Ready for patients to pay as reliably as your software performs?

If you’re on Allscripts (now largely operating under the Veradigm and Altera Digital Health brands), you already invested in a serious EHR and revenue cycle platform.

Yet your reality may look like this:

-

A/R days creeping into the 45–60+ range

-

A growing chunk of balances sitting in the 90+ day bucket

-

Patient balances increasing faster than your team can follow up

The technology is modern.

The unpaid invoices are not.

Where Allscripts stops and your debt problem starts

Allscripts / Veradigm / Altera are built to help you:

-

Register patients, capture charges, and code correctly

-

Submit cleaner claims and reduce preventable denials

-

Post payments and track financial performance

But your platform will not:

-

Call a patient five times over three months

-

Talk through a realistic payment plan with someone juggling multiple bills

-

Track down a patient who moved and left no forwarding address

-

Decide which accounts are “soft collections” vs “hard collections”

That’s not a software problem. That’s a collections strategy problem.

What Allscripts (Veradigm / Altera) actually does well

You don’t need to rewrite their brochure. Just recognize the parts that matter for A/R:

-

Eligibility & benefits checks

Catch coverage issues before the visit so fewer balances become messy “I thought insurance would pay” situations. -

Charge capture, coding, and claims

Integrated workflows help cut down on basic coding errors and format rejections, so you’re not creating avoidable denials. -

Denial work queues & workflows

Staff can see which claims bounced, why they were denied, and what needs to be fixed or appealed. -

Dashboards and financial reports

A/R aging, payer mix, patient vs insurance balances – all visible in one place, across locations and providers.

In other words: Allscripts helps you see the leak and reduce some of it. It does not mop up all the water on the floor.

Why you still end up with growing patient A/R

Even with a solid platform, money leaks out at predictable places:

-

High deductibles and co-pays

Patients are responsible for more, but many treat medical bills like low-priority debt. -

Front-desk gaps

Estimates aren’t explained clearly, consent forms are vague about financial responsibility, or payment options aren’t discussed. -

Denials that never quite get reworked

Staff are busy; some claims in the denial queue quietly age out. -

No clear “stop line”

Statements go out. A few calls are made. Then… the account just keeps aging because nobody wants to make a firm decision about collections.

If more than 15–20% of your A/R lives in the 90+ days column, you don’t just have “slow payers.” You have no defined end-game for overdue accounts.

Use your Allscripts reports to decide what goes to collections

You already have the data. Now give it a job.

Step 1: Watch your A/R aging, not just total A/R

Break it into:

-

0–30 days

-

31–60 days

-

61–90 days

-

91–120 days

-

120+ days

The danger zone is 91+ days, especially on patient balances.

Step 2: Split insurance vs patient responsibility

-

Insurance A/R → mostly a denial / follow-up / appeal workflow

-

Patient A/R → a collections workflow

They are not the same problem, even if they live in the same report.

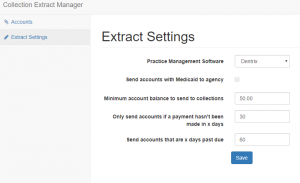

Step 3: Create simple placement rules

For example:

-

Any patient balance that is:

-

90+ days old,

-

No payment plan in place, and

-

No meaningful contact in the last 30 days

→ eligible for third-party collections.

-

-

Balances above a certain threshold (say $300, $500, or $1,000, depending on your practice) escalate faster than small balances.

-

Charity-care or hardship patients follow a different internal path, not collections, if you choose.

Write these rules down. Review them with your billing team. Then use Allscripts to pull a list every month that matches those criteria.

Hospitals vs medical groups: same software, different debt story

If you’re on the hospital / large system side (Sunrise / Altera):

-

You’re dealing with larger balances, multiple service lines, and often complex self-pay after insurance.

-

Bad debt can hide in small balances across many encounters, or in a few large cases that quietly age.

If you’re an ambulatory practice on Veradigm / Allscripts PM:

-

The pain is usually high-deductible patient A/R and chronic slow-payers.

-

Denials are often smaller per claim, but frequent, and staff can’t keep up.

In both settings, the pattern is the same: software surfaces the problem, but people must decide what to do with it.

What a collection agency can do that your EHR never will

A good, healthcare-focused collection agency adds capabilities your platform simply doesn’t have:

-

Dedicated follow-up far beyond a few statements

-

Trained negotiators who talk to patients all day, every day

-

Skip-tracing tools to find moved or non-responsive patients

-

Compliance expertise (HIPAA, FDCPA, state rules) baked into every call and letter

-

A structured approach to payment plans, settlements, and—if needed—legal escalation

Allscripts helps you organize information.

A collection agency helps you turn old information into real money.

You need both.

How Nexa fits in

If you’re already on Allscripts / Veradigm / Altera and your A/R is still swollen with 90+ day accounts, changing software won’t fix it. Strengthening your collections layer will.

That’s where Nexa comes in.

-

Nexa is an information portal, not a collection agency.

-

We do not perform any collections or credit reporting ourselves.

-

Instead, we learn about your specialty, average balances, and A/R pain points.

-

Then we share your collection requirements with a small set of shortlisted, healthcare-focused collection agencies we believe fit your profile.

-

It is entirely your choice whether to work with any of them.

If your Allscripts dashboards clearly show the problem but your bank account doesn’t, it’s time to connect the dots between great software and serious collections support—so your revenue cycle finally behaves as well as your EHR.

| Are you already using AllScripts? Have unpaid medical bills? Need to transfer your unpaid medical bills to a collection agency? Contact us

|