Summary: Indeed! Individuals can be legally forced to pay their debts with their cryptocurrency, but the creditor must have a judgment which states that the debtor is obligated to pay off the debt, including any cryptocurrency they own. Knowing whether or not the debtor owns crypto like bitcoin is of course a challenge. That is why a creditor must attempt to file a legal suit in which the debtor must declare all his assets under oath when asked by the judge.

Debtors are legally bound to pay their liabilities like outstanding credit cards or unpaid bills etc. Creditors have the legal right to claim for debts, and in case of nonpayment, they must attempt to ask the courts to bind individuals or companies to pay back their dues with all their financial assets, including the debtors’ crypto assets. Laws differ from state to state. Therefore one must ask their local attorney for the best possible approach.

U.S. government regulatory bodies treat cryptocurrencies differently.

- Security and Exchange Commission (SEC) treats cryptocurrencies as securities,

- Commodities and Futures Trading Regulator (CFTC) considers cryptocurrencies as commodities, and

- Internal Revenue Service (IRS) claims digital assets like properties.

The creditors should vividly understand how various regulatory bodies define cryptocurrencies before claiming their debts to pay with the digital assets of debtors.

Let’s review what could cryptocurrencies had seized by the U.S. government earlier before?

There are several occasions when the regulatory authorities of the U.S. have seized billions of dollars worth of cryptocurrencies to stop tax evasion, money laundering, false filling of tax returns, and trading illegal goods.

Recently, CNBC reported that IRS had confiscated around $1.2 billion worth of cryptocurrencies this year. The U.S. Marshals Service is responsible for auctioning the U.S. government’s crypto holdings. So far, Marshals agent has seized and auctioned more than 185,000 bitcoins valued at over $7.2 billion—notably known auction of 30,000 bitcoins from the Silk Road. In June 2021, the U.S. government auctioned more than $21,000 of bitcoin, litecoin, and bitcoin cash to compliance tax liability.

The sale proceeds are deposited into the U.S. Treasury Forfeiture Fund and the other commonly known fund is the Department of Justice Assets Forfeiture Fund.

