DeFi is a collective term for financial products and services accessible to anyone using Ethereum over the internet. DeFi Apps are built on the Ethereum blockchain.

List of contents

- What is DeFi?

- What exactly is DeFi?

- What is so special about DeFi?

- Why do we need decentralized finance?

- What are the use cases of DeFi?

- What are the reasons underlying DeFi as an emerging business trend?

- How to make money with DeFi products?

- Total locked value in DeFi

- Bottom Line

What is DeFi?

DeFi refers to Decentralized Finance, peer-to-peer financial services on a public decentralized blockchain network, particularly Ethereum. You can build DeFi applications on the Ethereum blockchain that run smart contracts when conditions are met.

It evolved by combining decentralized tech and finance. The two special features of DeFi are:

- 1 It generated a robust global financial system on the crypto space geared by open-source technology

- 2 It allows anyone to build financial applications without centralization of control

DeFi applications reconstruct traditional finance systems revolving around borrowing, lending, trading, and investing with digital assets. DeFi projects let you earn interest on the deposit of cryptocurrencies.

What exactly is DeFi?

It is a unique way to execute financial transactions in cryptocurrency & blockchain using financial applications.

Defi helps build financial products on the Ethereum blockchain to allow anyone, anywhere with internet access, to gain lending and borrowing services without intermediaries.

DeFi decreases the barrier of entry to financial products and services for people who are unbanked from traditional financial services because of significant reasons, such as lack of credit history, weak banking infrastructure, or limited banking hours.

What is so special about DeFi?

A system that interacts with buyers, sellers, borrowers, or lenders with peer-to-peer technology to access financial products or services bypasses middlemen such as financial institutions.

The magic revolution of DeFi is disempowering the centralized, traditional banking system & empowering people through peer-to-peer exchanges that enable decentralized finance for everyone.

Why do we need decentralized finance?

Decentralized finance has the potential to create more transparent financial markets that are accessible to anyone with internet connectivity worldwide; therefore, we need it.

The project, empowered by Dapps and protocols, uses Ethereum-based code that removes the middleman between transacting parties in a crypto-financial transaction.

It is widely adopted by eagle-eyed investors to make larger returns on capital.

The two popular concepts link to DeFi crypto.

Yield farming:

Yield farming is a process that allows crypto holders to stake or lock up their funds with DeFi platforms to provide liquidity to the pool & earn high rewards in returns.

Money Legos:

DeFi revolves around the concept of Money Legos–putting the idea that anyone can build a new financial product on top of an existing DeFi product. DeFi apps can compose new apps using code as building blocks.

Besides this, a significant type of DeFi application is being used in Decentralized exchanges, e-wallets, stablecoins, NFTs, flash loans, etc.

What are the use cases of Decentralized Finances?

The mentioned below three key use cases of Decentralized Finance are:

1) DeFi Lending Platforms:

DeFi lending platforms are collateral-based, connecting lenders and borrowers of cryptocurrencies, such as a compound allowing users to lend or borrow cryptocurrencies.

The platform sets interest rates algorithmically & lenders receive higher interest rates when the demand for borrowing crypto increases.

2) Stablecoin:

Stablecoin is another form of DeFi that is pegged to dollars or Euros to avoid price fluctuations in cryptocurrencies. It brings price stability in DeFi markets, therefore; it is highly desirable in lending, borrowing, and trading.

3) Margin and Leverage

DeFi markets allow users to borrow cryptocurrencies on margin using other digital assets as collateral. Smart contracts are programmed in such a way that leverage Defi protocols to maximize high returns on lending crypto assets.

What are the reasons underlying DeFi as an emerging business trend?

There are a couple of noticeable reasons that make it more prominent than traditional finance and the reasons for emerging business trend.

Equal access to financial services:

It let you develop financial products on an open public source platform irrespective of boundaries. Instead of an autonomous central server, the code controls the unique system.

The statistics of the World Bank Global Findex Report, currently, 1.7 billion individuals are unbanked and deprived of financial access due to credit checks or strong financial history. The new digital technology could help bring more people to easily access banking services by collateralizing their cryptocurrencies with DeFi platforms.

Instant and Low Transaction Cost:

The newly launched Ethereum 2.0 platform can make around 100,000 transactions per second to facilitate instant payment.

