In the modern regulatory environment, a collection agency is either a financial asset or a legal liability. From the strictures of the No Surprises Act to the nuances of state-level consumer protections, “good intentions” are not enough. At Nexa Collections, we believe that compliance is the foundation of recovery. We don’t just “debt collect”; our Account Reconciliation Team operates under a “Firm on Results, Fair on People” mandate that shields your practice from litigation and protects your brand from public “review-bombing”.

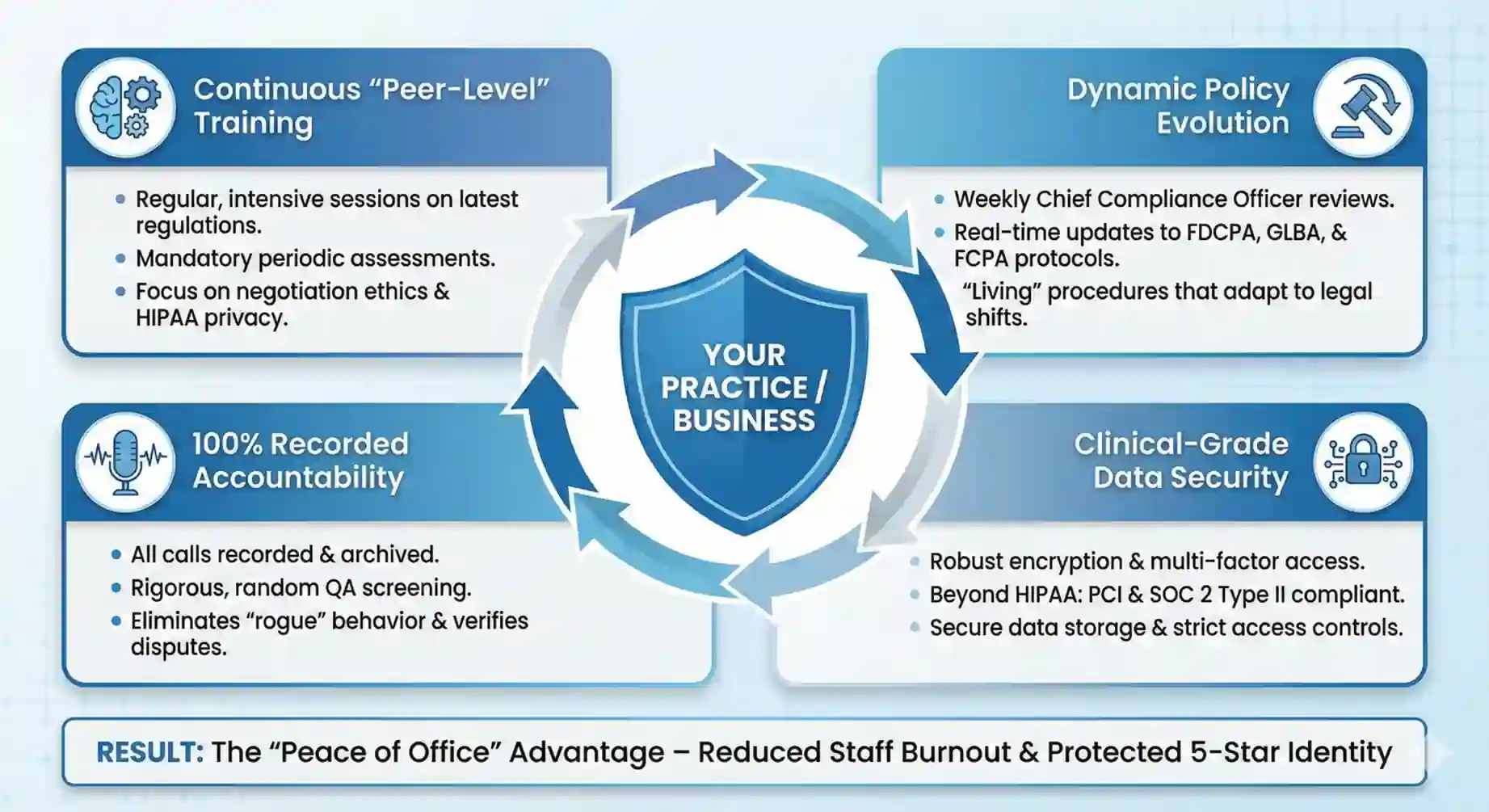

Our Four Pillars of Regulatory Excellence

1. Continuous “Peer-Level” Training

We don’t settle for annual checklists. Our specialists undergo regular, intensive training sessions focused on the latest federal and state-specific regulations. To maintain active status on our team, collectors must pass periodic assessments on negotiation ethics, HIPAA privacy standards, and the FDCPA. This ensures that every conversation reflects the same professionalism found in your own office.

2. Dynamic Policy Evolution

Laws change; so do we. Our Chief Compliance Officer conducts weekly strategy meetings to audit our internal policies against the latest shifts in the FDCPA, HIPAA, GLBA, and FCPA. By maintaining a “living” set of procedures, we ensure your accounts are always managed within the safest legal boundaries.

3. 100% Recorded Accountability

Trust is built on verification. We record and archive 100% of our outreach calls. These recordings are subject to random, rigorous screening by our quality assurance team to identify and correct even the smallest deviation from our “Respectful Friction” model. This process eliminates “rogue collectors” and provides a documented defense against unfounded patient disputes.

4. Clinical-Grade Data Security

We treat patient and business data with the highest level of technical scrutiny. Our systems are fortified with robust encryption, secure data storage, and strict multi-factor access controls. Beyond HIPAA, we maintain rigorous PCI and SOC 2 Type II compliance standards to ensure that your sensitive financial information is never compromised.

The “Peace of Office” Advantage

Compliance is more than just avoiding fines; it’s about preventing friction. When a recovery partner operates with clinical professionalism, patients and customers don’t call your front desk to complain. By outsourcing to our compliant team, you:

-

Reduce Staff Burnout: Your team stops absorbing the emotional stress of financial disputes.

-

Protect Your 5-Star Identity: Respectful outreach prevents the retaliatory “review-bombing” on Healthgrades or Google that can devastate a local business.

-

Ensure “Net-Zero” Cost: Professionalism leads to higher recovery rates, often making the service a self-funding investment in your practice’s health.

Compliance & Security FAQs

How do you stay updated on state-specific collection laws?

Our legal network monitors legislative updates in all 50 states. Whether it’s the Texas Debt Collection Act or the California Medical Debt Protection Act, our workflows are automatically adjusted to match current local requirements.

What happens if a patient disputes an account?

We move from “recovery” to “reconciliation.” We review the recorded call, verify the documentation (invoices, POs, or EOBs), and diplomatically clarify the balance with the patient. This documentation-first approach resolves disputes without losing the patient’s loyalty.