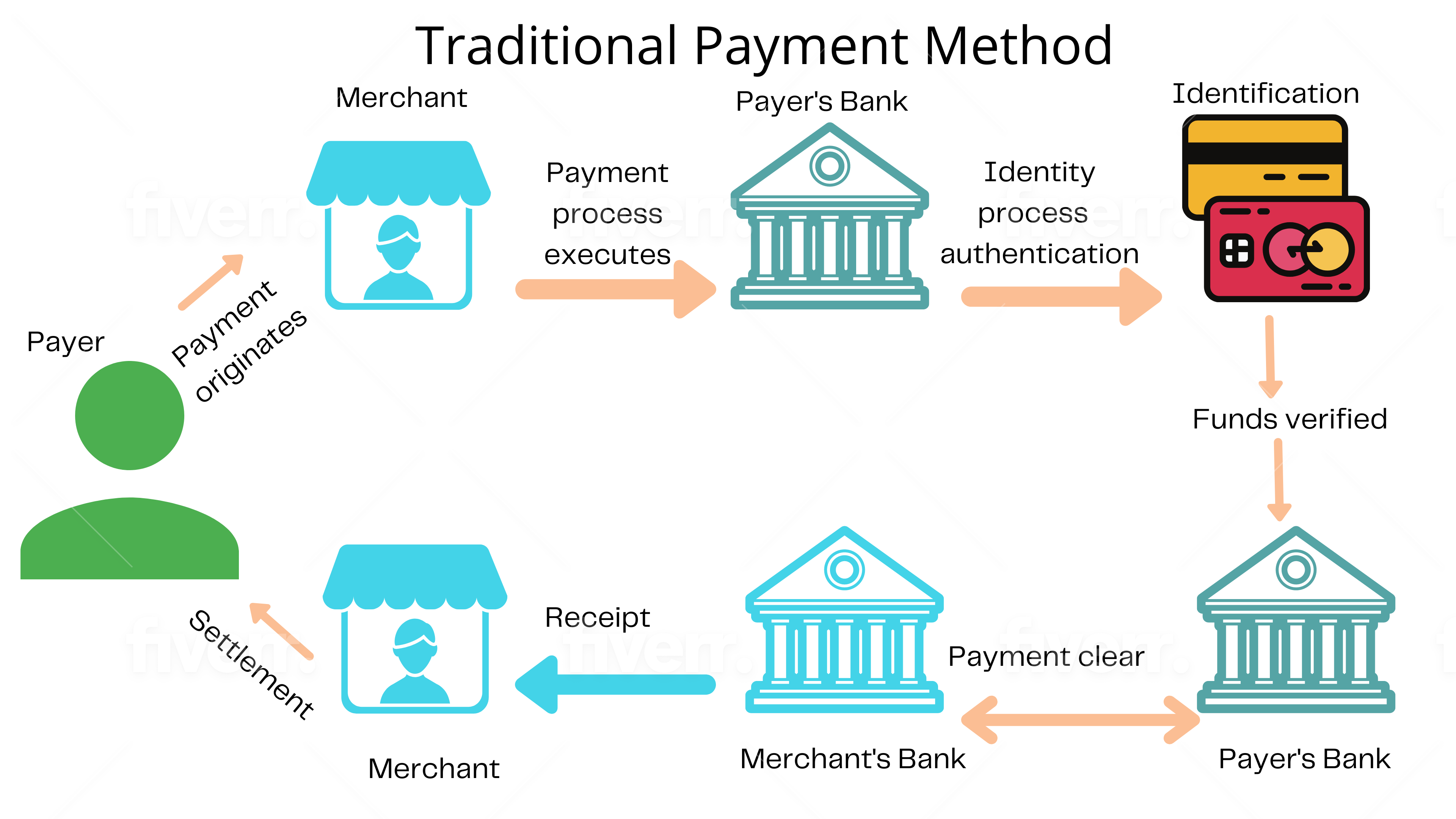

How do traditional payment methods work to collect payments?

Traditional payment method depends on centralization and the controlled influence of intermediaries. Users have no access to control and command.

Cash-based mechanisms build on a trusted system supported by the legal and regulatory bodies and are accepted mediums of exchange between judiciaries.

Contrary to this, decentralized distributed systems are trustless systems that do not rely on the parties; they depend on protocols that manage financial services.

Blockchain restructured the financial system in a decentralized way. The decentralized finance market DeFi has touched the peak of 89 billion dollars as of May 2021.

Here we discuss how U.S. traditional payment systems work and fit in the current legal and regulatory framework.

Alias walks into the restaurant to buy a cup of coffee. She can pay to the restaurant using multiple payment options. She can pay with provided below options;

- Cash

- Credit card / Debit card

- Mobile app including PayPal, Apple App, etc.

Cash is the preferred payment option. It doesn’t require the payer’s identity, but the main risks associated with cash are theft, loss, or carrying issues. The other preferred payment system is cashless payment through credit, debit card, or mobile apps.

Various payment options have different implications for payer and merchant.

Each payment method is accompanied by its own procedure and transfer rules from the buyer’s financial intermediary to the merchant’s financial intermediary body.

When the buyer makes the purchase, and the payment is delivered to the seller. Financial intermediaries should charge transaction fees, money can be theft electronically & transactions across borders takes plenty of time to execute due to the intermediary clearance settlement system.

The settlement process is complicated where goods or services are being exchanged against payments.

When the payer initiates the payment through Credit/Debit card, the merchant sends the transaction to a payer’s account to verify the payer’s identity, device, or transaction message connected to the payment system. In this way, the payer’s bank initiates payment to the merchant’s bank. This process also involves checks at various points, such as passwords, to verify the payer’s identity. The payer’s account provider verifies the identity of the payer before making the transfer of funds.

Then clear the payment to confirm the transaction before settlement. Finally, a receipt is issued to the payer when the merchant receives the funds. The amount is reconciled between two or more entities & finally, the payment process is completed.

When a payment transaction passes, it credits the merchant’s account and debits the payer’s account.

