What is Hybrid Collection Service?

| Hybrid program takes the hesitation out of moving a past-due patient to collections—especially when you’ve already made internal contact attempts. This is our most amicable recovery process, designed to protect your reputation while improving resolution rates.

It begins with outreach under your practice’s name and, only if needed, gradually transitions to formal collection-agency demands. |

Hybrid is the “in-between” recovery program that fixes the biggest AR mistake: Waiting too long fearing reputation damage if a collection agency gets involved.

Most medical practices don’t lose money because patients never pay. They lose money because the account sits in limbo:

-

Your team keeps “following up”

-

The patient keeps “meaning to pay”

-

And then suddenly it’s 120+ days past due and hard collections is the only lever left,

Hybrid recovery was built for that exact gap.

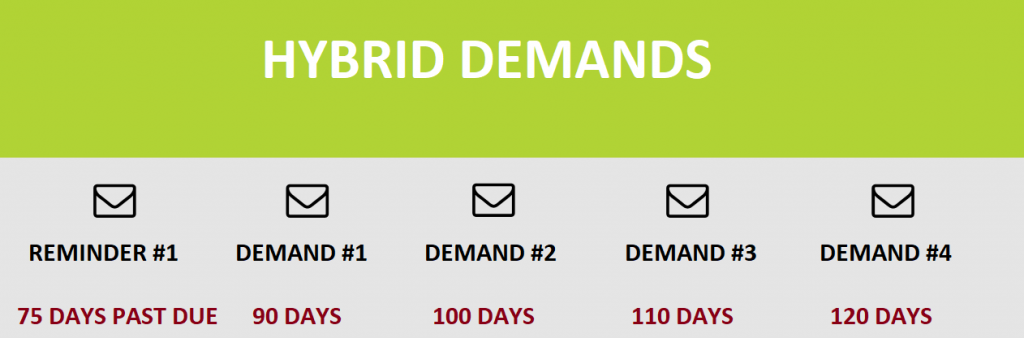

It’s not a harsh collections program, and it’s not passive billing either. It’s a structured, time-based escalation that starts right when accounts begin to slip—at 75 days past due—so you don’t wait until the balance is stale.

What “Hybrid” actually means