The more you defer working on your overdue bills, the financial situation of your customers/debtors will deteriorate. The probability of getting paid will decrease with each passing day, especially during a recession.

When the economy slows down, getting paid becomes harder—even by customers who normally pay on time. Rising interest rates can increase monthly payments on credit cards, auto loans, and mortgages, while layoffs and higher living costs squeeze budgets.

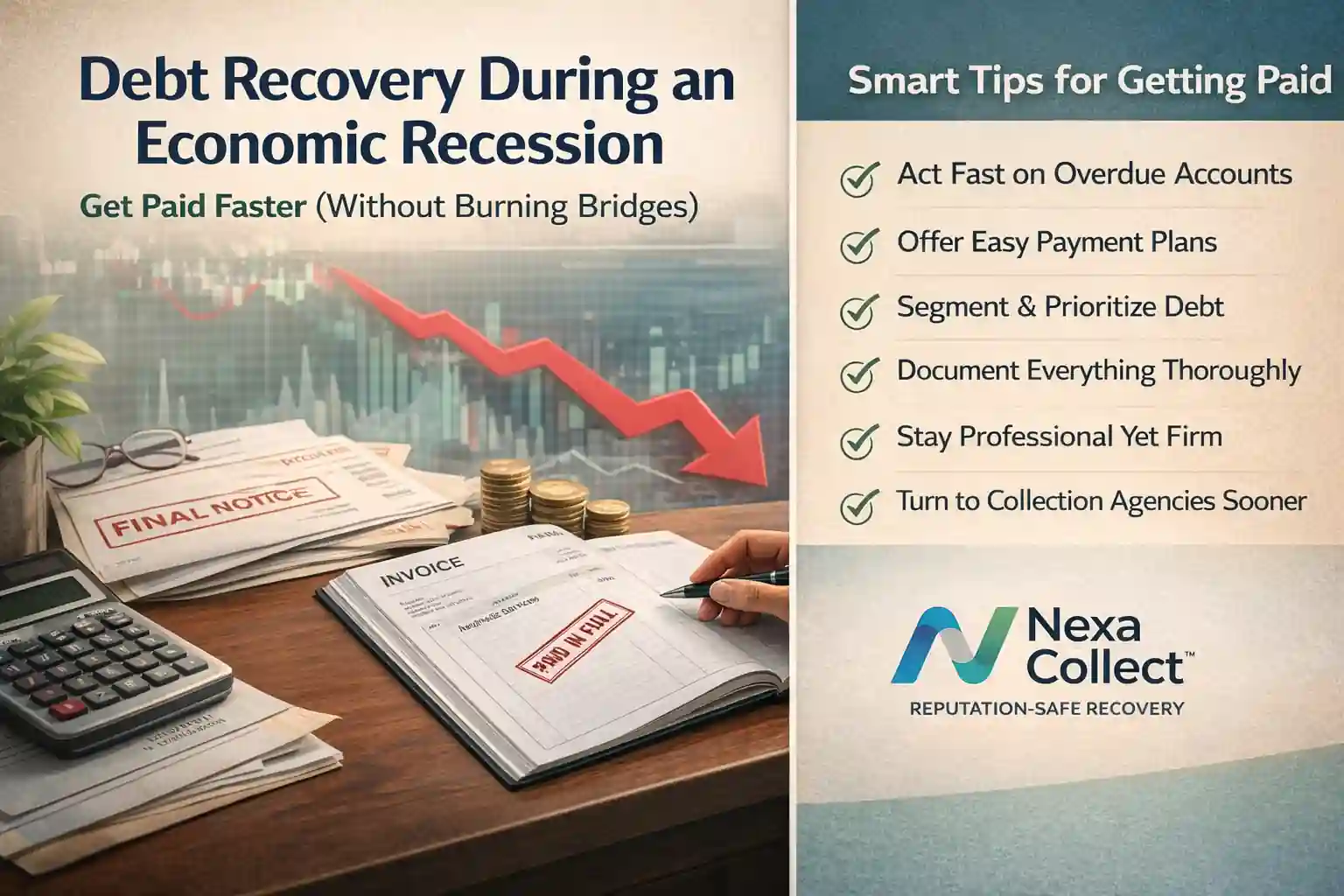

That’s why recession debt recovery isn’t just “collect harder.” It’s about collecting smarter, faster, and more professionally—before your invoices become last on the debtor’s priority list.

Quick Recession Debt Recovery Checklist

✅ Follow up early (don’t wait months)

✅ Prioritize your “most recoverable” accounts

✅ Offer structured payment solutions

✅ Tighten documentation and remove disputes

✅ Communicate firm but professional

✅ Use escalation deadlines

✅ Assign stuck accounts to collections fast

Nexa provides a reputation-safe approach, equipped with all 50-state collections license, offering free credit reporting, free litigation, free bankruptcy scrubs, and zero onboarding fees. Secure – SOC 2 Type II & HIPAA compliant. Over 2,000 online reviews rate us 4.85 out of 5.

Need a Collection Agency? Contact us

Below is a detailed, recession-friendly playbook that helps businesses protect cash flow while still keeping relationships intact.

1) Act Early: Fresh Debt Recovers Faster

Waiting is the biggest mistake. 30–90 days past due is still recoverable. 180+ days becomes high-risk.

Best timeline:

-

Follow up within 3–7 days of due date

-

Escalate at 15–30 days

-

Consider collections at 45–60 days if ignored

2) Segment Accounts (Don’t Treat Everyone the Same)

Prioritize like triage:

-

A: Most recoverable (recent, responsive)

-

B: Needs negotiation (cash-flow issues)

-

C: High risk (disputed, non-responsive, closed)

3) Offer Structured Payment Options

One-time demands often fail in a recession. Give simple choices:

-

2-part split payment

-

3–6 month plan

-

Fast-pay incentive (where appropriate)

People don’t need pressure—they need a path.

4) Reduce Disputes With Strong Documentation

Disputes increase during downturns. Be ready with:

-

invoice + contract/PO

-

proof of delivery/completion

-

approvals/scope emails

-

payment history summary

Clean paperwork speeds agreement.

5) Stay Professional: Reputation-Safe Recovery Works

Aggressive tactics can backfire. A recession-friendly tone is:

calm, direct, consistent.

Use firm lines like:

-

“Let’s resolve this before it escalates.”

-

“Here are options to close the balance.”

6) Escalate Smart: Deadlines Without Drama

Structure gets results. Use a clear ladder:

Reminder → Final notice → Resolution window → Third-party collections

Always include a deadline + next step so it doesn’t drag on forever.

7) When to Involve a Collection Agency

If internal follow-ups aren’t working, a collection agency can help by:

-

contacting debtors professionally

-

negotiating settlement plans

-

escalating correctly

-

recovering funds while you focus on business

It also removes awkward chasing and improves recovery odds.

Why Recessions Create More Past-Due Accounts

During an economic recession, debtors typically do three things:

-

Delay payments to preserve cash

-

Dispute invoices more often to buy time

-

Ghost vendors instead of negotiating

Even customers with good intentions may prioritize essentials (payroll, rent, fuel, inventory) and push your invoice to “later.” And unfortunately, “later” often turns into never.

Need help recovering overdue invoices during a recession? Contact us