Tired of a beautiful CareCloud dashboard and an ugly aging report?

You’re not alone. Many practices get the front end right—claims go out, payments come in—yet a stubborn pile of old patient balances never really moves.

Why CareCloud users still struggle with A/R

CareCloud checks a lot of boxes:

-

Cloud-based EHR and practice management

-

Integrated RCM tools or full billing services

-

Dashboards that show denials, collections, A/R trends

On paper, everything looks under control.

But in real life you still see:

-

Accounts that sit 60, 90, 120+ days past due

-

A growing chunk of A/R tied to patient responsibility

-

Staff who “will follow up later” but never quite get to it

That’s not a software bug. That’s the gap between billing and debt recovery.

Where CareCloud helps you – and where it stops

CareCloud is very good at what it is supposed to do:

-

Capture charges and create claims

-

Scrub and submit those claims accurately

-

Post payments and adjustments

-

Generate aging and KPI reports

-

Send standard statements and reminders

What it does not do:

-

Call a patient every week for two months

-

Track down a guarantor who moved and changed numbers

-

Negotiate a realistic payment plan when a family is already behind on other bills

-

Decide which accounts should move from “late” to “collections”

If your strategy is “we’ll keep sending statements and hope something happens,” your old A/R will keep growing—no matter how polished the software is.

The “red zone”: when an invoice stops being a bill and becomes bad debt

Every practice has a point where, if you’re honest, you know:

“If this hasn’t been paid by now, it probably won’t be… unless someone treats it like a collections problem.”

A few simple signals:

-

Age: The balance has been sitting for three to four months with no meaningful payment.

-

Silence: Statements went out, maybe a couple of calls… and then nothing.

-

Behavior: The patient stopped responding, keeps cancelling, or ignores every message.

CareCloud will happily show you these accounts in your A/R Aging report. It will not make the hard decision for you.

You need a line in the sand that says:

“After this point, this stops living in our billing workflow and moves to our collection workflow.”

Turn your CareCloud A/R into a simple rulebook

Instead of debating every account, build a small rulebook that lives on top of your CareCloud data.

Here’s one way to structure it:

Rule 1: Time

-

If a patient balance has no payment in 90+ days, and

-

You’ve already made at least 3 contact attempts (statement, portal reminder, or phone call),

→ it is eligible for collections.

Rule 2: Amount

-

Very small balances (for example under $50–$100):

-

Either batch them once or twice a year, or make a decision to write them off.

-

-

Mid-sized balances (for example $150–$750):

-

Follow your normal reminder workflow; if still unpaid at 90–120 days, move them to collections.

-

-

Larger balances (for example $1,000+):

-

Review earlier and escalate faster if there is no payment or plan by 60–90 days.

-

Rule 3: Exceptions

-

Keep out:

-

Formal payment plans that are being honored

-

Active disputes

-

Approved charity-care or special-case patients

-

Once this is written down, CareCloud becomes a trigger engine, not just a reporting tool.

How a CareCloud-friendly collections workflow fits in

Now you need a way to turn those rules into an actual, repeatable process.

That’s where a CareCloud-friendly debt-collection utility comes in. The goal is to make the handoff from CareCloud → collection agency:

-

Easy to configure

-

Boring to run

-

Hard to forget

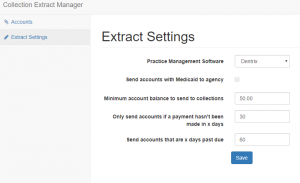

Typical knobs you control:

-

Minimum balance:

“Only send accounts with balances over $200 or $300.” -

Account age:

“Only send accounts where there’s been no payment for 90 days (or 60 / 120 / 180—your choice).” -

Recovery path:

-

Start with a fixed-fee letter series (firm but courteous demand letters), or

-

Go straight to contingency collections for the worst accounts.

-

-

Exclusions:

-

Remove accounts in payment plans, flagged disputes, or any category you mark as “do not place.”

-

Once configured, the utility:

-

Reads the A/R data from CareCloud.

-

Finds accounts that match your rules.

-

Prepares a clean, secure file for your collection partner.

You’re no longer “remembering to send accounts to collections”. It just happens on schedule.

Three simple playbooks (you can adjust the numbers)

You don’t have to reinvent anything. Start with patterns like these and tweak them to your comfort level.

Playbook 1 – Standard patient A/R

-

Balance ≥ $200

-

No payment in 90+ days

-

At least 3 contacts recorded

→ Send to a fixed-fee letter program first. If no response after that series, escalate to contingency collections.

Playbook 2 – High-balance safeguard

-

Balance ≥ $1,000

-

No payment or arrangement at 60 days

→ Manager review + one last internal call.

If still no plan by 90 days, move to a full collections placement.

Playbook 3 – Old A/R cleanup

Once a month, run a report of all patient A/R over 120 days that isn’t in a payment plan or dispute.

-

Decide whether to:

-

Place them in bulk with your collection agency, or

-

Close / write off accounts that truly have no recovery path

-

Either way, you stop letting “forever balances” clutter your CareCloud reports.

“Won’t using a collection agency upset our patients?”

It depends on who you choose and what you ask them to do.

A good healthcare-focused collection agency will:

-

Work under HIPAA and other privacy rules, sharing only the minimum needed information

-

Follow debt-collection regulations and your own communication preferences

-

Approach patients with a firm but respectful tone

-

Offer realistic payment options instead of “pay in full or else” ultimatums

Your team stays focused on care and early financial conversations.

The agency focuses on late-stage accounts that have already been given reasonable chances.

Where Nexa fits in (and what we don’t do)

Quick clarification:

-

Nexa is an information portal.

-

We are not a collection agency.

-

We do not call your patients or report to credit bureaus.

What we do:

-

Talk with practices that use platforms like CareCloud and dig into their A/R challenges, typical balances and patient mix.

-

Help you think through placement rules that sit on top of your existing CareCloud reports.

-

Share your collection requirements with a shortlist of medical collection agencies we believe are a good match for your type of receivables.

-

Leave it completely up to you whether to work with any of them.

CareCloud already gives you cleaner claims, better reporting, and a clearer view of your revenue.

Layer a simple, rule-based collections process on top, and those stubborn 60–120+ day balances stop being long-term residents in your aging report—and start becoming cash you can actually use.

| Already using CareCloud Software? Have unpaid medical bills? Need to transfer your overdue accounts receivable to a collection agency? Contact us

|