“Dental Malpractice Insurance” also called “Professional Liability Insurance” is essential for all dental practices to protect them against the liabilities if a patient files a lawsuit.

According to recent NPDB data, the U.S. sees roughly 10,000–12,000 paid medical malpractice claims each year. In 2023, there were 11,440 payments totaling about $4.8 billion (≈ $420,000 average). In 2022, there were 9,778 payments totaling $3.57 billion (≈ $365,000 average).

For dentistry specifically, the average paid claim in 2022 reported to the NPDB was about $113K (nationwide), though both frequency and severity vary by specialty, procedure mix, and state.

Even if a claim is dismissed, defense costs can be substantial. A dental malpractice policy typically covers attorney fees, expert witnesses, trial and court costs (subject to policy terms and limits). Note that in NPDB reporting, legal expenses are only included in a malpractice payment if they’re part of the payment itself.

Finally, malpractice laws and damages rules differ by state (e.g., statutes of limitations, caps, pre-suit requirements), so premiums and claim outcomes vary by jurisdiction and metro area.

Most common reasons patients sue dentists for malpractice:

1. Tooth extractions can cause Nerve damage, Perforation of the sinus membrane, Undiagnosed infections, Wrong tooth was removed etc.

2. Anesthesia and Root Canal complications.

3. Lack of Informed Consent from the patient.

4. Failure to diagnose Gum disease, oral tumors and cancers.

5. Orthodontists who fail to monitor patients with braces accurately or incorrectly apply braces.

6. Infections of tooth decay from an ill-fitted crown.

7. Unexpected or adverse drug reactions.

8. Failure to refer the patient to a specialist.

9. Injury due to slipping or falling while at the dental office.

10. Complications from Dental Implants, Bridges and Crowns.

11. Death.

Without Dental Malpractice Insurance coverage, you may be unable to defend yourself and harm your hard-earned reputation.

Types of Dental Malpractice Insurance

1. State Patient Compensation Fund (PCF)

Many states like Pennsylvania, Wisconsin, Kansas, Indiana, Louisiana, New Mexico, Nebraska, South Carolina and New York have a provision that limits the liability of the physician/dentist in case a malpractice lawsuit is filed. Dentists usually pay an annual amount to participate in the PCF. This is not a replacement for Malpractice Insurance but only protects when the claimant demands huge sums of money, often beyond the coverage of Malpractice Insurance. Each state has different rules in the way PCF is implemented.

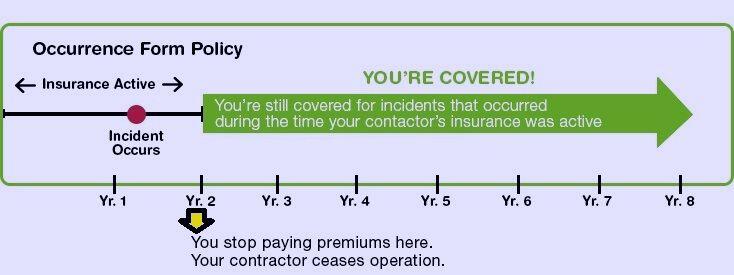

2. Occurrence Malpractice Insurance Policy:

Under this policy, you are covered while the policy was in effect. It does not matter if the coverage is in effect when the claim is made. The benefit of occurrence coverage is that even if you cancel your policy at some future date, you will still have coverage for events that occurred while the policy was in effect.

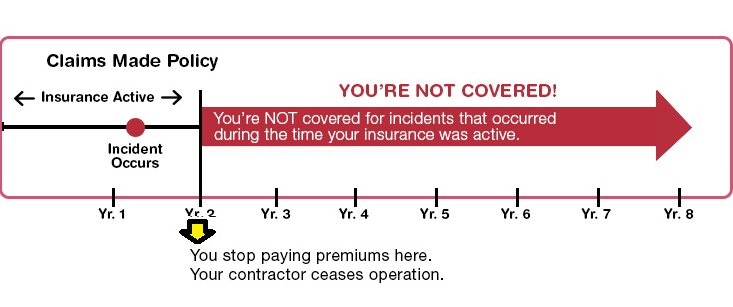

3. Claims Made Malpractice Insurance Policy:

The policy covers claims made against you only while the policy is in effect. The downside of this type of policy is that coverage must be continued indefinitely to assure coverage for claims filed in the future for actions that occurred in the past. Essentially, once the policy has lapsed, you no longer have coverage. If you no longer need coverage, you can purchase an “Extended Reporting Endorsement or Tail Coverage” to protect you from the past.

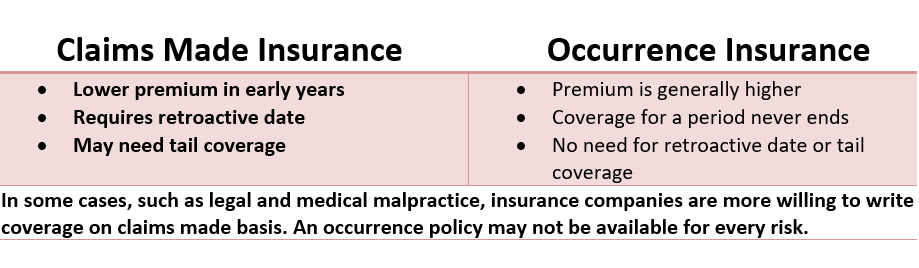

Comparison

Popular places to buy insurance:

1. American Dental Association (www.insurance.ada.org)

2. Mitchell & Mitchell Insurance (www.mitchellandmitchell.com/dental/)

3. www.medpro.com/practicing-dentists (www.medpro.com/practicing-dentists)

4. DentistCare by ProAssurance (www.proassurancedentistcare.com)

5. Fortress

6. CNA and Aon Affinity also offers dental firms nationwide malpractice insurance coverage to meet the needs of dental practices.

Links to buy dental malpractice insurance:

- https://www.medpro.com/practicing-dentists

- https://www.profsolutions.com/industries/dentists/insurance/malpractice/

- https://www.cna.com/web/guest/cna/industries/affinity/dentists

- https://www.tdicinsurance.com/Find-Coverage/Professional-Liability

Cost

Recent dental school graduates often pay $0–$100 for the first year (common new-grad promos on claims-made policies), with premiums ramping toward ~$1,800 by year 5 as discounts phase out. Some carriers quote a wider first-year range of ~$350–$1,500 depending on procedures and limits.

For general dentists after about five years of practice (mature rates), expect ~$2,000–$3,000 per year in many states; large metros cost more, and surgical/cosmetic specialties can run $10,000–$25,000+.

Many insurers still offer a risk-management seminar discount (typically 5% for two policy years) on professional liability premiums.

Coverage add-ons: Employment Practices Liability Insurance (EPLI)—covering claims like wrongful termination and sexual harassment—is available as an endorsement to some dental professional liability policies or via a BOP/stand-alone policy, for an additional premium

Litigious Scrub of Collection Agencies

Patients file many lawsuits after failing to pay for the treatment, but when the dental practice staff tries to recover money from the patient, they wait for a debt collection law violation to sue the dental practice back for huge payouts. Many of these patients have a history of suing medical practices. It is advisable to transfer accounts to a collection agency after it has been due for over 60-90 days. Collection agencies are well trained on debt collection laws, and many agencies do a litigious scrub on these. If a patient is found to have a history of suing doctors, they advise the dental practice accordingly.

Sources:

www.npdb.hrsa.gov

www.eqgroup.com/occurrence_claimsmade_explained/

www.wwml.ca/insurance.html