In Iowa—from the advanced manufacturing plants of the Cedar Valley to the sprawling agricultural networks of the Des Moines metro—business is built on trust. When that trust is broken by unpaid debt, you need a partner who understands the Iowa Consumer Credit Code (ICCC).

Nexa provides 100% reputation-safe, compliant with the Iowa Attorney General’s notification requirements, equipped with all 50-state collections license, offering free credit reporting, free litigation/bankruptcy scrubs, and zero onboarding fees. Secure – SOC 2 Type II & HIPAA compliant.

Need a Collection Agency? Contact us

The Iowa Legal Landscape

Iowa is a unique state for creditors. While it offers a long window to sue, it places strict annual limits on how much can be taken from a single debtor.

| Debt Type | Statute of Limitations | Iowa Code (IC) |

| Written Contracts | 10 Years | IC § 614.1(5) |

| Oral/Open Accounts | 5 Years | IC § 614.1(4) |

| Medical Debt | 5 Years | IC § 614.1 |

| Wage Garnishment | ALLOWED (Annual Caps) | IC § 642.21 |

Key Iowa Rules:

-

The 10-Year Window: Iowa offers one of the longest statutes of limitations in the U.S. (10 years for written contracts), allowing Nexa to recover “zombie debt” that other agencies have given up on.

-

Garnishment Caps: Iowa limits garnishment based on annual income (e.g., if a debtor makes less than $12,000/year, you may only be able to garnish $250 annually). Nexa’s “Iowa Desk” uses automated income verification to stay within these legal bounds.

-

Notification Threshold: Iowa’s unique annual garnishment caps (IC § 642.21) act as a strict legal “speed limit,” allowing creditors to garnish as little as $250 per year if a debtor earns under $12,000, while 2026 shifts have pushed the Iowa Attorney General’s notification threshold to $71,900—meaning any agency collecting above this amount without state registration is operating illegally and exposing your business to penalties.

Cost-Effectiveness: The Nexa Advantage

-

Fixed-Fee Recovery ($15/account): Ideal for early-stage receivables. Debtors pay 100% directly to you.

-

Contingency Service (20%–40%): Performance-based recovery. If we don’t collect, you don’t pay. No recovery, no fee.

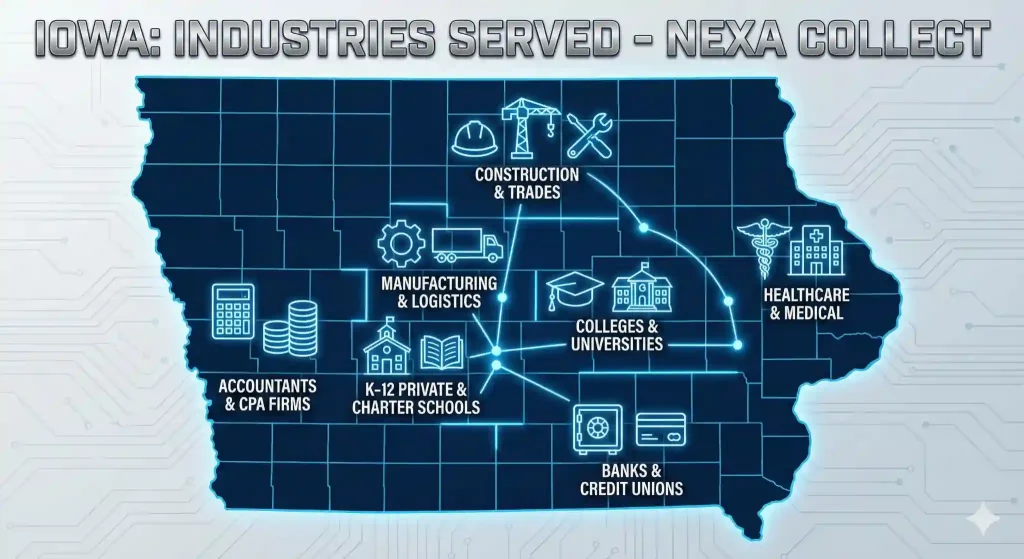

Industries We Serve in Iowa

-

Manufacturing & Industrial: B2B recovery for the machinery and food processing sectors. We handle high-value disputes for suppliers in the “Cultivation Corridor.”

-

Healthcare & Medical: 100% HIPAA-compliant. We manage patient balances while ensuring compliance with Iowa’s strict Debt Collection Practices Act to protect your clinic’s reputation.

-

Colleges & Universities: From major state institutions to private colleges, we manage tuition recovery and housing balances with a diplomatic approach that preserves student relationships.

-

K-12 Private & Charter Schools: Managing unpaid enrollment and textbook fees. We offer a family-sensitive mediation style tailored for Iowa’s local communities.

-

Accountants & CPA Firms: Recovery of professional service fees. We understand the Iowa tax cycle and recover your fees without damaging long-term client trust.

-

Banks & Credit Unions: Expert handling of delinquent consumer loans and deficiency balances. We utilize Iowa’s legal judgment tools to secure repayment on high-risk portfolios.

-

Construction & Trades: Revenue recovery for HVAC, electrical, and general contractors. We are experts in Iowa Code Chapter 572 (Mechanic’s Liens).

-

Restoration & Waste Management: Specialized B2B and B2C recovery for emergency service providers and environmental firms across the state.

Recent Iowa Recovery Results

Case 1: Des Moines Specialty Surgical Center (Medical)

-

The Problem: $92,000 in aging patient debt, much of it over 3 years old.

-

The Result: Nexa recovered $64,000 in 120 days using a “soft-touch” mediation strategy that resulted in zero complaints to the Attorney General.

Case 2: Cedar Rapids Construction Supplier (B2B)

-

The Problem: A $35,000 unpaid invoice for materials. The debtor was ignoring all calls.

-

The Result: Nexa’s legal team filed a Chapter 572 notice, resulting in a full $35,000 recovery plus interest within 45 days.

Frequently Asked Questions (FAQ)

1. Can you garnish wages for medical debt in Iowa?

Yes. Following a court judgment, Iowa law allows wage garnishment, though it is subject to the annual maximum caps set by IC § 642.21.

2. What happens if an Iowa debtor moves to another state?

Because Nexa is licensed in all 50 states, we don’t stop at the border. We follow your debtor to their new home and apply local state laws to ensure recovery.

3. Does the $15 service include the mandatory Iowa demand letter?

Yes. Our service includes the specific “Notice of Right to Cure” language required by the ICCC for consumer accounts.

Popular Cities: