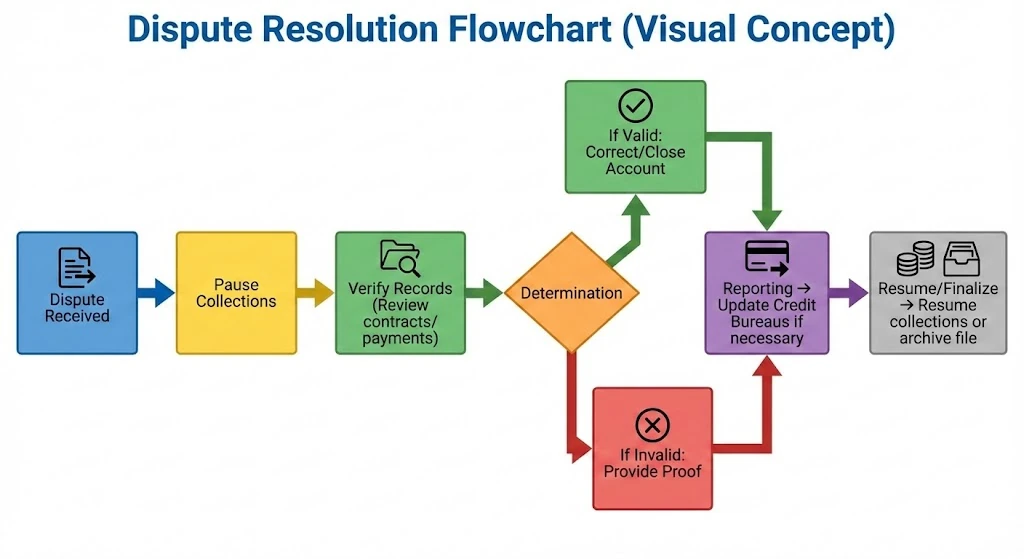

How to Handle Debtor Disputes & Complaints

Managing disputes professionally is a hallmark of a compliant collection agency. Following federal regulations ensures that the rights of both the creditor and the debtor are protected.

Mandatory Compliance & Procedures

-

Immediate Cease of Activity: When a debtor disputes a debt, the collection agency must immediately halt all collection efforts until the dispute is verified.

-

Regulatory Adherence: All processes must align with the Fair Debt Collection Practices Act (FDCPA) and the Fair Credit Reporting Act (FCRA) nationwide.

-

Evidence Gathering: Collect and review all account statements, original contracts, and payment history to verify the debt’s accuracy.

-

The 30-Day Rule: By law, if a dispute is raised during the validation period, the collection agency has 30 days to provide backup documentation. If the creditor cannot provide this, the account may need to be closed.

Valid vs. Invalid Disputes

-

Valid Disputes: Occur if the debt was already paid, is a result of identity theft, or contains accounting errors. The collection agency must correct these records and update credit bureaus immediately.

-

Invalid Disputes: Occur when the debtor acknowledges the debt but is attempting to delay payment. In these cases, provide clear, written evidence of the debt to the debtor to resume collection activities.

Escalation and Legal Review

-

Attorney Involvement: If a debtor is represented by counsel, the account is classified as “litigious.” The collection agency should consult with the client to determine if the account should move to legal action or be closed.

-

Staff Training: Ensure all personnel are trained on dispute resolution to maintain high standards of effectiveness and legal compliance.

Frequently Asked Questions (FAQ)

-

Can a collection agency contact me during a dispute?

No. Once a written dispute is received, the agency must stop contact until they provide verification of the debt.

-

What happens if the original creditor doesn’t have the paperwork?

If documentation cannot be produced within the legal timeframe, the collection agency must generally cease collection efforts on that specific debt.

-

Does a dispute automatically remove the item from my credit report?

Only if the dispute is found to be valid and the information is proven inaccurate. If the debt is verified, it remains on the report.