Medical insurance claims submitted by doctors, dentists, and hospitals with proper documentation must be paid within established time limits, or the insurers may face penalties and other sanctions. These requirements, known as “prompt-pay statutes,” are primarily enforced within the healthcare industry.

Helping Medical Professionals to Recover Unpaid Insurance Claims !Serving Nationwide: Contact Us |

When a third-party collection agency contacts an insurance company, the insurer is reminded of its obligation to pay claims promptly. Failing to resolve medical insurance claims on time can result in a violation of state law.

Once an insurance company receives a collection notice from a professional collection agency, they are under pressure to act fast.

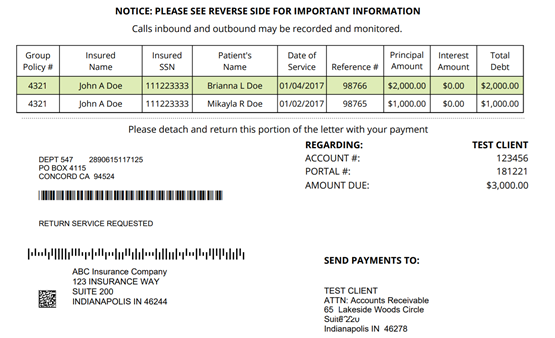

Collection Notice ( Sample)We have made repeated attempts to resolve this matter with no response from your office. This leaves us no alternative but to pursue this debt through more intense collection methods. We hope that further efforts will be avoided on this account by sending payment in full to the address in the bottom portion of the letter. As of the date of this letter, the balance due and owing is stated above. Because of interest that may vary from day to day, the amount due on the day you pay may be greater. Hence, if you pay the amount shown above, an adjustment may be necessary after we receive your check, in which event we will inform you before depositing the check for collection. For further information, please write the undersigned. THIS COMMUNICATION IS FROM A DEBT COLLECTOR. THIS IS AN ATTEMPT TO COLLECT A DEBT AND ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE. |

These laws and payout periods vary from state to state in terms of operation, complexity, and severity. However, they all share the common goal of compelling insurers to promptly and fully pay all legitimate claims. Debt issues in the BSFI market are anticipated to grow significantly over the next 10 years.

Non-timely reimbursements is a leading cause of stress and burnout among medical professionals, then why not outsource unpaid medical insurance claims to a professional agency and get paid faster.

Examples of “prompt-pay statutes” law in some states.

Texas Insurance prompt payment statute:

The Texas Prompt Pay Act (“TPPA”) is codified in the Texas Insurance Code as Subchapter J of Chapter 843 (governing health maintenance organizations (HMOs)) and Subchapters C and C-1 of Chapter 1301 (governing preferred provider organizations (PPOs)).

California prompt payment statute:

California Health & Safety Code 1371. A health care service plan, including a specialized health care service plan, shall reimburse claims or a portion of a claim, whether in-state or out-of-state, as soon as practicable but no later than 30 working days after receipt of the claim by the health care service plan, or if the health care service plan is a health maintenance organization, 45 working days after receipt of the claim by the health care service plan.

Florida Insurance prompt payment statute:

Florida statute 627.6131, otherwise known as the “Prompt Pay Statute,” requires insurance companies to make decisions and pay out on claims quickly. The timeframe created by this legislation depends on how the claim was received, either electronically or physically.

New York State prompt payment law health insurance:

Law § 3224-a (McKinney 2000) requires payment of health claims by health insurance companies within 45 days of receipt of such claim; N.Y. Ins. Law § 5106 (McKinney 2000) requires motor vehicle no-fault providers to pay health claims arising from vehicular accidents to be paid within 30 days of receipt of such claim.

North Carolina: 30 days for payment or denial.

North Dakota, Georgia: 15 days

Ohio, Oregon, Delaware, Idaho, Kansas, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Montana, Nevada, Wisconsin: 30 days

Oklahoma, Colorado, Pennsylvania, Missouri, Nebraska, Vermont, Virginia, Wyoming: 45 days

Alabama, Arkansas: 30-45 days

Arizona: 30 days after the claim is approved

Louisiana: 25 to 45 days

Mississippi: 25-35 days

( days refer to “working” days)

References:

www.tlrfoundation.com/sites/default/files/pdf/TLR_Prompt_Pay_PDF_V01.pdf

danahyandmurray.com/florida-prompt-payment-statute/

www.dfs.ny.gov/insurance/ogco2002/rg207242.htm