In the world of debt recovery, the calendar is just as important as the contract. While “the sooner, the better” is the golden rule, there are specific windows throughout the year where liquidity peaks and debtor psychology shifts in your favor.

If you time your submissions correctly, you can see a recovery spike of 20% to 30% without increasing your workload. Here is how to navigate the 2026 collection calendar for maximum results.

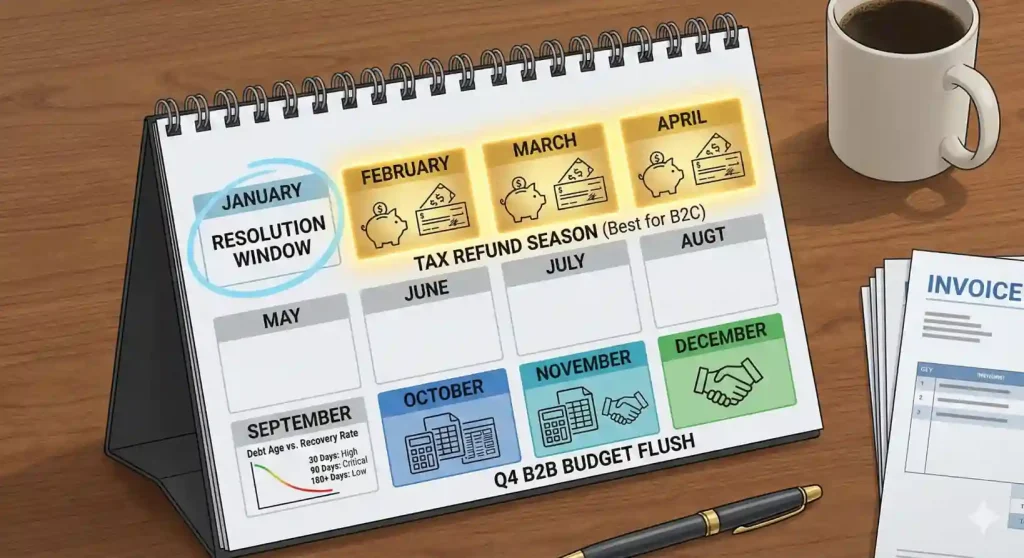

1. The “Golden Window”: Tax Refund Season (December – March)

For B2C collections (medical, dental, retail), this is the “Black Friday” of debt recovery.

-

The Math: Statistics show that roughly 35% of consumers plan to use their tax refunds specifically to pay down debt.

-

The Strategy: Do not wait until April. Submit your accounts in mid-January. This allows your collection agency to perform “skip-tracing” and send initial notices so that you are the first creditor in line when the refund hits their bank account in February.

2. The Q4 “Budget Flush” (October – December)

This is the critical window for B2B (Business-to-Business) collections.

-

The Logic: Businesses are eager to clean up their balance sheets before the fiscal year ends. Managers often have “leftover” budget that must be spent or allocated, and they prefer to enter the new year without outstanding payables hanging over their reputation.

-

The Numbers: Submitting by October 15th gives an agency 60 days to resolve disputes before the December 31st deadline, which is often a hard cutoff for corporate accounting.

3. The “Resolution” Window (January & February)

The start of the year brings a psychological shift. Debtors often start the year with financial “New Year’s Resolutions.”

-

The Opportunity: While cash may be tight immediately after the holidays, engagement levels are high. This is the best time to establish long-term payment arrangements that stick, as debtors are in a “fix-my-credit” mindset.

4. The Science of “Aging” vs. “Seasonality”

While seasonal windows are powerful, they cannot beat the 60-90 Day Rule. The value of a debt drops significantly every month it sits on your books.

| Debt Age | Estimated Recovery Value | Status |

| 30 Days | 87% of Original Value | High Priority |

| 90 Days | 33% of Original Value | Critical Transition |

| 180 Days | < 15% of Original Value | Write-off Risk |

The Bottom Line: If an account is already 90 days past due in August, do not wait for “Tax Season” in February. The 67% loss in value from aging will far outweigh any seasonal boost you might get by waiting.

Summary Checklist

-

January: Submit backlogs to catch Tax Refund season.

-

May: Review “lull” accounts before summer vacations start.

-

September/October: Final push for B2B year-end settlements.

-

Always: Automate the hand-off at the 60-90 day mark regardless of the month.

Nexa provides a reputation-safe approach, equipped with all 50-state collections license, offering free credit reporting, free litigation, free bankruptcy scrubs, and zero onboarding fees. Secure – SOC 2 Type II & HIPAA compliant. Over 2,000 online reviews rate us 4.85 out of 5.

Need a Collection Agency? Contact us