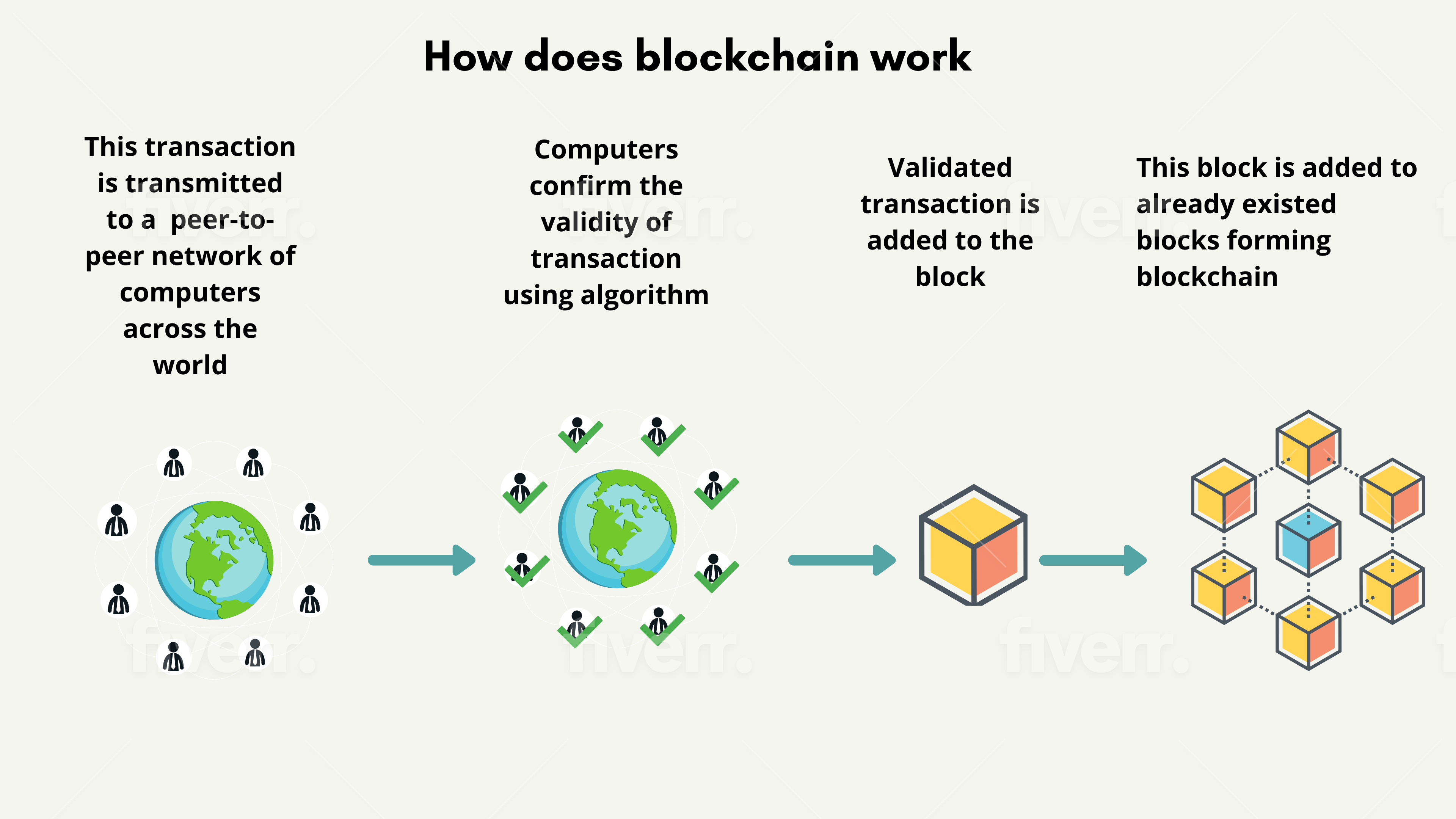

How does Blockchain work?

Blockchain is a digital ledger that keeps immutable or non-forfeitable records of transactions and distributes them across the network of computers or nodes on the Blockchain, eliminating the need for third parties or financial institutions to process payments.

Transactions on the Blockchain are cryptographically secured. The term cryptography is used for the hidden art of writing secret codes. Every transaction recorded in the block is duly time-stamped and added to the already existing Blockchain, making the blockchain chain.

Here is the infographic that describes how does Blockchain works?

