaints/reviews | Scripted empathy, QA, complaint workflow, call recordings | “Share scripts and QA scorecards.” |

| Reporting & portal | Visibility = control | Dashboard, notes, cohort analytics, exports | “Show a sample weekly/monthly report.” |

| Credit reporting | Powerful but regulated | Clear criteria; dispute-friendly; compliant timing | “When do you report and when not?” |

| Legal escalation | Needed for select cases | Nationwide attorney network; pre-suit success gates | “List pre-suit thresholds and costs.” |

| Onboarding speed | Faster start = faster cash | List load < 3 days; custom letters/dialer SLAs | “Give me a timeline with owners.” |

| Service levels | Predictable CX | SLAs for response, dispute TAT, call-recording access | “Include SLAs in the contract.” |

| Results & benchmarks | Proof over promises | Cohort data by age bucket and balance size | “Share anonymized performance by segment.” |

| References & reviews | Third-party validation | Industry-matched references and public reviews | “Can I speak with two similar clients?” |

14-Point Checklist (Actionable)

1) Industry fit

Choose an agency with proven workflows for your vertical: Medical, Dental, Commercial, Education, Utilities.

Ask this: “Show vertical benchmarks and two references like us.”

2) Pricing clarity: fixed-fee vs contingency

Match fees to account age and balance; avoid hidden add-ons. Compare options on our Pricing & Fees page.

Ask this: “Share fee tiers and a sample invoice.”

3) Compliance program

Verify FDCPA adherence and, where applicable, HIPAA/GLBA safeguards and TCPA-safe communications (see how we handle this in Medical and Dental).

Ask this: “Provide written policies and training cadence.”

4) Data security

Look for documented security controls (MFA, encryption at rest/in transit, least-privilege access) and cyber insurance.

Ask this: “Send attestations and cyber policy limits.”

5) Skip-tracing quality

Better data sources = higher right-party contacts and faster resolution. Relevant for both Commercial and consumer verticals.

Ask this: “What are your hit rates by segment? Is it included in fees?”

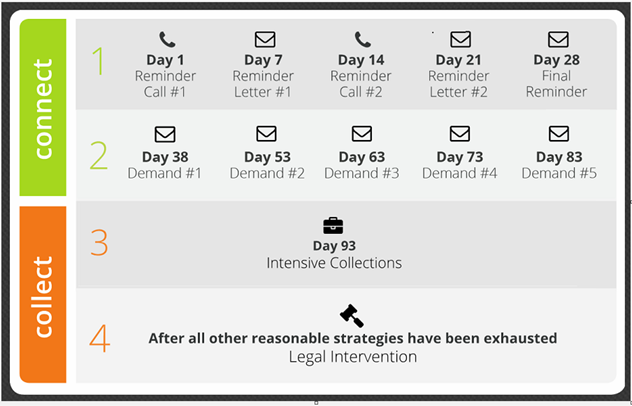

6) First-party vs third-party workflows

Early-out brand-safe touches vs firm third-party demands; both should be configurable. See examples within our services overview.

Ask this: “Show cadence and channels (email/SMS/IVR/letters).”

7) Reputation protection

Scripted empathy + QA reduces complaints and protects reviews—critical in Dental and Senior Living.

Ask this: “Share call scripts, QA scores, and complaint process.”

8) Reporting & transparency

Demand a portal with account notes, dashboards, cohort analytics, and exports. For what we report, see our services overview.

Ask this: “Send a sample weekly/monthly report.”

9) Credit-bureau reporting

Use carefully, lawfully, and with consumer-friendly dispute handling. Policy differs by vertical—e.g., Utilities versus Commercial).

Ask this: “When do you report and when is it withheld?”

10) Legal escalation

Seek a nationwide attorney network with pre-suit success gates and transparent costs. This is particularly relevant on older balances in Commercial.

Ask this: “Share thresholds for suit and cost schedule.”

11) Results & benchmarks

Insist on anonymized performance by age bucket (<90, 90–180, >180 days) and balance size—see case patterns across Medical, Dental, and Commercial.

Ask this: “Provide cohort outcomes for accounts like ours.”

12) Onboarding time

Clear milestones: list-load, custom letters, dialer setup, portal training. We outline this in our services overview.

Ask this: “Map the timeline with owners for each step.”

13) Service levels

Contractual SLAs for response, dispute TAT, complaint handling, and call-recording access.

Ask this: “Add SLAs to the MSA/SOW.”

14) References & reviews

Validate with industry-matched references and public reviews; you can also review outcomes by vertical: Medical, Dental, Utilities, Schools.

Ask this: “Can I speak to two similar clients?”

🚩 Red Flags to Avoid 🚩

-

No written compliance program or training logs

-

No security attestations (e.g., SOC 2) or cyber insurance

-

Complaints about aggressive tactics or sudden review spikes

-

Opaque pricing, “per-hit” skip fees, or surprise add-ons — compare with our Pricing & Fees

-

No reporting cadence or portal access

-

One-size-fits-all approach; no industry references

FAQs

Q: What recovery rates should I expect by account age?

A: Newer accounts (<90 days) recover the most via first-party/fixed-fee. Older balances often perform better on contingency with targeted outreach and (when appropriate) credit reporting or legal options. Explore by vertical: Medical, Dental, Commercial.

Q: How do I choose between fixed-fee and contingency?

A: Use fixed-fee for fresh, lower-balance accounts where reminders work (you keep 100% of payments). Move older/harder debt to contingency with transparent tiers. See examples on Pricing & Fees.

Q: How are patient/customer complaints handled?

A: Ask for the complaint workflow, response-time SLA, sample responses, and how QA audits calls to prevent issues. For sensitivity in senior care, review our guidance for Senior & Assisted Living.

Q: Do I need credit reporting?

A: Not always. It’s powerful but regulated. Your agency should document when it’s used, validate accounts, and handle disputes promptly (see Utilities vs. Commercial).

Q: What legal costs might I incur?

A: Pre-suit demand is typically included. Court filing and process-server fees are usually client-approved pass-throughs. Get costs in writing before escalation. Learn how we approach this in Commercial Collections.

Talk to Us

Want a side-by-side agency comparison tailored to your industry? We’ll map fees, workflows, and expected recovery by age bucket.

Get a comparison → https://nexacollect.com/contact/

See our services → https://nexacollect.com/debt-recovery/