The stats are brutal: Once a debt hits 90 days old, you have to spend $1.00 to collect just $0.10. The secret isn’t working harder to chase old money; it’s re-engineering your workflow to prevent the debt from aging in the first place.

The Standard Advice is “Send a Bill.” Here is the Advanced Class.

You are running two businesses: a healthcare practice and a micro-lender. Most dentists obsess over Production (Clinical Dentistry) but treat Collection (Financial Surgery) as an afterthought.

Here are 15 high-impact, unconventional strategies to master your ledger.

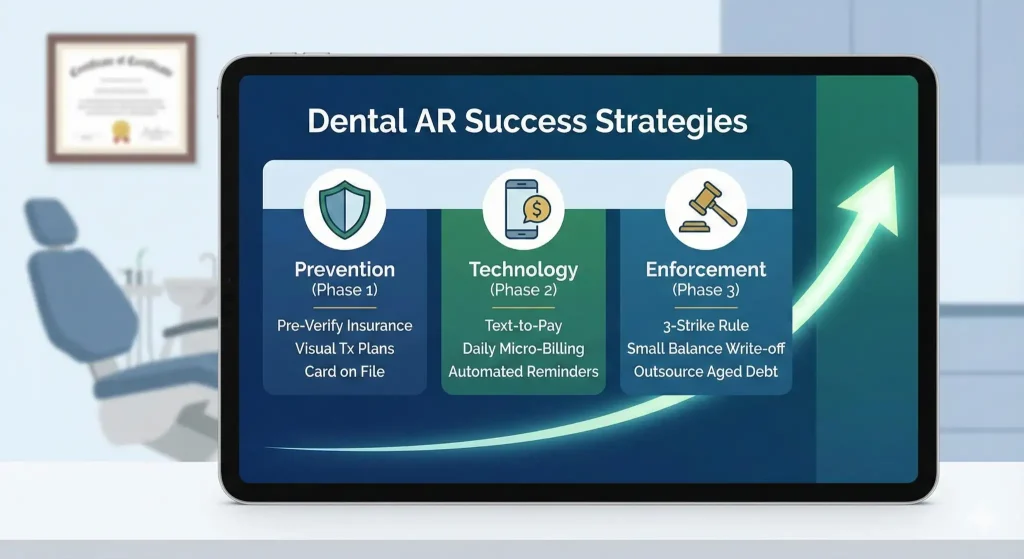

Phase 1: The “Psychological” Firewall

Most AR problems aren’t financial; they are psychological. Patients don’t pay because they are confused, surprised, or unmotivated.

1. The “Visual” Treatment Plan (The 50% Rule)

Don’t just hand a patient a text-heavy breakdown of costs.

-

The Stat: Humans process visuals 60,000x faster than text.

-

The Hack: Circle the “Patient Responsibility” number in red ink. Physically pointing to it and saying, “This is the only number you need to worry about today,” increases same-day collection by up to 50%.

2. The “Ghost” Benefit Check

Verifying “Active” status is amateur hour.

-

The Hack: Your front desk must check for the “Ghosts”: Waiting periods, frequency limitations, and missing tooth clauses.

-

The Result: Telling a patient “Your insurance is active, but they won’t cover a crown on this tooth for 6 more months” prevents a guaranteed angry phone call and unpaid bill later.

3. The “Morning Huddle” Financial Audit

Don’t wait for the patient to arrive to check their balance.

-

The Hack: In your morning huddle, flag every patient with a past-due balance >$50.

-

The Script: “Mrs. Jones, I see you’re here for your cleaning. I also see a small balance of $75 from last time. Which card would you like to use to clear that up before we take you back?”

4. Scripting “Assumptive” Language

Stop asking “If.” Start asking “How.”

-

The Fix: Ban the phrase “Would you like to pay today?” (It invites a “No”).

-

The Swap: “The total is $200. We can take Visa, MasterCard, or Apple Pay. Which one do you prefer?” This subtle shift makes payment the default social expectation.

5. The “Education” Pre-Empt

Patients don’t pay bills they don’t understand.

-

The Hack: If a procedure involves a complex code (like a build-up), explain it before the drill starts. “Insurance might downgrade this to a filling, which means you’d owe $50 more. Are you okay proceeding?”

Phase 2: Frictionless Technology

If it takes more than 2 clicks to pay you, you are losing money.

6. Text-to-Pay (The “Uber” Experience)

Paper statements have a 15% open rate. SMS has a 98% open rate.

-

The Hack: Stop mailing $0.65 stamps for $25 copays. Send a secure text link.

-

The Stat: Practices using Text-to-Pay see a 35% reduction in AR days within 3 months.

7. The “Card on File” Mandate

Modernize your intake like a hotel or Netflix.

-

The Hack: Require a credit card on file for any balance under $100.

-

The Script: “To save you paperwork, we keep a card on file for small balances like deductibles. We will always text you a receipt instantly.”

8. Daily “Micro-Billing”

Why wait for “Statement Day”?

-

The Hack: Send the bill the exact minute the insurance EOB posts.

-

The Psychology: The pain of the bill must be connected to the memory of the relief (the cured tooth). Wait 30 days, and the gratitude is gone.

9. Automate the “Nudge”

Your front desk gets busy. Robots don’t.

-

The Hack: Set your PMS to automatically email a friendly reminder at Day 30 and Day 45. Save the human phone call for Day 60 when it really matters.

10. Digital Financing Integration

Don’t make them fill out a paper application for CareCredit/Sunbit in the lobby.

-

The Hack: Send the financing link to their phone before they come in. Let them get approved in the privacy of their car. It reduces shame and increases acceptance rates.

Phase 3: Strategic Enforcement

When the “Nice Guy” approach fails, you need a business protocol.

11. The “Small Balance” Write-Off Strategy

Stop spending $10 in labor to collect $8.

-

The Hack: Automate a write-off for any balance under $10 after 90 days. It clears the clutter so your team can focus on the $500 debts that actually impact payroll.

12. The “3-Strike” Clinical Hold

This is controversial but necessary.

-

The Hack: If a patient has an Over-90-Day balance, the PMS should lock their ability to schedule non-emergency treatment.

-

The Script: “We’d love to get that crown scheduled. Once we clear up the $150 balance from the root canal, we can book that spot for you.”

13. Audit Your “Denial Rate”

Are you blaming the patient for your team’s typos?

-

The Stat: 30% of denials are simple clerical errors (wrong birthday, wrong code).

-

The Hack: Track your denial rate. If it’s over 5%, your “AR problem” is actually a “Training problem.”

14. Legal Escalation (The “Letterhead” Effect)

Sometimes, a patient needs to know you are serious.

-

The Hack: You don’t always need to sue. Often, a single letter on an attorney or agency letterhead (Step 2 service) is enough to wake up a dormant debtor.

15. Outsource to Prevent Burnout

Your highest-paid employee (Office Manager) shouldn’t be stuffing envelopes.

-

The “Opportunity Cost” Hack: Calculate your Office Manager’s hourly rate. If they spend 5 hours a week chasing $50 bills, you are losing money. Outsourcing this to a fixed-fee service is often cheaper than the internal labor cost.

The Final Step: Close the Loop

If you have implemented these hacks and still have an “Over 90 Day” bucket that makes you nervous, it’s time to call in the specialists.

| Need a Dental Collection Agency? Contact Us |

NexaCollect acts as the “bad cop” so you can stay the “good doctor“. We seamlessly integrate with dental workflows to recover aged balances without ruining the patient relationship.