Debt collection in 2025–26 is shifting fast. Delinquencies are climbing across multiple industries, regulations are getting tougher, and clients want recovery solutions that protect their brand image as much as their bottom line.

Agencies that move early, stay compliant, and communicate respectfully are in the best position to win. Let’s break down where the real opportunities lie.

The Big Picture

Businesses everywhere — from trade schools to telecom companies — are under pressure to collect faster and more transparently. Regulation F, state-level laws, and new credit-reporting rules have made compliance more critical than ever.

The winning strategy?

Work early, use automation wisely, and combine fixed-fee programs with contingency collections. This dual approach keeps costs predictable for clients while boosting overall ROI.

High-Potential Industries for 2025–26

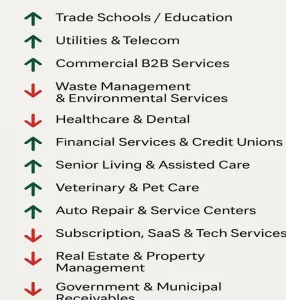

Below are industries showing strong growth or stability for debt-collection services, grouped for readability instead of a wide table.

1. Education & Trade Schools

-

ROI: High

-

Risk: Low to Moderate

-

Volume: High

Trade schools and vocational programs face steady delinquencies from tuition and course fees. They appreciate fixed-fee bulk recovery that preserves goodwill with students.

2. Utilities & Telecom

-

ROI: High

-

Risk: Low

-

Volume: Very High

Recurring billing, high turnover, and cost-of-living pressures are creating record volumes. Automated reminders and self-service payment links work best here.

3. Commercial B2B Services

-

ROI: High

-

Risk: Moderate

-

Volume: High

Staffing, leasing, and engineering firms struggle with client delays and contract disputes. These are ideal for contingency-based recovery, often with solid returns.

4. Waste Management & Environmental Services

-

ROI: High

-

Risk: Low

-

Volume: Moderate

Regional haulers and recyclers see steady volumes of unpaid invoices. Early outreach preserves customer relationships while keeping internal AR lean.

5. Healthcare & Dental

-

ROI: Moderate

-

Risk: High

-

Volume: High

Credit-reporting limits and medical-billing reforms mean compliance is everything. Focus on early patient engagement and compassionate communication.

6. Financial Services & Credit Unions

-

ROI: Moderate to High

-

Risk: High

-

Volume: Medium

Rising defaults and tighter lending rules are bringing more accounts to agencies — but only those that meet strict data-security and member-sensitivity standards.

7. Senior Living & Assisted Care

-

ROI: High

-

Risk: High

-

Volume: Medium

An aging population means more billing disputes over care balances. Sensitivity and empathy are critical, but ROI potential is strong with respectful handling.

8. Veterinary & Pet Care

-

ROI: High

-

Risk: Low

-

Volume: High

Pet-care costs are climbing, and practices often face delayed self-pay balances. Friendly outreach yields surprisingly high recovery rates.

9. Auto Repair & Service Centers

-

ROI: High

-

Risk: Low

-

Volume: High

Frequent small-ticket accounts make this perfect for fixed-fee placements. Low compliance exposure and strong repeat volume.

10. Subscription, SaaS & Tech Services

-

ROI: High

-

Risk: Low

-

Volume: Very High

Cancellations and card-failures are driving spikes in receivables. Automated, digital-first recovery workflows perform best here.

11. Real Estate & Property Management

-

ROI: Moderate

-

Risk: Low to Moderate

-

Volume: Moderate

HOA dues, tenant charges, and commercial rent balances are steady business. Legal awareness of landlord-tenant rules is key.

12. Government & Municipal Receivables

-

ROI: Moderate

-

Risk: High

-

Volume: Medium

Permits, citations, and local fines require licensed, transparent processes. Bureaucratic but reliable for established agencies.

What’s Driving These Shifts

-

Regulation Tightening:

The CFPB’s proposed expansion of “larger participant” definitions could bring more agencies under direct oversight. -

Digital Outreach Rules:

Email, SMS, and AI-based contact methods are now allowed — but closely watched. -

Medical-Debt Reforms:

Accounts under $500 and surprise billing restrictions have reduced leverage for healthcare providers. -

Economic Strain:

Interest rates and inflation are squeezing both consumers and businesses, increasing delinquency rates but also opportunity.

Smart Playbook for 2025–26

-

Go early. The younger the account, the higher the recovery and lower the risk.

-

Automate where it counts. Use tech for reminders, not for tone.

-

Show compliance. Transparency wins contracts and renewals.

-

Focus by region. States like Texas, Florida, Georgia, and North Carolina combine volume with manageable regulation.

-

Lead with empathy. Consumers and businesses respond to clarity and respect — not pressure.

The Bottom Line

The next 18 months belong to agencies that act like partners, not enforcers.

By combining compliance, technology, and timing, collection firms can scale responsibly and profitably.

Early, ethical, efficient — that’s the formula for growth in 2025 and beyond.