Trusted by businesses nationwide to recover millions in lost revenue annually. We combine a 80% success rate on viable claims with a diplomatic “Velvet Hammer” approach—ensuring you get paid without damaging valuable B2B relationships.

Commercial collection (also known as B2B debt collection) refers to the process of recovering money owed by one business to another. Unlike consumer debt, commercial disputes often involve complex contracts, supply chain issues, and multiple decision-makers.

Unpaid invoices can significantly strain a company’s finances. Businesses must partner with a dedicated collection agency to recover these funds swiftly—without draining internal resources. Our service is cost-effective, results-driven, and built on professionalism.

Quick Facts: Why Choose Us?

-

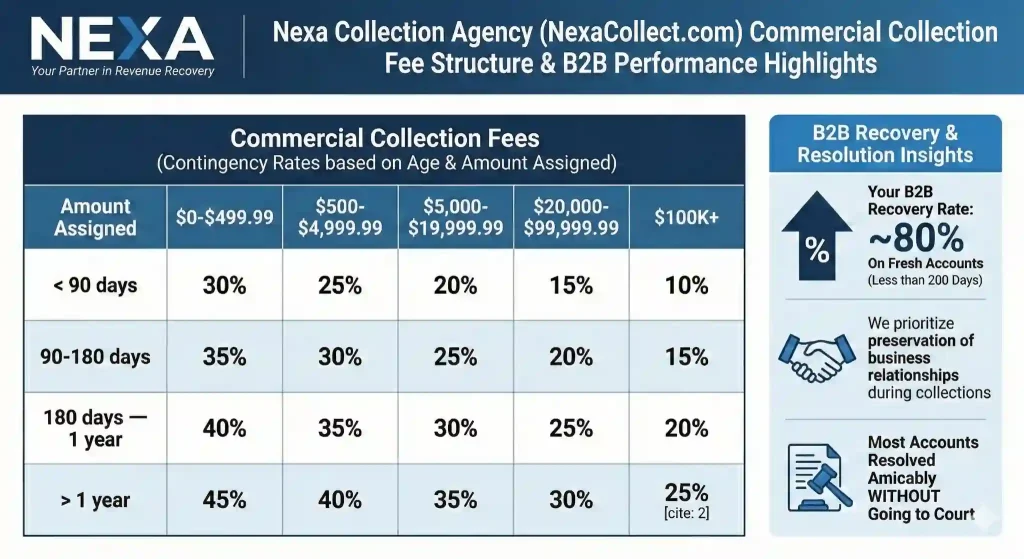

High Success Rate: While industry averages sit between 15% to 40%, we achieve a nearly 80% success rate on viable debts (accounts under 300 days old backed by solid documentation). Fee communicated in advance after reviewing your case. Results may vary as viability depends on documentation, debtor solvency and dispute status.

-

Business Credit Reporting: We report unpaid accounts to major Business Credit Bureaus. This affects the debtor’s ability to get future financing, creating a powerful incentive to pay you.

-

No Risk Pricing: We operate on a contingency basis—No Recovery, No Fee.

-

Nationwide Compliance: Backed by over 20 years experience, we are licensed in all 50 states and strictly follow the Uniform Commercial Code (UCC) and TCPA regulations.

The “Velvet Hammer” Approach for B2B

A business debtor is often also a potential future client. We understand that preserving the business relationship is critical. Our collectors use a “Velvet Hammer” strategy: we are persistent and firm regarding the financial obligation, but professional and respectful in our communication. This approach recovers your money while leaving the door open for future business.

