You did the work. You delivered the product. You sent the invoice. And then… silence, or excuses.

In small business, an unpaid invoice isn’t just a “late payment”—it’s a Cash Flow Crunch. Whether you’re a B2B consultant or a B2C home service provider, every day that balance sits on your aging report, your profit evaporates.

The secret to recovery isn’t being “the heavy”—it’s Diplomacy. You want your money, but you also want to protect your local reputation and your professional bridges.

Need a Collection Agency for your Business?Contact us• Nationwide Coverage • US Citizens-Only Team • High Recovery Rates • Free Bankruptcy screening • Free Credit Bureau reporting • Free skip tracing • 5-star rated • 24×7 Secure Portal • Industry Specific Collectors • Cost-Effective • No Onboarding fee or Minimums |

The Psychology of Non-Payment: Why They “Ghost”

Whether it’s a CEO or a homeowner, the reason for silence is usually the same: Embarrassment. * The Business Client: Often stuck in “Decision Paralysis” due to internal budget shifts.

The Individual Customer: Often overwhelmed by personal financial stress.

Nexa acts as your Neutral Mediator. We lower the heat, shifting the conversation from a “confrontation” to a “resolution.” We preserve your brand while we secure your profit.

The Nexa “Dignity-First” Recovery Ladder

We separate “administrative confusion” from “bad debt” to maximize your recovery while protecting your reputation.

Step 1: The Account Reconciliation (Fixed Fee – $15)

Ideal for accounts 60–90 days past due. This is a soft, third-party “nudge” that identifies simple misunderstandings, insurance gaps (for B2C), or internal billing errors (for B2B). You look professional, not desperate—and you keep 100% of the money recovered.

Step 2: Full-Service Mediation (Contingency)

For aged debt or unresponsive people/entities. We perform deep-data scrubs to find the decision-makers and the funds. We use Diplomatic Negotiation to resolve the balance without litigation whenever possible. No Recovery = No Fee.

Small Business Best Practices (B2B & B2C)

-

The “Stop Work” Policy: If the last invoice is unpaid, don’t start the next phase. Your time is your inventory; don’t give it away.

-

Friendly Reminders vs. Demands: Your first two internal follow-ups should always frame the issue as a “possible billing error.” This gives the client a “graceful exit” to pay without admitting they were short on cash.

-

Charge Interest: Your contracts/service agreements should always include a “Late Fee” clause. Even if you waive it later, it provides a powerful negotiating chip.

Why Small Businesses Choose Nexa

-

The Reputation Shield: One bad review on Google or Yelp can kill a small business. We record and audit all calls to ensure your clients and customers are treated with extreme respect.

-

FDCPA & HIPAA Ready: We handle the legal “alphabet soup” so you don’t have to. We ensure every B2C interaction is 100% compliant with consumer protection laws.

-

The “Audit” Reframe: We don’t call as “debt collectors.” We call as your “Account Reconciliation Partners.” This lowers defenses and leads to faster payments.

Frequently Asked Questions (FAQ)

1. Will I lose the client if I send them to Nexa?

Actually, our Step 1 ($15) service often saves the relationship. It identifies the “administrative friction” that was causing the silence, allowing both parties to move forward with a clean slate.

2. Can you collect if there is no written contract?

Yes. For B2C, we can use work orders and signed estimates. For B2B, we can use email chains and “Proof of Work” deliverables to establish the debt.

3. Is my “small balance” worth it?

Yes. Our Step 1 is designed specifically for small amounts. If you have 10 customers owing $100, our system recovers that $1,000 for a fraction of the cost.

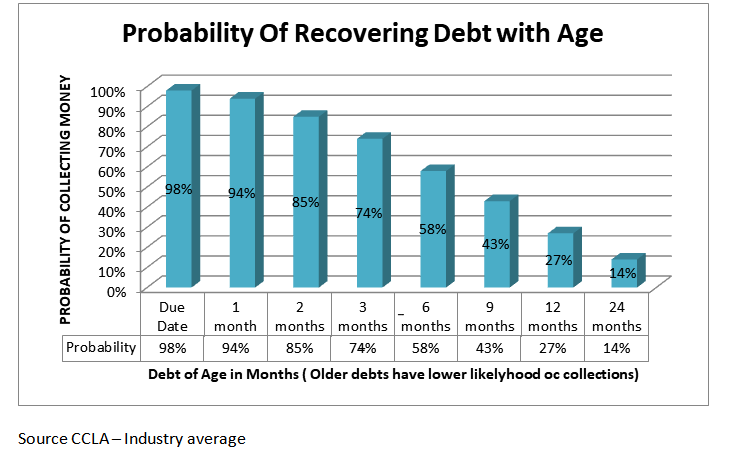

Act Fast!