The Simple Guide to Profitability

In dentistry, “business” does not always equal “profitability.” You can have a packed waiting room and still struggle with cash flow if your overhead is out of control. Calculating your overhead isn’t just an accounting chore—it’s taking the financial pulse of your practice.

The Basic Formula

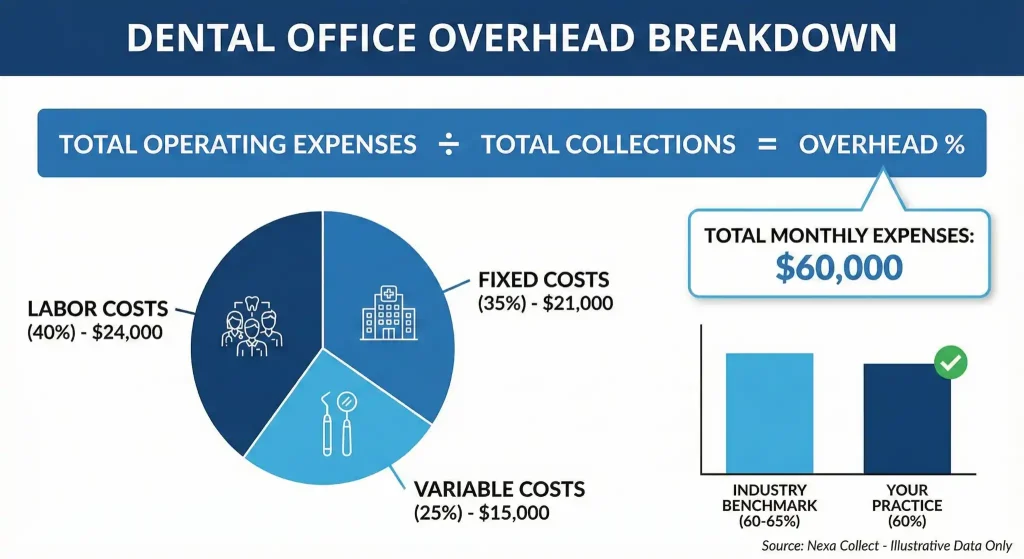

To find your overhead percentage, use this simple calculation:

(Total Operating Expenses ÷ Total Collections) x 100 = Overhead %

Example: If your annual operating expenses are $700,000 and your total collections are $1,000,000, your overhead is 70%.

Step 1: Categorize Your Expenses

To get an accurate number, group your costs into three main buckets:

-

Fixed Costs (The “Stay Open” Costs):

These don’t change regardless of how many patients you see.-

Rent/Mortgage

-

Utilities & Software Subscriptions

-

Insurance (Malpractice, Business)

-

Loan Payments

-

-

Variable Costs (The “Production” Costs):

these fluctuate based on your volume.-

Dental Supplies (Gloves, composite, impression material)

-

Laboratory Fees

-

-

Labor Costs (The Biggest Slice):

-

Staff Salaries & Benefits (Hygienists, Assistants, Front Desk)

-

Payroll Taxes

-

Note: Do not include the owner-dentist’s personal salary here.

-

Step 2: Know the Benchmarks

Where does your practice stand? According to industry standards, here is the breakdown of a healthy practice:

-

Total Overhead: 60% – 65% (The “Sweet Spot”)

-

Staff Labor: 24% – 28%

-

Dental Supplies: 5% – 6%

-

Lab Fees: 8% – 10%

-

Facility/Rent: 7% – 9%

The Red Flag: If your overhead is consistently above 75%, you aren’t running a business—you’re running a non-profit. It’s time to audit your supply waste or re-evaluate your scheduling efficiency.

Step 3: Increase the “Gap”

You can improve your overhead in two ways: Cutting costs or Increasing production. * Audit your supplies: Are you over-ordering?

-

Optimize the schedule: Are there gaps in the day where you are paying staff but not seeing patients?

-

Review Lab Fees: Negotiate better rates with your primary lab partners.

The Bottom Line

Understanding your overhead turns you from a “worker in the practice” into an “owner of the business.” Track these numbers monthly to ensure that your hard work translates into the take-home pay you deserve.