Financial businesses of all sizes frequently struggle with their accounts receivable, trying to recover money from those 2%-3% accounts who just refuse to pay on time, even after repeated followups. This is when a financial collection agency can be extremely helpful to recover money from unpaid bills.

Financial institutions often spend too much of their own time, resources and money chasing after these delinquent accounts then they are worth. After a few contacts, even the in-house employees feel helpless and frustrated since these borrowers refuse to budge, continue to give awkward excuses, start your ignoring calls and repeatedly break their promise to make payments on time. Some of them may even become unreachable or relocate to a new address unknown to you.

Writing off these accounts can result in a big financial hit for any business. These bad debts can either lower the profit margin of your company and in extreme cases, drag your income statements in red, and causing cash flow issues for your financial business.

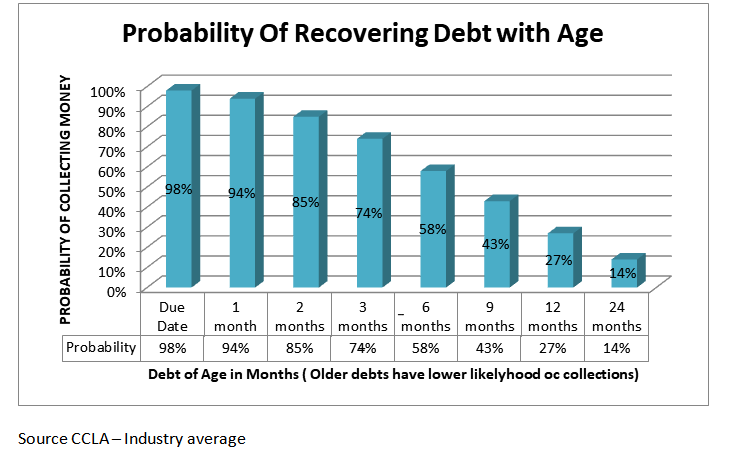

Accounts which do not get resolved in the first 90 days, rarely get settled. If these accounts are not transferred to a Financial Collection Agency, the likely-hood of they ever getting resolved reduces by 10% every passing month.

Loans, mortgages, credit card debt, student loan, overdraft fees, returned checks and account fees are some of the most common debts incurred by financial businesses like Banks and Credit Unions. Some debts may be as low as $20 and others running into thousands of dollars. Borrowers can be individual consumers or business entities.

| Summary of Financial Collection Agency’s Services

|

| Collection Letters Service |

|

| Collection Calls Service |

|

You must hire a financial collection agency which has extensive experience in both Consumer debt collection and commercial debt collection. They should ideally be licenced in all 50 states. Banks and Credit unions use collection agencies extensively.

If you need a cost-effective financial collection agency: Contact Us