The debt collection industry has been through one of its most difficult periods in modern history, and the recovery looks slow and prolonged. A national and, at the same time, a global recession has been caused, not by financial crises, but rather by an unexpectedly devastating health issue. This is a time to show resilience and learn what we can in order to protect ourselves in the future.

Performance of Collection Agencies during Covid-19 PandemicEconomic downturns create a huge opportunity for the debt collection industry. A large number of creditors are stuck with unpaid invoices, and as their own efforts fail they tend to submit more accounts to collection agencies. However, during the recession, even the collection agencies find it hard to recover money as people have no funds to pay off their bills. However, as the economy starts to turn around, collection agencies are able to perfectly time their recovery efforts to maximize the chances of successful debt collection to ensure that their clients are the first ones to be paid. During peak Covid-19 duration (May-Nov 2020) many states prohibited debt collection for several months. Recoveries dropped to a mere 50% of the normal levels. It was the worst time for collection agencies in decades. Many agencies had to shut down during this period. The turnaround came the following year, during tax refund season as the debt recovery levels went up substantially ( March/April 2020). Additionally, the government-assisted stimulus packages resulted in recovery rates jumping by almost 1.5 times than normal, because people wanted to pay off their debts with this extra cash. Collection levels will stabilize to normal levels only after the Covid-19 problem completely subsides. |

Given its unprecedented scope, how can we access the resources at our disposal and organize our industry’s practices and decisions in a way that would enable us to survive and recover sooner rather than later? Looking at the two major crises in the last century, the Great Depression and the Great Recession, we can use the traditional route of analyzing both pre-and in-crisis data, to identify which receivables can be collected with a higher success rate and focus our efforts there.

Reporting information to build a reliable database

One of the difficulties in accessing that data is the reporting of consumer information by creditors and by debt collection agencies, themselves. The number of those actually furnishing payment information to the consumer reporting agencies has decreased in the last 10 years. A report released by the Consumer Financial Protection Bureau placed the number of reported payments on credit card accounts at 40% in 2020. In 2013, it was at 88%. The Bureau estimates that, as of 2020, ‘only about half of issuers with recent payments furnish these data’.

There may be several factors driving this decline, but what it boils down to for us is the unavailability of reliable information in terms of assessing the number of consumers that made payments, the number of accounts being paid and the speed at which their outstanding debts were being paid. Given this problem, we have to look elsewhere.

A boom in unchecked credit precedes economic crises

It’s generally accepted that ‘the more credit intense the expansion years preceding a crisis, the more severe the recession and the slower the recovery’ (Household Debt and Economic Recovery Evidence from the U.S. Great Depression, EHES Working Papers in Economic History | No. 36, p.4, March 2013). Now we know that before the Great Depression, there was a credit boom accompanying the economic expansion of the 1920s, where banks and financial intermediaries competed to extend credit for consumption and investments. As everyone tried to get a piece of the pie, investments became riskier and regulators turned more of a blind eye, caught in the euphoria of the boom, until the economic bubble began to contract due to non-viable financial choices that were economically unsupported long-term. The widespread, large volume of those financial decisions dragged down a vulnerable system, where consumer and commercial credit had been offered with no restraint.

The Great Recession of 2008 follows a similar pattern, where the domestic credit and subsequent debt in the financial and non-financial sectors increased significantly before and during the crisis. Financial institutions and regulators seem to have still a hard time establishing preemptive policies and controls to prevent recessions, from minor to devastating, from occurring.

What’s also interesting about financial and economic crises is which industries seem to recover time and again, where innovation is coupled with bold investment choices or sweeping reforms that draw from the strengths of previous solutions. The automotive industry is a fascinating example of stubborn efforts and reliable reinvention decade after decade.

US economy before and during Covid

Before the Covid epidemic, US credit levels had been increasing for several years, accompanied by an increase in delinquencies. Excessive borrowing and already vulnerable sectors of the economy might have led to another man-made financial crisis eventually, but the virus cut that transition short quite violently, sending shockwaves through the entire world. Even industries that were doing well, such as commercial construction, transportation, biopharmaceutical research and development, found themselves forced to overhaul their operations at an unprecedented cost. In November of 2020, some Harvard economists calculated that the pandemic would cost the US at least $16 trillion, provided it ended by the fall of 2021.

