Eaglesoft is popular. Old A/R is, unfortunately, even more popular.

Eaglesoft has been around for 25+ years and serves nearly 30,000 active users across the U.S. and Canada. It’s a serious platform, not a hobby product.

Yet typical dental A/R tells a different story:

-

Benchmarks often show the average dental practice with tens of thousands of dollars sitting in 90+ day A/R, and once balances cross 90 days, practices usually recover only a small fraction of that money.

-

Many offices see A/R days around 45, even though insurers often pay in roughly 30 days.

In other words: Eaglesoft can be rock-solid and you can still be leaking cash.

This page is about that gap — and how to use both Eaglesoft and a collection agency (via a small, free utility) to close it.

What “healthy” A/R actually looks like for a dental office

Before talking integrations, it helps to know what you’re aiming for.

Dental advisors commonly recommend:

-

A/R days: roughly 30–45 days. Anything consistently above that suggests slow collections or broken workflows.

-

A/R over 90 days: under 10% of total A/R (excluding long ortho contracts).

-

Net collections: around 98–100% of adjusted production.

-

A/R ratio (A/R ÷ average monthly production): ideally close to 1.0–1.5 months of production on the books, not 2–3 months.

Reality check for Eaglesoft users:

If your Eaglesoft A/R report shows A/R days >45, more than 10% of A/R in 90+ days, or an A/R ratio well above 1.5, you’re outside the comfort zone. Those aren’t “slow payers” — that’s bad debt in slow motion.

Eaglesoft does the early work. Late A/R is a different game.

Eaglesoft is built to manage your everyday operations:

-

Scheduling, charting, imaging

-

Insurance claims and e-attachments

-

Statements and online payments (via integrated partners like Vyne Trellis, DentalXChange, CarePay+, card-on-file tools, etc.)

-

A/R and production reports by provider, location, and date

That’s a powerful early-stage revenue engine.

But Eaglesoft will never:

-

Chase a non-responsive patient every week for six months

-

Dig up a new address or phone number

-

Negotiate a multi-step payment plan with someone already behind on other bills

-

Decide which accounts are worth escalating and which should be written off

That’s the line where “practice management” ends and “debt collection” begins.

Step one: find your “collection zone” inside Eaglesoft

Instead of going by gut feeling (“she’s nice, give her more time”), let your Eaglesoft reports tell you when an account has crossed the line.

Start with the A/R Aging report:

-

Look at the breakdown: 0–30, 31–60, 61–90, 91–120, 120+ days.

-

Focus on patient balances, not just insurance A/R.

Ask:

-

What percentage of my A/R is in 90+ days?

-

How much of that is patient responsibility?

-

How long has it been since any payment or meaningful contact?

Remember: once a balance hits 90+ days, your recovery odds drop sharply. Waiting another three months rarely helps.

The free Eaglesoft collection utility: a small tool with sharp teeth

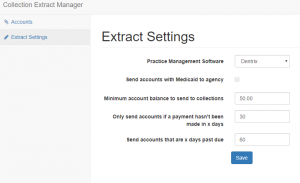

To turn “we should send these to collections” into something automatic, you can use a small, free Eaglesoft debt collection utility.

You stay in control; the utility just enforces your rules.

You can typically set:

-

Minimum balance to send

-

Example: only send accounts over $100, $250, or $500.

-

-

Age of the account

-

Based on days since last payment or last activity — for example, 60, 90, 120 or 180 days.

-

-

Which recovery step to use

-

Gentle, fixed-fee letter campaigns first,

-

or direct to full contingency collections for serious delinquents.

-

-

Which patients to exclude

-

Ortho on long payment plans

-

Genuine hardship or charity-care cases

-

VIPs you want to handle personally

-

Once the criteria are saved, the utility:

-

Reads the Eaglesoft database.

-

Finds accounts matching your rules.

-

Prepares a clean export for your collection partner (no retyping from screens).

You go from “someday we’ll clean this up” to “once a month, our 90+ day list is automatically prepped for collections.”

Practical placement rules (feel free to modify)

Here are sample rules a typical Eaglesoft practice might adopt:

1. Standard rule for everyday accounts

-

Balance ≥ $200

-

No payment in 90+ days

-

At least 3 statements / reminders already sent

→ Send to fixed-fee letter service or step-2 style demand program.

2. High-balance rule

-

Balance ≥ $750 or $1,000

-

No payment in 60+ days

-

Not in ortho or active payment plan

→ Move faster: short internal follow-up, then straight to contingency collections.

3. Low-balance batch rule

-

Balance $50–$200

-

No payment in 120+ days

→ Either batch these to collections once or twice a year or write off; don’t let tiny balances chew up staff time.

If you can shrink 90+ A/R from something like $100,000 down to $25–30k over time by tightening collections, that’s tens of thousands of dollars back in the bank, not abandoned on old ledgers.

How this plays with the Eaglesoft ecosystem you already use

You don’t have to choose between Eaglesoft integrations and collections. They’re different layers.

-

Claims and e-attachment partners

-

Help you send cleaner claims, get ERAs faster, and reduce payer delays.

-

-

Payment and text-to-pay tools

-

Make it easier for patients to pay via text, mobile, online, and card-on-file.

-

Those tools are about preventing A/R from aging in the first place.

The Eaglesoft collection utility + a third-party collection agency are about what to do when, despite all that, money still isn’t coming in.

Think of it as:

Eaglesoft + payment integrations = early-stage collections.

Eaglesoft + our utility + a collection agency = late-stage collections.

You need both layers for a truly healthy A/R.

Where Nexa fits in

A quick clarification, because it matters:

-

Nexa is an information portal, not a collection agency.

-

We do not call your patients, and we do not do any credit reporting.

What we do:

-

Help Eaglesoft practices think through placement rules and thresholds so they’re using data, not guesswork.

-

Provide access to a free Eaglesoft collection utility that makes it easy to pull and send the right accounts.

-

Share your collection requirements with a short list of dental-savvy, compliant collection agencies we believe fit your profile.

-

Leave the final decision — who you use, when you start, which accounts you place — entirely up to you.

If your Eaglesoft reports show A/R days in the 40s or 50s and a 90+ column that never seems to shrink, it’s not a reason to abandon Eaglesoft.

It’s a signal to:

-

Tighten your early A/R with the integrations you already have, and

-

Add a clean, rules-driven pipeline from Eaglesoft → utility → collection agency.

That’s how you turn “we’ll get to it someday” receivables into money that actually hits your bank account.

| Already using Eaglesoft Dental Software? Have unpaid medical bills?

|