If you’re running your practice on eClinicalWorks and still watching A/R creep past 45–60 days, the problem isn’t just “slow payers.” It’s that you’re using a powerful EHR and RCM platform without a clear, disciplined collections strategy around it.

eClinicalWorks is strong EHR software. It’s not a collections department.

eClinicalWorks has grown into one of the largest ambulatory EHR and PM platforms in the U.S. Tens of thousands of providers rely on it every day for:

-

Scheduling and clinical documentation

-

E-prescribing, labs, and imaging

-

Charge capture and coding

-

Claims, posting, and reporting

Many practices also use eCW RCM tools and services for:

-

Eligibility and deductible checks

-

Claim scrubbing and automated edits

-

ERA posting and denial queues

-

Dashboards and KPIs

More recently, eCW has leaned heavily into AI-powered, “agentic” RCM to reduce manual work and speed up claim cycles.

All of that is valuable. But even with great software, most practices still face:

-

A/R days drifting into the 40s and 50s

-

10–20% of A/R sitting in 90+ day aging

-

Denial rates in double digits, especially as payer rules change

At some point, technology alone cannot force patients or payers to pay. You need clear policies, people, and collection partners around the system.

What eClinicalWorks does well for revenue — and what it doesn’t do

It helps to draw a clean line:

eCW is great at:

-

Capturing charges quickly and consistently

-

Reducing obvious coding and format errors

-

Submitting and tracking claims electronically

-

Highlighting denials and underpayments

-

Producing A/R and aging reports by payer, provider, and location

eCW does not:

-

Call overdue patients and arrange payment plans for you

-

Negotiate with stubborn self-pay accounts that are 120+ days old

-

Skip-trace bad addresses or wrong phone numbers

-

Litigate or pursue hard-to-collect balances

-

Replace a licensed, compliant, third-party collection agency for bad-debt A/R

If you treat eClinicalWorks like a “set it and forget it” collections machine, you end up with a beautiful dashboard and a growing pile of unpaid balances.

Are your eClinicalWorks numbers actually healthy?

The first step is to stop guessing and look at your eCW reports like a CFO, not just a clinician.

Key metrics to pull from eCW:

-

Days in A/R (overall)

-

Strong practices aim for roughly 30–40 days.

-

When you’re consistently over 45–50 days, something is off.

-

-

A/R aging buckets

Break out patient and insurance A/R into:-

0–30 days

-

31–60 days

-

61–90 days

-

91–120 days

-

120+ days

As a rough rule of thumb, A/R over 90 days should be a small slice, not a large chunk. When more than 10–15% of your total A/R lives there, it’s a red flag.

-

-

Insurance vs patient responsibility

Look at how much A/R is:-

Payer balances

-

Pure self-pay

-

Patient-due after insurance

With high deductibles and co-insurance, patient balances are rising. These require a very different follow-up approach than payer A/R.

-

-

Denial rate and top denial reasons

eCW already shows you:-

Percentage of claims denied on first pass

-

Common denial codes (authorization, eligibility, coding, timely filing)

If denials are creeping up year over year, your staff is spending more time firefighting, and more balances are drifting into aged A/R.

-

Once you know your numbers, the question becomes: What happens to those 60-, 90-, and 120-day balances next?

Where balances slip through in eClinicalWorks workflows

Even well-run practices see money slipping through at a few critical points:

-

Front-office gaps

-

Demographics, insurance information, or eligibility checks are incomplete.

-

Patients are not clearly told how much they will owe or when.

-

-

Back-office overload

-

Denial queues in eCW grow faster than staff can work them.

-

Simple, low-dollar claims get ignored in favor of complex ones.

-

-

Weak patient follow-up

-

Statements go out, but no structured reminder schedule exists.

-

Staff make calls “when they have time,” which is never enough.

-

-

No clear escalation rule

-

Some practices keep accounts forever in “patient A/R” because nobody wants to “send patients to collections.”

-

Result: high A/R, low cash, and a lot of quiet write-offs.

-

eClinicalWorks shows you the problem clearly on screen. But unless you turn those insights into rules and actions, nothing changes.

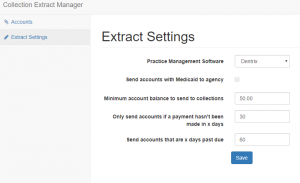

Using eClinicalWorks data to decide what goes to collections

A practical approach is to define simple, written placement rules based on your eCW reports. For example:

By aging:

-

Patient balances 0–30 days: statements and soft reminders only.

-

31–60 days: reminder letter + text/email + phone attempt.

-

61–90 days: stronger reminder, offer payment plan, final internal notice.

-

90+ days: if no progress or arrangement, eligible for third-party collections.

By balance size:

-

Small balances (for example, under $50 or $100):

-

One or two reminders, then internal write-off or batch placement depending on your policy.

