The Hard Truth: Every day an invoice sits unpaid, its recoverable value drops by roughly 0.5% to 1%. Waiting isn’t just annoying—it’s costing you profit.

While most agencies hide their pricing behind “Call for a Quote” buttons, we believe in radical transparency. Whether you need a low-cost fixed-fee reminder or aggressive litigation, you deserve to know the numbers upfront.

At a Glance: The 2026 Fee Structure (Consumer Collections)

Stop guessing. Here is how modern collection costs break down.

| Service Type | Cost to You | Best For | Risk Level |

| Step 1: Pre-Collection | ~$15 / account (Flat Fee) | < 90 days past due. Gentle reminders. | Low: You keep 100% of recovery. |

| Step 2: Escalation | ~$15 / account (Flat Fee) | 90-150 days past due. Formal demands. | Low: You keep 100% of recovery. |

| Step 3: Contingency | 20% – 40% of amount collected | Unresponsive accounts / > 180 days. | Zero: No recovery = No fee. |

| Step 4: Legal Action | 40% – 50% of amount collected | High-balance debtors with assets. | Med: Requires court costs + approval. |

(Keep your existing detailed “Key Things to Check” section here, but add this “Trust Trigger” box right after it)

⚠️ Warning: The “Hidden Fee” Trap

Be wary of agencies offering rates below 15%. Often, they make up the difference with:

-

Placement Fees: Charging you just to upload a file.

-

Membership Dues: Annual costs regardless of performance.

-

Cancellation Penalties: Fines for withdrawing an account.

NexaCollect Guarantee: We have Zero placement fees, Zero annual dues, and Zero hidden onboarding costs.

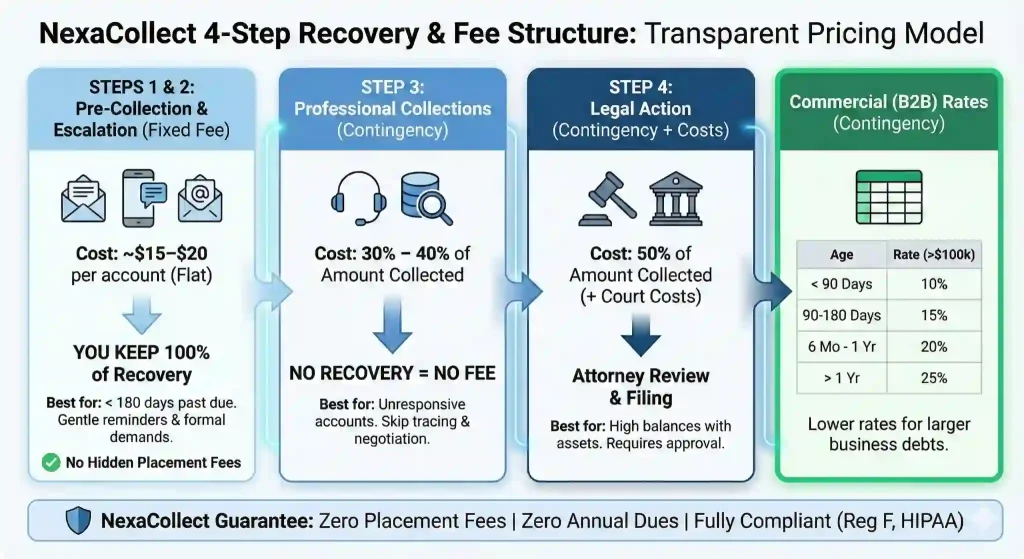

The 4-Step Recovery Model (B2C & B2B)

We use a “waterfall” approach. You pay only for the level of intensity you need.

Step 1 & 2: The “100% Back to You” Phase

-

Cost: ~$15–$20 per account.

-

The ROI: If you recover just one $500 account out of 20 placements, the service pays for itself.

-

What happens: A structured campaign of letters, emails, and texts (where compliant) sent first in your name, then ours.

-

Perfect for: Medical Practices and Dental Offices wishing to preserve patient relationships.

Step 3: The “No Recovery, No Fee” Phase

When letters don’t work, professional collectors step in.

-

Rate: ~40% (Consumer) or 10-35% (Commercial).

-

Activity: Skip tracing, credit monitoring, and compliant phone negotiation.

-

Why it works: A third-party demand carries weight that an internal billing call does not.