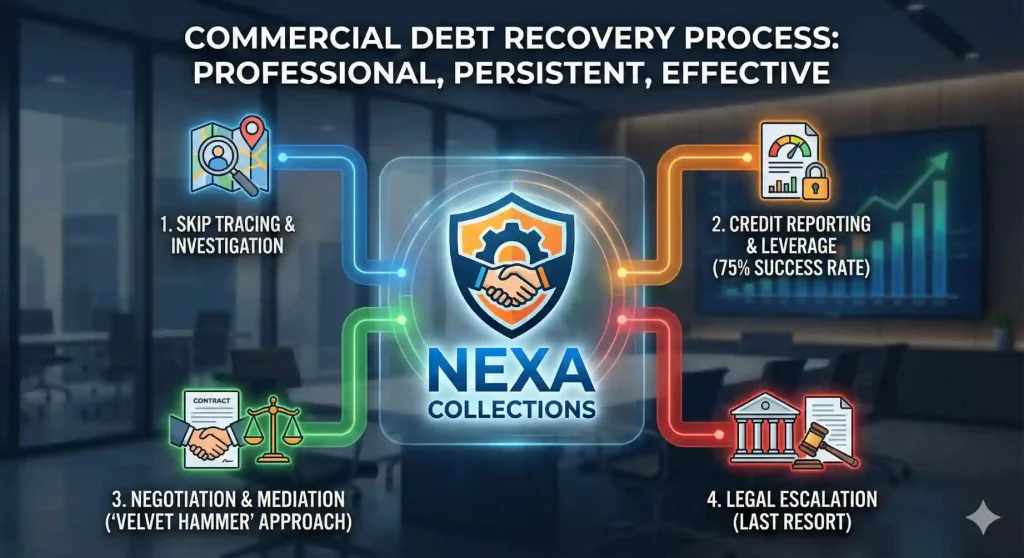

Our 4-Step Commercial Recovery Process

Our commercial debt collectors utilize persistent contact, credit leverage, and skilled negotiation to resolve the vast majority of cases amicably, reserving legal action strictly as a last resort.

1. Investigation & Skip Tracing

Before making the first call, we investigate. We verify business status, identify key decision-makers (owners, CFOs), and check for bankruptcy filings. If a debtor has “ghosted,” our skip tracing tools locate them.

2. Strategic Demands & Credit Reporting

We use a multi-channel approach (calls, emails, and mailed notices). Crucially, we utilize credit leverage:

Impact: A negative mark on a business credit report (such as D&B, Experian, or Equifax) can block a company from getting loans or vendor credit. This pressure often forces immediate payment.

3. Negotiation & Mediation

Commercial debts often involve disputes over service quality or contract terms. Our specialists act as mediators to cut through excuses and secure full payment or enforce a structured settlement plan.

4. Legal Escalation (With Your Approval)

If a debtor has assets but refuses to pay, we can forward the case to our affiliated network of commercial litigation attorneys. We handle the paperwork and manage the process, so you don’t have to.

| Need a Commercial Collection Agency? Serving Nationwide – Low Fee |

Industries We Specialize In

Commercial debt requires industry-specific knowledge. We have dedicated teams for:

-

Construction & Contractors: Handling liens, material disputes, and general contractor issues.

-

Manufacturing & Logistics: Collecting on unpaid freight bills, warehousing fees, and supply orders.

-

Staffing & SaaS: Recovering service fees and contract buyouts.

-

Wholesalers & Distributors: Managing high-volume, low-balance delinquent accounts.

- Commercial / Office leases

Proven Results & Legal Authority

-

Midwest Logistics & Freight ($140,000): Resolved a complex cross-border brokerage dispute in 22 days via targeted mediation, bypassing months of litigation.

-

Industrial Manufacturing ($210,000): Recovered 100% of principal plus interest in under 45 days using “Corporate Diplomacy” to reconnect with new decision-makers after a client’s restructuring.

-

Commercial HVAC Construction ($68,000): Secured a full retention payment in 24 days. By filing a “Notice of Intent to Lien,” we forced a developer to release funds to protect their property title.

Our Technical Edge: B2B Security

Secured Creditor Leverage: We specialize in UCC-1 filings and Mechanic’s Liens to “perfect” your security interests. This expertise ensures your business is moved to the front of the line during payment disputes or insolvency proceedings, providing the highest level of legal protection available.

Checklist: What We Need to Start

To achieve that 75% success rate, providing the right documentation is key. When you place an account, we recommend uploading:

-

Copies of the original Invoices.

-

The signed Contract, Purchase Order (PO), or Service Agreement.

-

Statement of Account (showing payment history).

-

Any relevant email correspondence regarding the debt.

Frequently Asked Questions (FAQ)

What is the difference between Consumer and Commercial collections?

Consumer collections (B2C) are regulated strictly by the FDCPA to protect individuals. Commercial collections (B2B) are governed more by the Uniform Commercial Code (UCC) and contract law, allowing for different strategies and shorter timelines for resolution.

How much does it cost?

We work on a contingency fee model. Our rates typically range from 15% to 40% depending on the age of the debt, the balance size, and the complexity of the case. If we don’t collect, you don’t pay a dime.

Can you collect from a business that has closed down?

It is difficult, but possible. If the business owner signed a Personal Guarantee, is a Sole Proprietor, or is part of a General Partnership, they are personally liable for the debt. , We check for assets or “successor liability” (if they opened a new business under a different name). Personal assets may also be reached if there is evidence of Fraudulent Transfers (hiding assets), though pursuing personal wealth typically requires an attorney or court judgment rather than standard collection efforts.

Ready to Boost Your Cash Flow?

Don’t let unpaid invoices sit on your books. Statistics show that after 90 days, the chance of collecting a debt drops by 10% every month.