Distribution runs on trust and terms. But when invoices slip past 30, 60, and 90 days, “normal AR” turns into a cash-flow leak. Your team resends statements. The buyer promises “next week.” Your sales team keeps the relationship warm. And the unpaid balance just sits there.

That’s where Nexa comes in.

We help distribution companies recover unpaid B2B invoices through a contingency-first collections model built for commercial relationships—firm, professional, and results-driven.

Trusted by businesses nationwide to recover millions in lost revenue annually. We combine a 80% success rate on viable claims with a diplomatic “Velvet Hammer” approach—ensuring you get paid without damaging valuable B2B relationships.

| Need a Commercial Collection Agency? Contact Us Serving Hundreds of Businesses !Easy to use • Fully Compliant with Federal and State Laws • USA Citizens-Only Team • 24×7 Secure Portal • High Recovery Rates • Over 20 years Experience • Free Commercial Credit Bureau reporting • Low fee • Highly Rated ! |

Why Distribution Companies Struggle With Unpaid Accounts

Most overdue distribution balances follow the same pattern:

- The buyer delays using “paperwork issues” or “pricing mismatch”

- Internal AR gets stuck in repeated reminders

- The customer stays active, but old balances remain unresolved

- The account ages until it becomes harder to collect

- Your business absorbs the loss through write-offs

The fix is simple: earlier escalation + better structure.

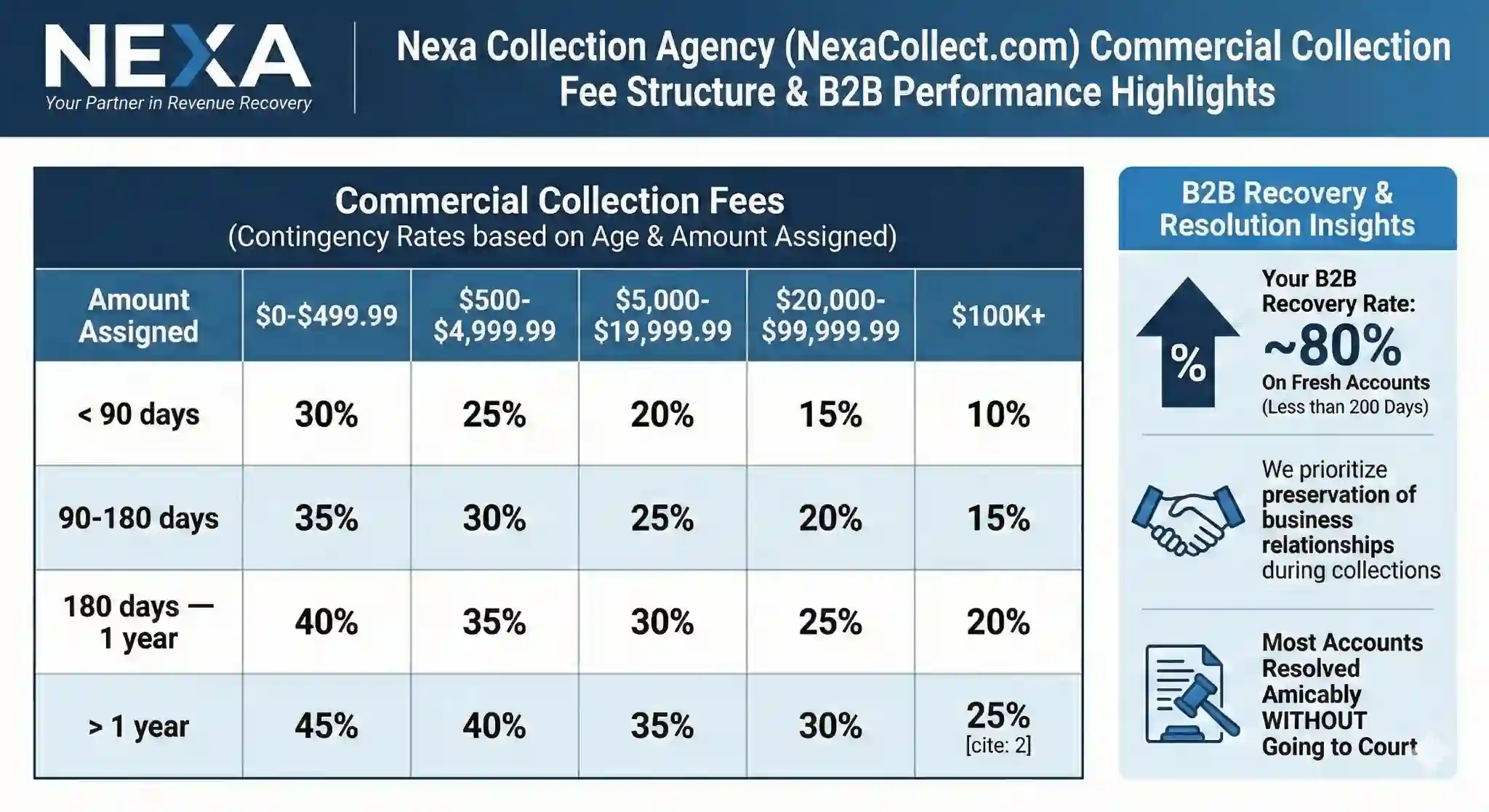

Commercial Collections Pricing (Contingency-Based)