-

-

Mid-range balances (for example, $100–$500):

-

Follow full internal workflow, then move to collections at 90+ days.

-

-

Large balances (for example, $500+ or $1,000+):

-

Earlier calls, more effort at 30–60 days.

-

Do not let them quietly age into 6–12 months.

-

By payer / visit type:

-

Chronic non-paying payers or plans:

-

Tighten pre-authorization and eligibility rules.

-

Make sure balances from those plans are watched closely.

-

-

Certain visit types (procedures, high-dollar imaging, elective care):

-

Stricter front-end collections (deposits, signed estimates).

-

Faster escalation path if the patient balance is ignored.

-

You can set up most of these segments directly inside eCW using existing reports and filters. The missing piece is the policy and follow-through.

| Already using eClinicalWorks Software? Have unpaid medical bills? Need to transfer your overdue accounts receivable to a debt collection agency? Contact us

|

AI + humans: pairing eCW RCM with real-world collections

eClinicalWorks’ newer AI and automation features are ideal for:

-

Scrubbing claims and catching coding issues

-

Checking status with payers

-

Pushing clean claims out faster

-

Flagging risky accounts before they age out

What AI cannot do on its own:

-

Talk a scared patient through a bill they don’t understand

-

Negotiate a realistic payment plan with someone juggling multiple debts

-

Track down a moved patient with no forwarding address

-

Decide when it’s time to escalate to legal action

That’s where professional medical collection agencies come in. The best ones:

-

Understand HIPAA, FDCPA, and modern medical-debt rules

-

Are comfortable working from eClinicalWorks exports and reports

-

Use patient-friendly scripts and payment options

-

Provide feedback that helps you tweak your eCW workflows upstream

Think of it as a layered system:

-

eClinicalWorks + your staff: prevent as much A/R and denial waste as possible.

-

Collection partners: recover what inevitably slips through, without abusing patients or damaging your reputation.

What a healthcare-focused collection agency should know about eClinicalWorks

If you’re on eCW, look for agencies that can speak your language. They should be ready to:

-

Accept secure exports of aging reports, patient contact data, and balance details from eCW

-

Work with your payer codes, rendering providers, and locations

-

Respect your do-not-contact lists, charity-care policies, and state-specific rules

-

Report back recovery data in a format you can easily map to your eCW metrics

Red flags:

-

Agencies that treat medical debt exactly like credit-card collections

-

No understanding of No Surprises Act, medical-debt credit reporting changes, or balance-billing limits

-

No process for protecting PHI or signing Business Associate Agreements

You want a partner that understands both medical compliance and the reality of patient-pay balances in a high-deductible world, not just a generic call center.

FAQs: eClinicalWorks and medical collections

Does eClinicalWorks include a built-in collection agency?

No. eClinicalWorks offers powerful billing and RCM tools, and in some cases full-service RCM, but it is still software and services—not a contingency collection agency. It will not pursue old patient debts the way a licensed collection firm does.

What A/R days should a practice on eClinicalWorks aim for?

Many practices using eCW aim for 30–40 days in A/R with a relatively small slice of A/R over 90 days. If your dashboards show 45–50+ days consistently, or a large chunk of your A/R sitting 90+ days, that’s a sign your follow-up and collections process needs work.

How do I know which eCW accounts to send to collections?

Use your eClinicalWorks aging reports to define clear rules by age, balance size, and visit type. A common pattern is: once a patient balance is 90+ days old with no response, it is a strong candidate for third-party collections.

Can I still use eClinicalWorks if I outsource collections?

Yes. Most practices continue to use eCW for charge capture, billing, and reporting, while sending specific sets of aged accounts to an external agency. The data starts and ends in your EHR/PM system; the collection agency simply works that data in between.

Will using a collection agency upset my patients?

Handled poorly, it can. Handled well, it doesn’t have to. A good medical-focused agency uses respectful language, offers payment plans, and knows when to back off. Often, patients have already ignored multiple statements and calls before an account is ever placed.

How Nexa helps eClinicalWorks practices strengthen collections

If your eClinicalWorks reports look impressive but your bank balance doesn’t, it’s time to rethink the collections layer around your EHR.

Nexa is an information portal that helps businesses and medical practices, including those on eClinicalWorks, find suitable collection agencies.

-

We are not a collection agency ourselves and we do not perform credit reporting.

-

Instead, we learn about your specialty, A/R profile, and compliance needs.

-

Then we share your collection requirements with carefully shortlisted medical-focused agencies that we believe can perform well for your kind of A/R.

-

It is entirely up to you whether or not to use their services.

If your eClinicalWorks dashboards show rising A/R and stubborn patient balances, share a few details about your situation. You keep focusing on clinical care and clean data; we’ll help you explore options to turn more of that A/R into collected, predictable cash.