Why do Chinese come to USA for Child Birth?

The increased patronage of US-based fertility clinics by Chinese clients can be attributed to several factors, unique to the demographic, cultural, and legal landscapes of the country.

- Advanced Medical Technology: The US is known for its advanced medical technology and high standard of healthcare services, especially in the field of fertility treatments. This attracts individuals seeking state-of-the-art reproductive assistance.

- Legal Restrictions in China: China had a strict one-child policy for decades, which was only recently relaxed. This policy, along with other reproductive regulations, may limit the availability and scope of fertility treatments in China, prompting individuals to seek options abroad.

- Perception of Quality: There is a perception among many that healthcare and fertility services in the US are of a higher quality than those available locally. The US clinics often offer a wide range of services, including genetic screening and advanced IVF technology.

- Surrogacy Services: Commercial surrogacy is illegal in China. Many Chinese individuals and couples turn to the US, where commercial surrogacy is legal in many states, for these services.

- Education and Immigration Considerations: Some Chinese clients may choose to have a child in the US due to educational and citizenship advantages. Children born in the US automatically receive American citizenship.

How can Fertility Clinics collect Unpaid Bills from China

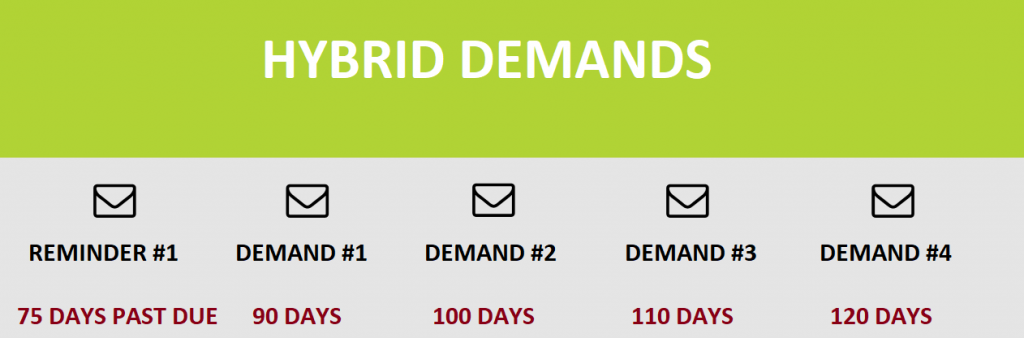

Collecting unpaid bills from debtors in China can be a complex process for US-based fertility clinics, mainly due to differences in legal systems, geographical distance, and potential language barriers. Here are some steps and considerations for US fertility clinics attempting to collect debts from individuals in China:

- Understanding Legal Frameworks: The first step is understanding the legal frameworks and debt collection regulations in both the United States and China. This includes understanding international law and bilateral agreements that might affect debt collection.

- Engaging Legal Counsel: It’s advisable to engage legal counsel with expertise in international debt collection. Law firms that specialize in cross-border financial disputes can navigate the legal complexities and provide guidance on the feasibility and process of debt recovery.

- Translation and Communication: Given the language barrier, it’s important to have all communications, including legal documents, accurately translated into Chinese. This ensures clear communication with the debtor and adherence to legal standards in China.

- Utilizing International Debt Collection Agencies: There are agencies that specialize in international debt collection. These agencies are familiar with the legalities and cultural practices of debt collection in different countries and can act on behalf of the US clinic to collect the debt.

- Negotiation and Settlement: Sometimes, direct negotiation with the debtor can lead to a settlement. It might be more practical to settle for a partial payment than to pursue the full amount, considering the costs and uncertainties involved in international debt collection.

- Exploring Legal Action in China: If other methods fail, legal action in China might be necessary. This is a complex and potentially costly route, as it involves navigating the Chinese legal system with the help of local attorneys.

- Understanding Cultural Differences: Awareness of cultural differences in business and legal practices is crucial. What is considered a standard practice in the US might be different in China, and vice versa.

- Compliance with International Laws: Ensure compliance with international laws such as the Hague Convention, if applicable, and local laws regarding privacy, debt collection, and financial transactions.

- Enforcement of Judgments: If a US court issues a judgment against a debtor in China, enforcing it can be challenging. It depends on whether China recognizes and enforces US court judgments, which is not always the case.

- Cost-Benefit Analysis: Before proceeding, it’s important to conduct a cost-benefit analysis to determine if the potential recovery of the debt justifies the costs and efforts involved in international debt collection.

Huge Risks of Transmitting data to China

Navigating the complex landscape of collection laws in the United States is a challenging endeavor. The country’s legal framework is unique in that each of the 50 states has its own set of collection laws, akin to 50 individual countries with varying regulations and time zones. For instance, the laws governing collections in California differ significantly from those in New York, and similarly, the regulations in New York vary from those in Nevada and Texas.

This complexity is further compounded when dealing with debtors residing in foreign countries, such as China, especially when the contractual agreement was made with a US-based fertility clinic. In such cases, it is essential for both domestic and international collection agencies to ensure full compliance with the collection and data security laws of both the United States and the debtor’s country of residence, in this instance, the USA and China.

A prime example of this complexity is the adherence to the “GLBA” data security law, which mandates collection agencies to maintain security measures comparable to those of banks. However, this law is not enforced internationally, posing significant risks for US creditors like fertility clinics, especially when transmitting patient data that will eventually be sent abroad. There is always a possibility that the foreign collection agent or lawyer may not comply with GLBA, HIPAA, and FDCPA laws. This uncertainty raises concerns, particularly in scenarios where a foreign debtor might engage a US-based attorney and pursue legal action, which could vary significantly depending on the country involved.

Moreover, most international collection agencies operating within the United States (and occasionally Canada) often collaborate with local agencies, agents, and lawyers for operations in other countries. This presents a substantial risk when transmitting medical client data to countries like China, given the complexities and potential legal and security implications involved.

A Better Approach

Modify your contract and make sure that all your clients who are not paying their medical bills in full before leaving, should arrange for a USA guarantor or a relative in USA as a backup, in case they go back to China without paying for the procedure.

In summary, US-based fertility clinics should approach the collection of unpaid bills from debtors in China methodically, understanding the legal complexities and cultural nuances involved. Professional legal and financial advice is crucial in navigating this challenging task.