Whether you’re a family-run yard or a regional building supplier, local construction cycles shouldn’t dictate your cash flow. Don’t let past-due contractor notes stall your inventory turnover while the competition keeps building across town. We help our local partners reconcile accounts before a single bad debt weakens your standing in our community.

Lumberyards Are Not Banks: Stop Financing Your Customers’ Projects

As a supplier, you are operating on razor-thin margins. Industry data for 2024 shows that the average net profit margin for building material dealers often hovers between 3% and 6%.

Here is the math that keeps owners awake at night: If you write off just $10,000 in bad debt at a 5% margin, you have to sell an additional $200,000 in lumber just to break even.

Nexa provides a reputation-safe approach, equipped with all 50-state collections license, offering free credit reporting, free litigation, free bankruptcy scrubs, and zero onboarding fees. Secure – SOC 2 Type II & FDCPA compliant. Over 2,000 online reviews rate us 4.85 out of 5.

Need a Collection Agency? Contact us

In the building materials sector, your reputation is as important as your inventory. We act as your Account Reconciliation Team, using a “Velvet Hammer” approach—diplomatic enough to protect your 5-star online reputation but firm enough to ensure you are the first creditor paid. Our team includes dedicated Spanish-speaking collectors to bridge communication gaps immediately.

The “Dispute” Game: How GCs Delay Payment

We know the specific excuses you hear from general contractors, because we handle them every day. Traditional agencies treat every debt like a credit card bill. We treat lumber debts like construction disputes.

We know how to push back on the common “stall tactics” used in the lumber trade:

-

The “Culling” Claim: The contractor waits 45 days to tell you that 20% of the framing package was “unusable” due to wane or shake. We demand the timestamped photos and the rejection notice that should have been sent upon delivery, not two months later.

-

The “Phantom” Shortage: They claim the load was short five bundles of studs. We counter with the signed Proof of Delivery (POD) and GPS data from your drop.

-

The “Pay-When-Paid” Bluff: GCs often tell suppliers they can’t pay until the owner pays them. In most states, this clause does not apply to material suppliers. We remind them of the law.

Transparent Recovery for Building Suppliers (B2C Accounts)

Cash flow is the lifeblood of the lumber industry. We provide straightforward pathways to get your balance sheet back in the green without the guesswork:

-

Fixed-Fee Recovery ($15): Best for early-stage accounts. You pay a flat fee per account and your business retains 100% of the recovered funds.

-

Contingency Resolution (40%): Our “No Recovery, No Fee” model ensures we only get paid when you do.

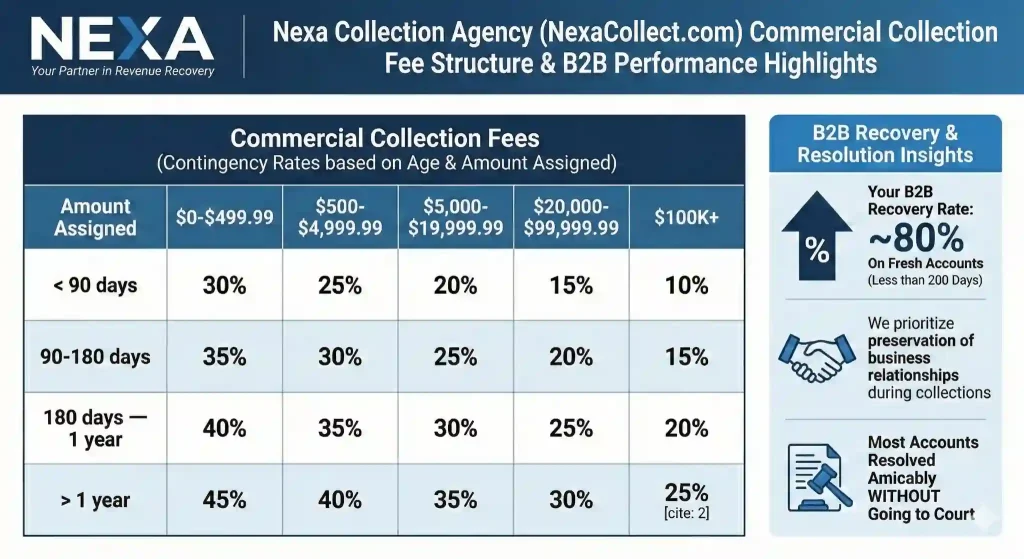

Pricing for Commercial B2B Accounts

Why LBM Dealers Choose Us

-

We Check Before We Chase: We provide Free Bankruptcy and Litigious Checks on every account. If a builder has already filed Chapter 7, we tell you immediately so you don’t throw good money after bad.

-

We Protect Your Brand: The construction world is small. We recover your money firmly but professionally, ensuring you don’t get a reputation for being “impossible to work with” in the local market.

-

Nationwide Reach: Whether you shipped a load across the county line or across the country, we are licensed to collect in all 50 states.

Success Story: The $42,000 “Pay-When-Paid” Pivot

The Conflict: A General Contractor (GC) stalled a $42,000 framing invoice, using the “Pay-When-Paid” excuse to treat a local lumber yard like an interest-free bank.

The Strategy: We bypassed the stall by initiating a Phase 2 Lien-Aware Escalation, diplomatically reminding the GC that material suppliers are legally exempt from such clauses.

The Result: The balance was settled in full within 18 days—prioritized to avoid a bond claim—and because our “Velvet Hammer” approach preserved the relationship, the contractor has since returned for a new $60,000 cash-up-front order.

Q&A: Real Issues from the Lumber Yard

Q: Can you help if the material was stolen from the job site?

A: This is a massive issue. Contractors often try to refuse payment for material stolen after delivery. However, legally, FOB Job Site means the risk of loss transfers to the buyer upon delivery. If you have a clean POD, we enforce payment. The contractor’s lack of site security is not your financial loss.

Q: Do you handle Retainage disputes?

A: Yes. Retainage (usually 5-10%) is standard, but GCs often “forget” to pay it out months after the project is closed. We track substantial completion dates and aggressively pursue these “leftover” balances that add up to significant profit.

Q: What about “Moisture Content” disputes?

A: This is frequently a user error (improper storage on site) rather than a product defect. We know how to ask the right questions to determine if the lumber was left uncovered in the rain versus actually being delivered wet.

Stop Cutting Into Your Margins

You delivered the wood. You deserve the check. Stop letting bad debt eat away at your hard-earned profits.

Collecting money for Lumberyards NationwideContact us & start recovering. High recovery rates. |