The distinguishing feature of DeFi projects is a low-cost transaction as compared to exorbitant banking transactions. Expatriates send their remittances to their homeland through payment solution providers or banking systems. These channels charge high transaction cost that eats most of the savings. However, decentralized projects verify the payment transactions through a set of nodes eliminate the intervention of middle authority for payment settlement between the sender and receiver, cutting down the supplement fees and costs and saving a considerable amount of money.

Decentralized trusted model:

It replaced the traditional centralized model with a decentralized trusted model. We often observe that millions of banking customers using credit cards, ATMs, or transacting online have been hacked from the centralized database of the bank.

Conversely, the DeFi system is more secure and transparent that is immutable & irreversible. Each transaction is cryptographically secured & keeps record transactions across a group of nodes distributed decentralized over the internet. The hash function restricts hacking endeavors; it verifies transactions and digests data into a string value. If anyone attempts to hack data, the hash value of the last block does not match the current block making it transparent. Similarly, users have more control over their data when compared to traditional financial institutions.

Unrestricted Operational services:

DeFi markets are continuously operating day and night with no intervals. Unlike the traditional financial industry, DeFi has no working hours restrictions or time zone limits. It can potentially extend nonstop investing and trading services to customers anywhere, anytime in the world.

How to make money with DeFi?

DeFi offers an enormous opportunity for earnings to customers connected to the interlinked digital ledger.

We list some of them below:

Lending:

DeFi platforms allow customers to generate interest income by a lending loan against collateralization of cryptocurrency or stablecoin such as compound or Dai coin

Borrowing:

It lets you borrow funds from liquidity pools & sell the funds to other DeFi projects, make their profit, and pay back the loan to the loan initiator pool.

Staking:

Users can make money by locking up their crypto with smart contracts on the DeFi pool to provide liquidity to that pool and receive tokens as staking rewards in return.

Total Locked value in DeFi:

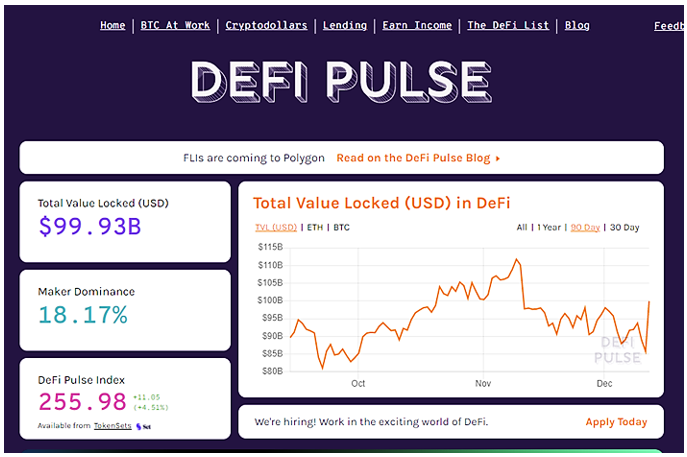

The DeFi market is evolving fast. Currently, the total value locked in different DeFi Protocols stands at $99.93 billion as of December 12, 2021. Previously, it touched to a peak of $111.754 billion on November 09, 2021.

Bottom Line:

The scope of DeFi apps is far-reaching, The DeFi market has been emerging fast, and total locked value in DeFi protocols signals the skyrocketed move in the future.

References:

* cointelegraph.com/explained/decentralized-finance-explained

* decrypt.co/resources/defi-decentralized-finance-explained-guide-learn

* www.coindesk.com/what-is-defi

* www.worldbank.org/en/news/press-release/2018/04/19/financial-inclusion-on-the-rise-but-gaps-remain-global-findex-database-shows

* cointelegraph.com/defi-101/defi-a-comprehensive-guide-to-decentralized-finance

* www.forbes.com/advisor/investing/defi-decentralized-finance/

* www.investopedia.com/decentralized-finance-defi-5113835

* coinmarketcap.com/alexandria/article/what-is-yield-farming

* www.techopedia.com/definition/25777/peer-to-peer-network-p2p-network

* hackernoon.com/earning-passive-income-with-defi-staking-an-overview-4a1y3720

* defipulse.com/