Telehealth and virtual care have dramatically reshaped healthcare delivery, providing accessible, efficient, and patient-friendly alternatives to traditional in-person visits. Yet, telemedicine brings unique billing and debt collection challenges, requiring tailored strategies distinct from conventional medical billing.

Telehealth providers should partner with a collection agency that is HIPAA-compliant, highly rated, licensed in all 50 states, and experienced in medical collections. Just as importantly, the agency must prioritize data security and protect your reputation through respectful, patient-friendly practices.

Why Telehealth Debt Collections are Different

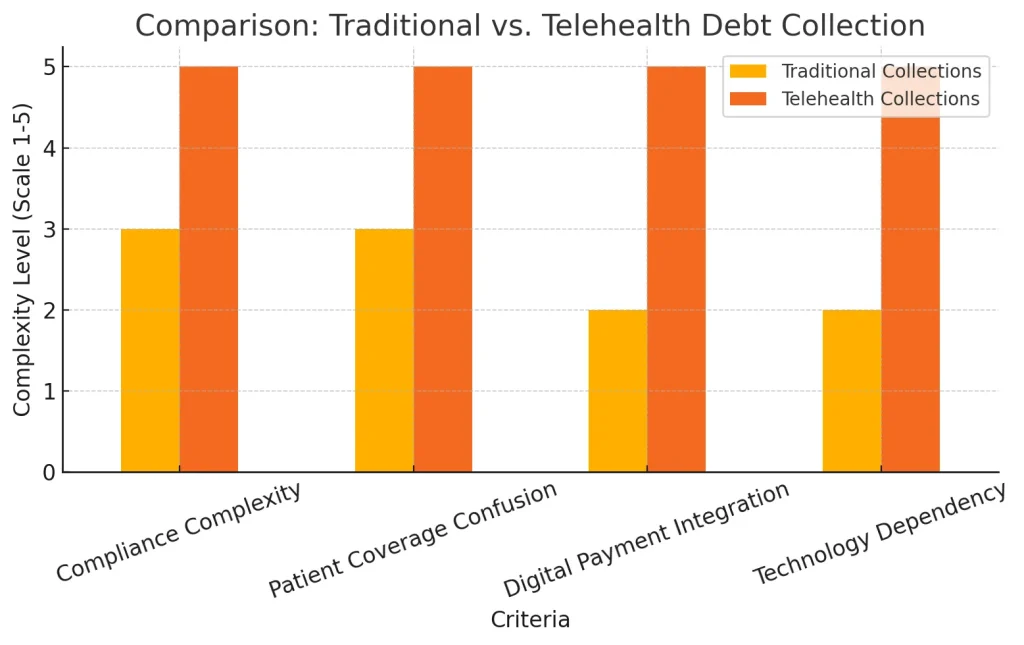

Telehealth collections differ significantly from traditional medical billing due to:

- Geographic complexity: Telehealth providers often treat patients across state lines, introducing varied billing regulations and compliance requirements.

- Technology-driven workflows: Virtual care relies heavily on digital payments and patient portals, necessitating robust online billing systems.

- Insurance variability: Telehealth insurance coverage can differ greatly depending on the patient’s policy, state, and the nature of virtual visits, often resulting in unexpected denials.

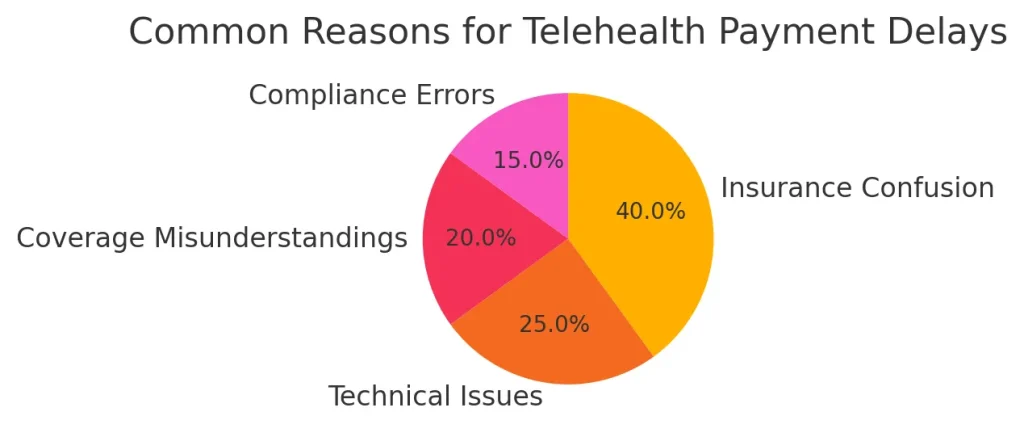

Unique Challenges in Telehealth Debt Collection

- Compliance Across Jurisdictions: Telehealth providers must comply with differing state laws, licensing requirements, and telehealth-specific billing regulations. Failure can lead to denied claims and collection complexities.

Example: A virtual mental health provider treating patients in multiple states must adhere to each state’s telehealth reimbursement rules to avoid insurance rejections.

- Patient Confusion Regarding Coverage: Patients often misunderstand the scope of their telehealth coverage, resulting in higher rates of non-payment or delayed payments.

Example: Patients might assume all virtual visits are fully covered, only discovering afterward that certain visits, such as teletherapy sessions, have limited coverage.

- Integration with Digital Payment Platforms: Effective collections require seamless integration with user-friendly online payment systems. Telehealth providers who lack intuitive payment portals see higher delinquency rates.

Example: Practices using platforms like Healow or MyChart for seamless bill payments see increased promptness and satisfaction compared to those using disconnected systems.

Effective Debt Collection Strategies for Telehealth

- Clear Communication of Coverage: Ensure patients clearly understand their financial obligations before appointments, reducing disputes and confusion.

- Omnichannel Billing Solutions: Provide multiple digital payment options, such as mobile payments, online portals, or SMS-based systems, enhancing convenience.

- Real-Time Eligibility Verification: Adopt technology that checks insurance eligibility instantly, reducing claim denials and associated collections.

- Compassionate Virtual Collection Practices: Telehealth is rooted in convenience and care—collection practices should reflect this ethos, employing empathy-driven scripts and digital reminders.

Selecting the Right Collection Agency for Telehealth

When outsourcing collections, telehealth providers must look specifically for agencies that:

- Have Multi-State Compliance Expertise: Ensure the agency is adept at managing collections under varying state telehealth regulations and laws.

- Leverage Technology for Efficiency: Agencies should integrate seamlessly with telehealth providers’ existing billing and patient portal systems, providing frictionless payment experiences.

- Offer Clear, Empathetic Communication: Prioritize agencies with a proven record of compassionate collection practices that align with telehealth’s patient-first model.

- Demonstrate Proven Telehealth Experience: Select agencies familiar with telehealth nuances, insurance complexities, and virtual care billing dynamics.

Real-World Success Story

A national telehealth provider partnered with a tech-forward collection agency, integrating their patient portal with the agency’s collection software. Within six months, patient satisfaction improved, and collections increased by 25%.

Conclusion

Debt collection for telehealth and virtual care is complex but manageable with strategic approaches that prioritize compliance, technology integration, and patient-focused communication. By thoughtfully selecting partners and investing in efficient digital systems, telehealth providers can significantly improve revenue cycles while enhancing patient satisfaction.