The Ultimate Guide to Cost Segregation (2025 Edition): Bigger First-Year Deductions, New Federal Rules, and State Traps

Cost segregation remains one of the fastest ways to increase after-tax cash flow for property owners. In 2025, it’s even stronger: federal law restores 100% bonus depreciation for newly acquired, qualifying assets (with important acquisition and placed-in-service timing rules), while many states still decouple and make you add back that bonus on your state return.

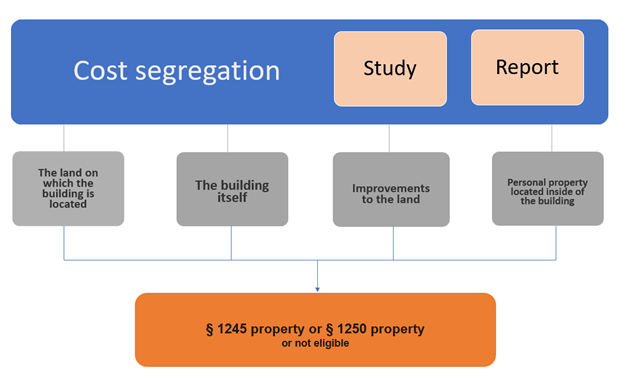

What a Cost Segregation Study Actually Does

A cost segregation study is an engineering-driven analysis that breaks a building into shorter-life components so you can depreciate large portions much faster than 39 years (or 27.5 years for residential rental):

-

39-Year (real property): shell, structure, foundation, roof, exterior walls/windows.

-

15-Year (land improvements): paving, curbs, landscaping, fencing, storm drainage.

-

7- / 5-Year (personal property): decorative lighting, specialty electrical/plumbing, millwork/cabinetry, dedicated process/mechanical components, furniture and equipment.

-

Qualified Improvement Property (QIP): interior, non-structural improvements to nonresidential buildings—15-year life and bonus-eligible.

High-quality studies map every component to a tax class, tie it to invoices and plans, and produce audit-ready workpapers and photos.

Start Saving – Get a Free Preliminary Assessment!

|

Bonus Depreciation in 2025: The New Federal Rules (and the Date You Can’t Miss)

-

100% bonus is available for qualified property that is both acquired and placed in service after January 19/20, 2025 (treat January 20, 2025 as the practical cutoff).

-

Property placed in service January 1–19, 2025 generally falls under the old phase-down (40%) unless a special transition applies.

-

A transitional election can allow 40%/60% treatment in specific cases even after the cutoff (useful for income smoothing).

-

Under current law, 100% bonus is permanent going forward for qualifying property.

-

Section 179 expensing is separate from bonus and, beginning in 2025 tax years, the limit is $2.5 million with a $4 million phase-out threshold (indexed after 2025). Use §179 where you want asset-by-asset control or where bonus doesn’t fit your plan.

Updated Example (2025 Timing)

-

Facts: You purchase a nonresidential building for $5,000,000 (excluding land) and place it in service February 1, 2025. The study supports:

-

20% as 5-year property ($1,000,000)

-

5% as 15-year property ($250,000)

-

-

Result: Because the asset was acquired and placed in service after the cutoff, the 5-/7-/15-year items qualify for 100% bonus in Year 1.

-

Year 1 deduction: $1,250,000 (bonus on 5/15-year) + regular MACRS on the remaining $3,750,000 ≈ >$1.34M total.

-

Cash impact: At a 37% marginal rate, that’s roughly $440,000 in first-year federal tax saved (state treatment may differ—see next section).

Key documentation to keep: binding purchase agreement, acquisition date support, placed-in-service logs, fixed-asset ledger tie-outs, photos.

State Conformity: Where You Can Get Burned

Most states do not automatically follow federal bonus depreciation. Many require you to add back the federal bonus on your state return and then recover it over time using state-specific depreciation.

-

California: Decouples from federal bonus; expect add-backs and separate state depreciation schedules.

-

New York: Disallows federal bonus for most filers; NY income often runs higher than federal in the first year after a big bonus claim.

-

New Jersey: Corporate and other taxpayers generally uncouple and maintain separate state depreciation.

-

Pennsylvania: No federal bonus for corporate net income tax; special state schedules apply.

-

Colorado: Often conforms quickly, but lawmakers can selectively decouple—verify each year.

Bottom line: Build a federal-to-state depreciation bridge before filing. It’s common to show a large federal loss while your state return shows positive income because of add-backs.

Who Should Consider a Study (and When)

-

New construction or major renovations—especially interior QIP work (nonresidential, non-structural).

-

Recent acquisitions—complete the study within the first year to fully capture the 100% bonus.

-

Older properties (“look-back” studies): Claim missed depreciation via Form 3115 (change in accounting method). No need to amend prior returns.

-

Tenant improvements: Many interior build-outs qualify; separate structural from non-structural work.

Cost, Quality, and Audit Durability

-

Typical fee: about $3,000–$15,000, scaling with size/complexity—often a fraction of the first-year tax savings.

-

Audit-ready studies include stamped engineering workpapers, asset maps, photo logs, acquisition and placed-in-service evidence, and a clear reconciliation to your fixed-asset ledger.

-

Align the deliverable to the IRS’s expectations for methodology and documentation.

Coordinating §179, Bonus, Interest Limits, and Recapture

-

§179 vs. Bonus: §179 gives surgical control and works well when you want to target specific assets/classes or manage taxable income. Bonus applies by class unless you elect out.

-

Interest limitation (§163(j)): Heavier first-year deductions can interact with interest-limitation rules. Model both together.

-

Recapture: Sale or change of use of 5-/7-/15-year assets can trigger §1245 recapture. Plan exits before you front-load deductions.

State-by-State Quick Notes (Selected)

-

CA: Bonus add-back; separate state depreciation.

-

NY: Bonus add-back common; watch city surtaxes where applicable.

-

NJ: Maintain uncoupled state depreciation; compliance tracking is critical.

-

PA: Corporate taxpayers use special schedules; no federal bonus for CNIT.

-

CO: Often conforms, but verify annually for targeted decoupling.

Action Checklist (2025)

-

Lock down dates: Prove acquisition and placed-in-service after January 19/20, 2025 to secure 100% bonus.

-

Commission an engineering-grade study and ensure it’s fully tied to invoices, plans, and the fixed-asset ledger.

-

Build a federal-vs-state bridge (CA/NY/NJ/PA especially) and forecast cash-tax impact before you file.

-

Coordinate §179 + bonus + interest limits with your CPA to match your income profile.

-

Segment QIP cleanly from structural work to preserve 15-year life and bonus eligibility.

-

Use Form 3115 for look-backs when prior depreciation was missed.

Plain-English Takeaway

Do the study. Prove your dates. Watch your states. In 2025, the federal rules can be wildly favorable—but state add-backs can surprise you without planning.

Disclaimer: This guide is informational only and not tax or legal advice. Work with a qualified CPA and a reputable cost-segregation provider to model your facts and keep current with law and state guidance.