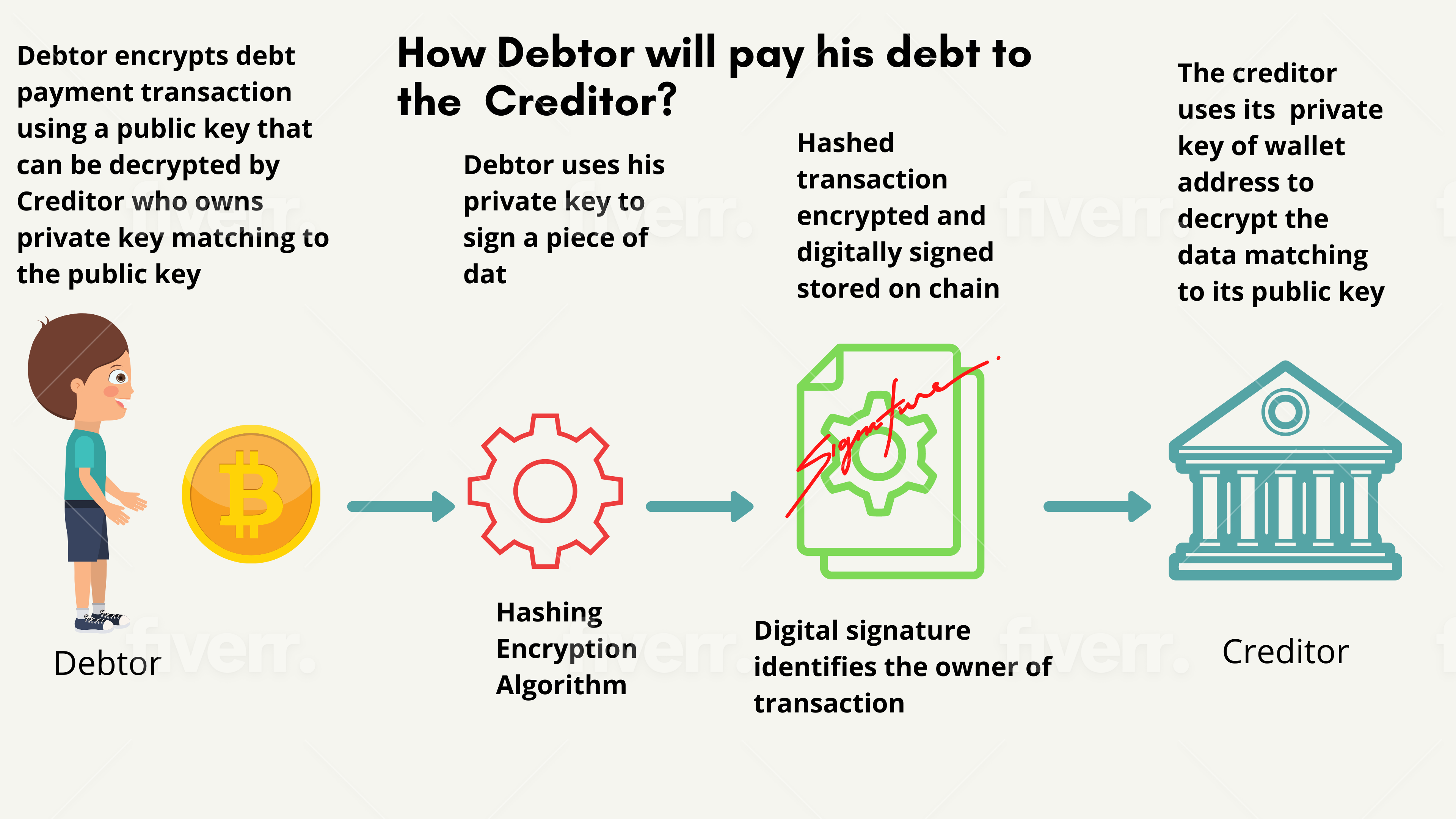

How will Debtor pay his Debt to the Creditor in a decentralized way?

Let’s understand by giving a simple explanation of how blockchain process the debt payment transactions that contribute when to interact with Creditor’s wallet to share value transmission across distributed ledger network without an external intermediary, ensuring transparency between Debtor and Creditor.

Every user or node keeps two keys; a public key and a private key in the blockchain network. The public key is used to encrypt/lock the transaction, while the private key is used to decrypt/ unlock the transaction.

A debtor can either transfer the dollars into his bank account by selling his bitcoins/crypto using one of the crypto exchanges and then making the payment to the creditor or a collection agency.

Otherwise, the Debtor will pay his Debt & send a digital transaction to the Creditor in the blockchain network.

The Debtor would use the public key that belongs to the Creditor’s wallet address to encrypt or lock the transaction. The Creditor will decrypt this transaction using its private key matching its public key that Debtor has already used to send the transaction to the Creditor.

This transmitted transaction becomes encrypted using hashing algorithm encryption and a private key of Debtor to sign the transaction. Now, the transaction is encrypted or locked and digitally signed by the Debtor, ensuring that the transaction originates from the Debtor who is the actual owner of the transaction in the blockchain network.

The Creditor will use its private key of wallet address to decrypt or unlock the transaction.

Closing Remarks:

El Salvador is the first country in the world that accept Bitcoin as legal tender. Governments are formulating laws to adopt crypto-assets in financial streams widely.

Besides this, in May 2021, CNBC reported a seizure incident of 1.04430259 bitcoin from a hardware wallet belonging to an individual in Kansas.

Many Crypto banks are emerging in the sphere, and laws are under formulation to allow creditors to force the debtors to pay their bills using crypto legally.

References:

https://medium.com/cryptolawreview/crypto-debt-collection-c3825a8588ca

https://www.alperlaw.com/blog/can-cryptocurrency-be-garnished/

https://en.wikipedia.org/wiki/Digital_signature

https://medium.com/technology-nineleaps/blockchain-simplified-part-1-6cc3079cfd24