Most distribution businesses prefer contingency collections because it aligns incentives.

✅ Contingency Fee Range: 10% to 45%

✅ No Recovery, No Fee

✅ Fees are set in advance based on balance size, age, documentation strength, and complexity

✅ Higher balances + newer invoices typically qualify for lower rates

✅ After initial review, fee communicated to you in advance

This gives you predictable cost with professional action—without increasing payroll or burning internal time.

~80% Recovery on Fresh Commercial Accounts (When Documentation is Strong)

Commercial recovery success depends heavily on timing and proof.

For fresher accounts—typically up to 200 days old—our partners consistently achieve ~80% recovery when the account is supported by the right backup documentation.

Examples of strong support:

- Invoice(s)

- Aging report / statements

- Proof of delivery (POD/BOL)

- Order confirmations or email approvals

- Signed credit application or contract terms (when available)

In distribution, documentation isn’t “nice to have.” It’s leverage.

How NexaCollect Recovers Distribution Debt (Step-by-Step)

We don’t rely on aggressive scripts. We run a commercial recovery workflow that gets attention fast and keeps the conversation professional.

Step 1 — Intake + Documentation Review

We review:

- balance amount and age

- customer profile and behavior patterns

- dispute signals vs stall tactics

- documentation strength

If anything is missing, we tell you exactly what to pull so we can proceed with confidence.

Step 2 — Executive-Level Outreach

This is where most recoveries happen.

We contact the right decision-makers and clearly communicate:

- the balance details

- the delivery/terms basis

- the resolution deadline

- the available payment options

The tone stays firm but respectful. It’s not emotional. It’s business.

Step 3 — Dispute Control + Resolution

Distribution “disputes” often include:

- short shipment claims

- pricing adjustments

- missing paperwork excuses

- partial-payment delay strategies

We separate real issues from stalling. If the dispute is legitimate, we document and resolve it. If it’s a delay tactic, we escalate strategically until a settlement or payment plan is secured.

Step 4 — Credit Leverage (When Appropriate)

Business credit reporting can create urgency for B2B customers who care about:

- trade reputation

- supplier approvals

- financing relationships

- future vendor terms

When appropriate and permitted, this lever pushes action without needing court.

Step 5 — Legal Escalation + Enforcement

If the account requires legal action, escalation can move to:

- attorney demand

- litigation strategy (jurisdiction + cost logic)

- judgment pursuit

- enforcement tools such as liens or bank levies (where available)

Most accounts won’t go this far—but the ability to escalate strengthens the pressure earlier.

What Distribution Accounts Are a Good Fit?

We’re strongest when the balance is tied to delivered goods and clear payment expectations, including:

- wholesale supply invoices

- net-30 / net-45 delinquency

- repeat buyer overdue balances

- partial payment patterns

- “promise-to-pay” loops

- older AR that stalled internally

If you can prove delivery and terms, you have a recoverable account.

FAQs for Distribution Collections

1) What do you need from us to start?

At minimum:

- invoices and aging report

- customer contact details

- proof of delivery (if available)

Stronger documentation = faster recovery.

2) Is it really “no recovery, no fee”?

Yes. Under contingency, if there’s no recovery, you don’t pay the contingency fee. Rates are agreed in advance based on the account profile.

3) How fast can you start?

Typically within 1 business day once the account details and documentation are received.

4) Will this damage customer relationships?

Handled poorly, yes. Handled professionally, it often restores clarity.

Our approach is commercial and respectful—designed to get paid while keeping the door open for future business.

5) What if the buyer disputes the balance?

We request proof, isolate the issue, and drive resolution. Real disputes get documented settlement paths. Delay tactics get structured escalation.

Stop Carrying Unpaid AR Longer Than You Need To

Unpaid distribution invoices don’t improve with time. They get harder to recover, and they distract your team from growth.

NexaCollect gives you a structured commercial recovery system that:

- moves faster than internal AR

- applies professional pressure

- protects customer relationships

- and escalates to legal enforcement when required

Recover the balance. Protect your cash flow. Keep your operations clean.