By law, all debt collectors are required to provide at least 30 days to the debtor/consumer to dispute the debt, after the consumer receives (or is assumed to receive) the validation information. Most collection agencies will add about additional 2 weeks to account for mailing delays and holidays.

This format is located here:

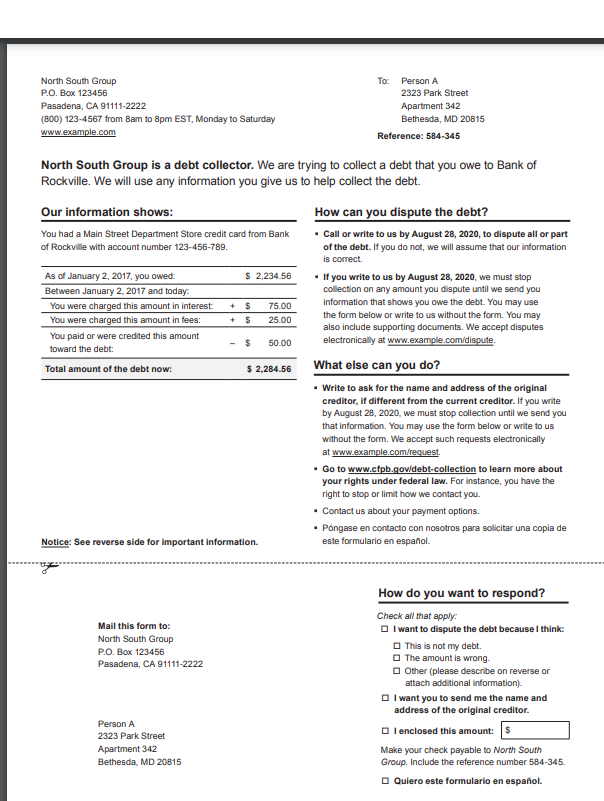

CFPB Debt Collection Validation Notice R19 ( as of Nov 2021)

https://files.consumerfinance.gov/f/documents/cfpb_model-validation-notice_2020-12.pdf

These are the standard options available to dispute the debt:

| Check all that apply: I want to dispute the debt because I think: * This is not my debt. * The amount is wrong. * Other (please describe on reverse or attach additional information). * I want you to send me the name and address of the original creditor. |

Collection agencies not following this exact format risk safe harbor and may possibly get sued by attorneys.

They may additionally add page 2, which essentially says:

This notice is to inform you the consumer that this debt was assigned to ABC collection agency and they will not take any action from XX days from the date of this letter.

( XX days can vary depending on the policy of the collection agency – Say 45 days or 60 days)