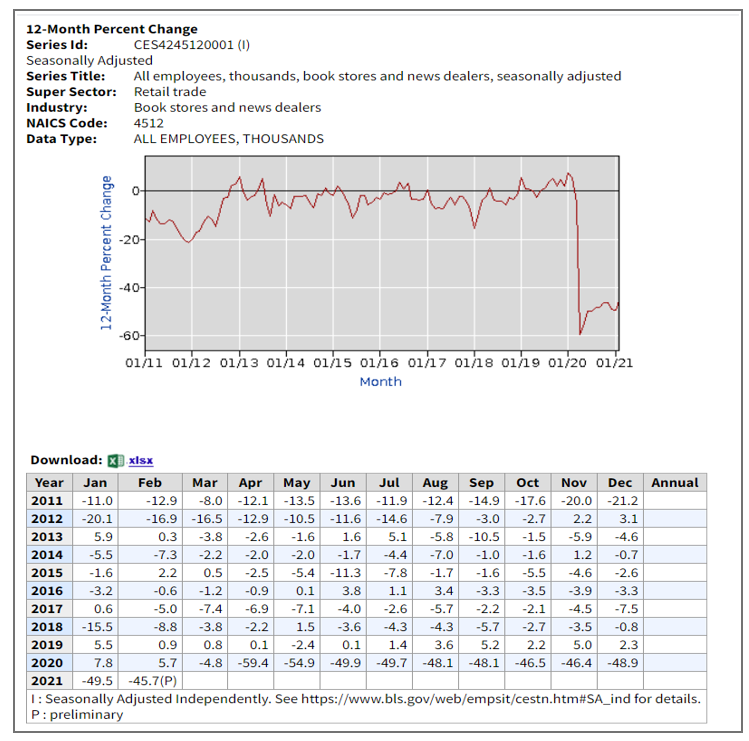

The levels of employment started spinning down at the beginning of 2020 with some industries hit so badly, it’s hard to believe they’ll take less than a few years to recover. For example, consider leisure and hospitality workers, whose employment fell by over 20% compared to 2019, or book retailers and news dealers, who recorded a 48.9% drop from 2019.

Source: US Bureau of Labor Statistics

These are industries where debtors will be hard-pressed to find money to pay debts for no other reason than that they are unemployed. They are, by no means, exceptions. The reports of the US Bureau of Labor Statistics provide a discouraging image of the levels of employment in 2020. There are a few industries that recorded positive percentages when compared to 2019, but they are rare: warehousing and storage, gardening and residential construction, software publishers and credit card issuers, and a few others.

It’s worth noting that credit card issuers and real estate credit maintained or increased their employment levels, due to continued demand for credit, but commercial banking and consumer lending decreased their payrolls.

A focused approach to keep costs down and maximize receipts

The next 6 to 12 months are going to be an uphill battle for creditors. As the economy improves, following vaccinations and easing of restrictions, recoveries for creditors will start going up as well. Until then, the focus of collection efforts needs to be on those consumers who are in the least-impacted industries. The important factors to look at are: ratio of debt to income, a history of debt repayment, occupation, likelihood that they’ll file bankruptcy (see bankruptcy demographics), family size, and employment status.

It’s good to remember that these are not infallible guides, but they help make sorely-needed predictions. Income, for instance, is not a totally reliable indicator of a consumer’s willingness to pay debt. In some cases, consumers with higher expendable income may maintain debt for longer periods of time specifically because it takes up a smaller percentage of that income. Those whose monthly credit card payments are only 20% of their income might be more comfortable with that debt. On the other hand, consumers with lower income, whose monthly credit card payment bites painfully into their short-term individual or household income, at around 30%-40%, may feel more inclined to resolve their debt situation, even if it means taking out a loan, or making low, but consistent, payments every month. Obtaining current information about a given consumer will help a collector evaluate and compare them to other collection opportunities.

In addition, debt collection rates vary widely from state to state. The population of the Southern states seem to have the hardest time paying off their debt, according to this interactive map about debt in America, last updated in March of 2021.

With many debt collection agencies having shut down and others operating with fewer staff and less financial resources, wasting time and money on chasing random debtors may be the last nail in the coffin for some agencies’ profit margins. Breaking down your portfolio of delinquent debts into categories based on the information here may help optimize your collection efforts and accelerate cash inflow.