Commercial (B2B) Contingency Rates

Business debts are often larger and settled by finance professionals, allowing for lower rates.

| Commercial Contingency fee (Based on Account Age and Amount Assigned) | ||||

| Age: If > 1 year | 40% | 35% | 30% | 25% |

| 180 days – 1 year | 35% | 30% | 25% | 20% |

| 90-180 days | 30% | 25% | 20% | 15% |

| < 90 days | 25% | 20% | 15% | 10% |

| Amount Assigned -> | $500- $5k | $5k- $20k | $20k- $100k | $100K + |

Need a good Collection Agency? Contact usServing Nationwide |

Frequently Asked Questions (FAQ)

1. Who pays the collection agency fees?

Typically, the creditor (you) pays the fee out of the recovered money. However, if your original contract with the debtor includes a clause covering “costs of collection,” we may be able to add our fees to the debtor’s balance (state laws permitting).

2. What is a standard contingency fee?

The industry standard for consumer debt is 33% to 50%. For commercial (B2B) debt, it ranges from 15% to 30%. Rates depend heavily on the age of the debt—older debt is harder to collect, so the fee is higher.

3. Is it worth using a collection agency for small amounts?

Yes, if you use a Fixed-Fee service (Step 1). For a flat ~$15, you can pursue small balances without giving up 40% of the total.

Why the “Cheapest” Collection Agency Often Costs You More

A lot of businesses still shop for a collection agency the way they shop for office supplies – by looking for the lowest price. That can be an expensive mistake.

Imagine you place $40,000 in unpaid accounts with two different agencies:

-

Agency A

-

Charges a contingency fee of 20%.

-

Obviously gives less time to each account. Recovers $6,000 (15% of your placements).

-

Your net after fees: $4,800.

-

-

Agency B

-

Charges a contingency fee of 30%.

-

Charges more, but also works a lot harder on each account. Recovers $16,000 (40% of your placements).

-

Your net after fees: $11,200.

-

Even though Agency B charges a higher fee percentage, you end up with more than double the money in your bank account.

This gap gets even larger when you add:

-

Fewer write-offs

-

Better documentation and compliance

-

Less time your staff spend chasing the same accounts

In today’s environment—where average agency recovery rates are often in the 20–30% range and top performers can do significantly better—the real question isn’t “Who is cheapest?” but “Who can recover the most, safely?”

Recent Results

Below are fresh, sample scenarios that reflect what a modern fee structure can look like in practice. These are illustrative only, not guaranteed outcomes.

-

Dental practice in Ohio – Fixed fee COMPLETE service

-

$18,600 in early-stage patient balances placed under 150 days past due.

-

Used Step 1 + Step 2 (~$20 per account for 220 accounts).

-

Within 45 days, $10,900 was recovered directly by the practice (no contingency fee; only the flat fees paid).

-

-

HVAC contractor in Texas – B2C contingency (Step 3)

-

$62,000 in residential invoices, most between 6–12 months old.

-

Placed directly into Step 3 at ~40% contingency.

-

Over 6 months, $34,500 collected; the contractor received roughly $20,700 after agency fees.

-

-

Wholesale distributor in California – B2B contingency

-

$210,000 in past-due invoices, mostly 90–180 days with a few just over a year old.

-

Fee grid ranged from 15%–30% depending on balance and age.

-

Within 4 months, $88,000 recovered; net back to client after fees: approximately $69,000.

-

-

Multi-location medical group in Florida – mix of fixed fee and contingency

-

$75,000 in balances under 120 days placed on COMPLETE (Steps 1+2) plus $40,000 older than 180 days on Step 3.

-

Fixed-fee side: about $31,000 recovered directly to the practice.

-

Contingency side: $14,400 recovered, with roughly $8,600 net to the group after Step 3 fees.

-

-

Technology services firm in New York – B2B legal placements

-

Ten disputed invoices totaling $180,000, all over 1 year old.

-

After non-legal efforts, select cases moved to Step 4 (legal) at ~40–50% contingency, plus court costs advanced by the client.

-

Three cases produced judgments and settlements totaling $72,000, with approximately $36,000–$40,000 net back to the client after legal fees and costs.

-

These examples show how different fee structures (fixed vs. contingency vs. legal) can be combined to match your risk, account age, and business goals.