In the digital age, hiring a collection agency has never been easier. There’s no need for in-person meetings, physical paperwork, or tedious calls to customer service for updates.

Contact us : We can make this process extremely smooth for you.

Tip: Never hire a very small collection agency as they would not have enough resources, security implementations to keep your data safe, or a national license. Ability to collect money in all 50 states is important as people move from one state to another especially when they have defaulted.

Most reputable collection agencies provide a convenient online client portal, allowing you to effortlessly sign up for their services from the comfort of your own home. Before making your final decision, request detailed information from the agency’s sales representative and schedule a consultation call to discuss their services and address any concerns you may have. This ensures a transparent and informed decision-making process, saving you valuable time and effort.

Steps before sending someone to collections

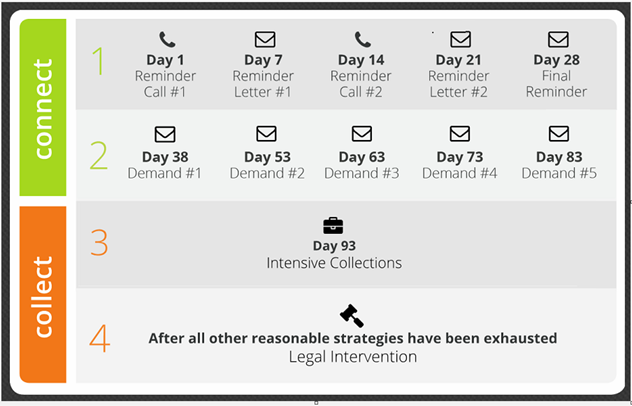

- Wait 90+ days: It’s generally recommended to wait at least 90 days after the invoice due date before considering collections.

- Resend invoices: Send the invoices again, ensuring they haven’t been lost or overlooked.

- Send reminders: Send polite reminders to the debtor, either through email or phone calls.

- Make phone calls: If reminders don’t work, try contacting the debtor directly to discuss the payment.

- Send a demand letter: A demand letter is a formal notice informing the debtor of the consequences of non-payment, including your intention to forward their account to a collection agency.

Ready to send account to a Collection Agency

- Verify the debt: Ensure the debt is valid and all necessary steps have been taken to collect it.

- Choose a collection agency: Research and select a reputable collection agency.

- Provide documentation: Provide the agency with all relevant documentation, including invoices, contracts, and communication records.

- Monitor progress: Track the progress of the collection efforts on their online client portal.

- Consider fixed fee service: Although most people tend to go with contingency-only collections (No Recovery – No Fee), however it almost always better and cheaper to go for fixed-fee service that averages $20 per account.