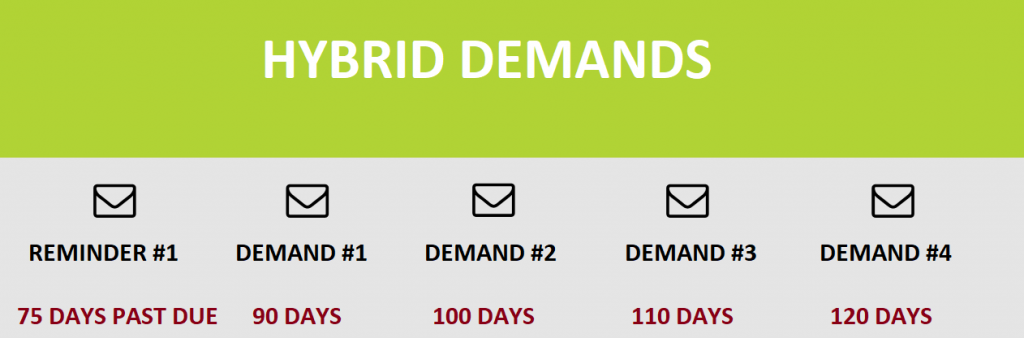

Use Fixed Fee Hybrid demands service for newer accounts !

You worked hard for that money. Why give half of it away?

If you run a medical practice, dental office, or small business, you know the pain: You have unpaid bills, but sending them to a traditional collection agency feels like a defeat. Why? Because most agencies take 33% to 50% of the money they collect as their commission.

That means on a $1,000 bill, you might only see $600. The rest vanishes.

But for debts that are less than a year old, there is a smarter way. It’s called Fixed-Fee Recovery, and it changes the math entirely.

The Problem: Traditional “Contingency” Collections

The traditional model works on a percentage. The agency says, “We don’t get paid unless you get paid.” That sounds great, but it’s expensive. It’s designed for old, difficult debt that requires hard labor to recover.

For newer accounts, you are overpaying. massively.

Fixed-fee collections use a diplomatic, professional approach that recovers your money while protecting your hard-earned reputation and preserving valuable client relationships.

The Solution: The “Pre-Collect” Fixed Fee Model

Instead of giving up a percentage of your revenue, you pay a small, one-time flat fee per account (typically around $15) to purchase a “block” of accounts.

Here is the difference:

-

Contingency: You pay a huge commission on success.

-

Fixed Fee: You pay a tiny flat rate upfront. You keep 100% of the money recovered.

Let’s Look at the Math

Here is a real-world comparison on a single $2,000 unpaid balance.

| Standard Agency (33%) | Fixed-Fee Service | |

| Debt Amount | $2,000 | $2,000 |

| Cost to You | $660 (Commission) | ~$15 (Flat Rate) |

| Money You Keep | $1,340 | $1,985 |

| PROFIT DIFFERENCE | +$645 |

How It Works (The 3-Step Process)

When you use a Fixed-Fee service through our partners, you are automating the pressure on the debtor without losing your profit margin.

-

You Upload the Accounts: You purchase a batch of accounts (credits) that never expire. You enter the debtor’s info into a secure portal.

-

The System Goes to Work: The agency sends a series of 5 attorney-approved demand letters and makes automated calls in your name.

-

You Get Paid Directly: The debtor is instructed to pay YOU. The money goes to your office or your bank account. The agency never touches it.

Is Fixed-Fee Right for You?

This model isn’t for everyone. It works best if you fit this profile:

-

Your debt is “fresh”: Accounts are between 60 days and 12 months past due.

-

You have smaller balances: If you have many accounts under $500, a contingency fee usually eats all the profit. Fixed-fee protects it.

-

You value customer relationships: Fixed-fee services are firm but professional. They are designed to get you paid without burning bridges or creating “bad blood.”

The “Smart Strategy” (Phase 1 vs. Phase 2)

We recommend a Two-Phase Approach to maximize your revenue:

-

Phase 1 (The Audit Phase): Send all accounts between 90–120 days past due to the Fixed-Fee service. This costs you pennies on the dollar and recovers the majority of solvable debt.

-

Phase 2 (The Cleanup Phase): Any accounts that still haven’t paid after the Fixed-Fee cycle can then be rolled over to a traditional contingency agency for harder collections.

Stop Bleeding Revenue

Don’t let unpaid invoices sit until they are worthless, and don’t pay 40% fees on easy-to-collect money.

Ready to try the low-cost approach?

Fill out the form below to get a quote for Fixed-Fee services tailored to your industry.