If you have been ignoring to collect money from those past-due accounts, it can seriously damage the cash flow needed for the smooth functioning of your business. Here are the vital signs that your accounts receivable are already overdue for some serious collection efforts. Your unpaid bills must be assigned to a debt collection agency without further delay.

- You are losing money due to non-payment from your customers.

- More than one customer has failed to pay you.

- You have regularly started getting excuses from your customer, “I am in a meeting, let me call you back“, but the call never comes back.

- Your customer has repeatedly started breaking promises to pay off their current balance on the agreed date.

- Your customers’ checks have bounced repeatedly.

- You and your staff are unfamiliar with collection laws and regulations and unknowingly risk getting sued.

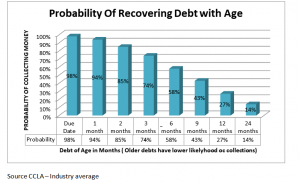

- Many of your accounts are over 90 days past due, and your internal collection efforts have effectively failed. You are losing about 10% money each month on these unpaid invoices as the probability of getting paid decreases with every passing day

- Your debtor is untraceable. Neither picking calls and your paper invoices are being returned as “un-deliverable” or “incorrect address“.

- You do not have the staff with enough knowledge to handle collection efforts; they are falling behind or unwilling to handle customer disputes over payment anymore.

- You are spending too much time chasing non-paying customers, time that could have been better utilized expanding your business.

- You are having trouble paying your own creditors because of non-payment from your customers. Accounts receivable have started to hurt you directly.

- You do not have the cash flow to hire new employees, forced to think about the cost-cutting measures or lack of money to purchase a piece of new equipment.

- If you have customers located all over USA, and you are finding it hard to track them.

- You got a favorable judgment from the small claims court, yet you are not getting paid by the debtor.

- A customer has falsely started pinpointing gaps in your service or how bad your product is. However, you know clearly that is not true.

- Ignoring accounts receivable has complicated the situation and can only be handled by an expert third party like a debt collection agency.

No one wants to be called by a debt collector, even if there is a legitimate reason for the call.

Debt collection agencies have resources, staff and tools to locate people, find their assets, collect money from accounts receivable and even take them to court if required.

Ignoring accounts receivable is a mistake as it will only hurt your business. It is crucial to have a company policy on how to handle accounts receivable.