If your practice runs on Dentrix or Dentrix Ascend and your A/R is still stuck around 45–60 days, you’re not alone. Dentrix is a strong dental platform – but it only improves collections when your team uses the right features and has a clear escalation path beyond the software.

Dentrix is powerful – but it’s not your collections department

Dentrix has been around for over 30 years and is used by tens of thousands of dental practices. It connects scheduling, charts, imaging, billing, and analytics into one ecosystem.

That scale is impressive, but it doesn’t guarantee:

-

Low A/R days

-

Consistently high collection ratios

-

Minimal write-offs on old patient balances

Dentrix gives you tools. How you use them – and what you do when accounts age out – is what really determines your cash flow.

The Dentrix features that matter most for getting paid

Instead of thinking about every menu, focus on the features that directly affect A/R and collections.

1. Insurance eligibility and estimates

Accurate eligibility checks and chairside estimates reduce surprises. When patients know their likely out-of-pocket cost, you collect more up front and see fewer “I’ll pay later” promises.

2. Electronic claims and attachments

Cleaner claims and faster submissions mean fewer denials and less money sitting in insurance A/R. Use Dentrix to send claims daily, not in sporadic batches.

3. Patient billing, statements, and online payments

Automated statements, email/text reminders, and easy payment links are where Dentrix earns its keep. If you’re still relying on one paper statement a month, you’re under-using the platform.

4. A/R and aging reports

Dentrix can show you exactly where money is stuck – by aging bucket, provider, and insurance vs patient. These reports should drive decisions, not just be printed and filed.

5. Analytics and KPIs

Dashboards and reports help you track trends: A/R days, collection ratio, and percentage of receivables in 90+ days. If nobody is reviewing these numbers monthly, you’re flying blind.

What your Dentrix A/R should look like

You don’t need perfect numbers; you need clear targets.

Use your Dentrix reports to monitor:

-

Days in A/R

-

Solid practices aim for about 30–45 days.

-

If you’re routinely above 45–50 days, it’s a warning sign.

-

-

A/R aging distribution

-

0–30 days should hold the majority of your receivables.

-

When more than 20–25% of your A/R is in 90+ days, you’re heading into bad-debt territory.

-

-

Collections vs production

-

Many healthy practices collect around 98% of net production over time.

-

If you’re consistently well below that, Dentrix is showing you a problem that needs action.

-

A simple test:

Open your Dentrix A/R report. If you wouldn’t be comfortable showing those numbers to a banker or buyer, your collections process needs tightening – even if Dentrix is fully installed.

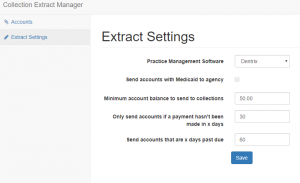

Using Dentrix to decide what goes to a collection agency

Dentrix gives you the data to build simple, written rules for escalation.

For example:

By aging:

-

0–30 days: normal statements and soft reminders

-

31–60 days: extra reminder (email/text) + one phone call

-

61–90 days: firm reminder, offer payment plan, final internal notice

-

90+ days: if no arrangement, eligible for third-party collections

By balance size:

-

Small balances (e.g., under $50–$100):

-

Limited internal follow-up, then either write-off or batch placement depending on your policy

-

-

Medium balances (e.g., $100–$500):

-

Full internal sequence, then send to collections at 90+ days

-

-

Large balances (e.g., $500+):

-

Extra attention at 30–60 days; do not let them quietly age out

-

By patient type:

-

Chronic late-payers: faster escalation

-

VIP or long-term families: more conversation before placement, but still a clear limit

The important part: make these rules explicit, use Dentrix to identify accounts that fit them, and follow the process every month.

Dentrix is your engine. A collection agency is the safety net.

Dentrix (and Dentrix Ascend) can help you prevent and reduce A/R:

-

Fewer claim errors

-

Better estimates

-

Stronger patient communication

-

Clear, timely reporting

But Dentrix will not:

-

Call seriously delinquent patients over and over

-

Negotiate with someone juggling multiple debts

-

Track down moved patients

-

File lawsuits or handle legal escalation

Once a balance is 90–120+ days old and unresponsive, you’re outside the normal office workflow. That’s where a dental-savvy collection agency comes in – working from Dentrix exports, using compliant scripts, and focusing on realistic payment solutions.

| Are you already using Dentrix? Have unpaid medical bills? Need to transfer your unpaid medical bills to a debt collection agency? Contact us

|

FAQs: Dentrix and dental collections

Does Dentrix include a built-in collection agency?

No. Dentrix provides billing and A/R tools, but it is not a contingency collection agency. It won’t chase old debts or pursue legal remedies on your behalf.

What’s a good A/R benchmark for a Dentrix office?

Many practices aim for 30–45 days in A/R, with less than 20–25% of receivables in the 90+ day bucket and a collection ratio near 98% of net production.

How do I use Dentrix with a collection agency?

Typically, your team exports aging reports and account details from Dentrix and securely transmits them to a collection agency. The agency works the accounts, then reports back recoveries that your staff posts in Dentrix.

How Nexa fits into your Dentrix collections strategy

If your Dentrix reports look busy but your bank balance doesn’t, it’s time to add the right safety net around your software.

Nexa is an information portal that helps dental practices find suitable collection agencies.

-

We are not a collection agency and we do not do any credit reporting.

-

Instead, we learn about your practice, your Dentrix setup, and your A/R pressures.

-

We share your collection requirements with carefully shortlisted agencies we believe can handle dental A/R in a compliant, patient-sensitive way.

-

It is entirely your decision whether or not to use their services.

If your Dentrix A/R shows rising days and a stubborn stack of 90+ day balances, share a few details about your situation. You keep focusing on clinical care and patient experience – and let strong Dentrix usage plus the right collection partner help you turn more production into collected cash.