NextGen is modern. Your A/R might not be.

NextGen has grown into a major player in ambulatory EHR and practice management, with cloud-based tools for scheduling, documentation, billing, and revenue cycle management for both small practices and larger enterprise groups.

On paper, it can:

-

Streamline claims

-

Reduce days in A/R

-

Accelerate collections

NextGen even offers A/R recovery support, where a specialist team works aged accounts and some clients see several-fold returns on that investment.

Yet many practices still see:

-

Days in A/R drifting well past 40–50 days

-

A growing stack of 60–120+ day patient balances

-

No clear policy on when an account stops being “just late” and becomes bad debt

The problem usually isn’t the software. It’s the last mile of collections.

What NextGen actually does well for the money side

Before talking about collections, it helps to be clear about what NextGen already brings to the table.

For billing & RCM, NextGen can:

-

Capture charges and push cleaner claims through its integrated PM and clearinghouse

-

Use rules engines and edits to reduce denials and rework

-

Provide A/R dashboards and reports so you can see aging, payer mix, and payment lag

-

Offer RCM services teams who focus on insurance A/R, underpayments, and denials

Done well, a practice-management system like NextGen should help you keep most payments inside 30–40 days, with overall A/R days ideally under 40–50.

What it doesn’t do is chase stubborn patient balances indefinitely.

Where NextGen stops and true collections begin

NextGen is built to manage the revenue cycle:

-

Registration

-

Eligibility

-

Coding and charges

-

Claims and remits

-

Insurance follow-up

But once a self-pay or residual balance has:

-

Ignored statements, texts, and portals

-

Sat in 60–120+ day aging buckets

-

Stopped responding to your staff

…you’re no longer dealing with a billing issue. You’re in debt recovery territory.

At this stage, you need:

-

Persistent, structured follow-up over weeks and months

-

Skip-tracing when contact data is wrong

-

Negotiation skills with patients juggling multiple debts

-

A clear path to escalation or closure

That’s work for a collection agency, not an EHR.

A simple NextGen → collection agency workflow

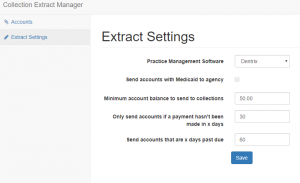

Instead of exporting random spreadsheets whenever someone has time, you can turn your overdue A/R into a repeatable pipeline.

Your existing page already hints at a NextGen debt collection utility. Let’s frame what that looks like in a way that’s clear for readers.

You keep control over four levers:

-

Minimum balance

-

Example: only send accounts above $100, $250, or $500, depending on your patient base and risk tolerance.

-

-

Account age / last payment date

-

Only send accounts where no payment has been made in, say, 60 / 90 / 120 / 180 days.

-

This uses the “last payment” or “last activity” data already living in NextGen.

-

-

What “step” they go into

-

Soft, fixed-fee letter campaigns (polite but firm, branded notices).

-

Or straight into phone-driven, contingency collections for chronically late payers.

-

Or a combination: letters first; calls later if there’s still no response.

-

-

Who not to send

-

Disputed cases

-

Active payment plans

-

Certain payer classes or assistance programs

-

Any accounts you want to treat with extra care

-

Once those rules are locked in, the workflow is simple:

-

Run your NextGen aging / A/R reports

-

The utility picks up accounts that meet your rules

-

Approved accounts are transferred cleanly to your chosen collection partner

-

As money is recovered, payments are posted back in your system like any other payment

No re-keying. No “we’ll do this someday.”

When does a NextGen account become a collections account?

Every practice needs its own policy, but your NextGen data should drive that decision, not gut feeling.

A practical approach:

1. Watch your aging buckets

From your NextGen PM or RCM reports, track:

-

0–30 days (normal cycle)

-

31–60 days (reminders + phone calls)

-

61–90 days (warning zone)

-

91–120+ days (high risk / probable bad debt)

If a noticeable chunk of your patient A/R lives in 91+ days, those dollars are in danger.

2. Set a time rule

For example:

-

Any patient balance with:

-

No payment in 90+ days, and

-

At least 3–4 contacts (statements / reminders / calls), and

-

No active arrangement

→ Eligible for collections placement.

-

3. Set a dollar rule

-

Very small balances (say, under $50–$100):

-

Bundle them for periodic batch placement or write-off.

-

-

Mid-size balances (e.g., $150–$750):

-

Full reminder sequence, then collections at 90–120 days.

-

-

Big balances (e.g., $750+ or $1,000+):

-

Extra attention early; don’t let them quietly age past 60–90 days.

-

Once you’ve written these rules down, your NextGen reports become a placement engine, not just an FYI.

Why a NextGen-savvy collection agency matters

NextGen already gives you:

-

Detailed A/R and encounter data

-

Insurance vs patient split

-

Notes about earlier contact and billing history

A good collection agency knows how to work with that data instead of starting from scratch. That means:

-

Using your exports to prioritize high-yield accounts

-

Respecting your patient-experience expectations while still being firm

-

Staying compliant with HIPAA, FDCPA, and state collection laws

-

Reporting back with enough detail that you can reconcile easily inside NextGen

You’re not looking for “sharks.” You’re looking for a specialized extension of your revenue cycle that understands how NextGen practices operate.

Where Nexa fits in

A quick reminder, because it’s easy to get confused:

-

Nexa is an information portal, not a collection agency.

-

We do not call your patients, post payments, or do credit reporting.

Here’s what we actually do:

-

Talk with medical practices using platforms like NextGen about their A/R headaches, balance sizes, and payer mix.

-

Help clarify when it makes sense to keep accounts in your own NextGen workflows and when it’s time to escalate.

-

Share your collection requirements with a shortlist of medical-focused, compliant collection agencies we believe can handle your type of receivables.

-

Leave the choice completely in your hands — you decide which, if any, agency to work with.

If your NextGen dashboards look sophisticated but your aging report is still bloated, it’s not a sign you picked the wrong software.

It’s a sign you’re ready for a sharper, rules-driven bridge between NextGen and true debt recovery — so more of that “Accounts Receivable” line finally turns into cash in the bank.

| Already using NextGen Dental Software? Have unpaid medical bills?

|